Gold is Just Getting Started

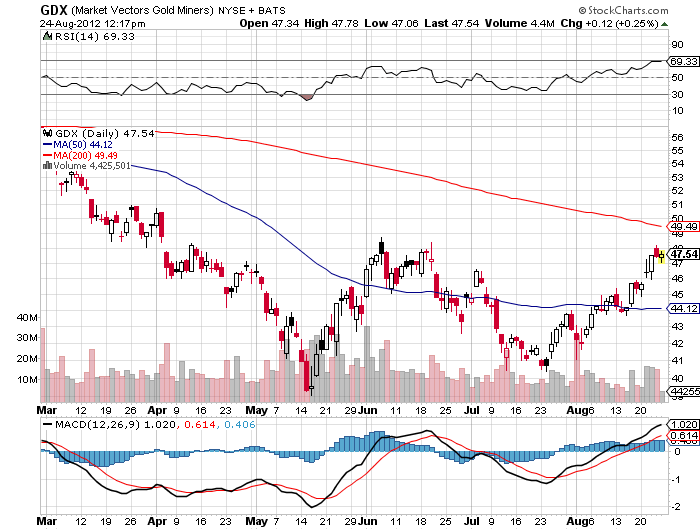

One of my best calls of the year was to plead with readers to avoid gold like the plague, periodically dipping in on the short side only. The barbarous relic has been in a bear market since it peaked at $1,922 an ounce at the end of August last year. Gold shares have fared much worse, with lead stock Barrack Gold (ABX) dropping 36% since then and the gold miners ETF (GDX) suffering a heart rending 43% haircut.

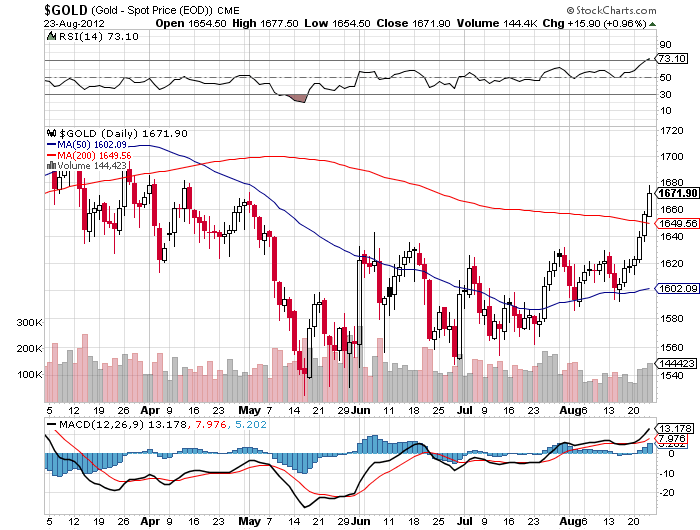

However, the recent price action suggests that hard times may be over for this hardest of all assets. Despite repeated attempts, the yellow metal has failed to break down below the $1,500 support level that I have been broadcasting as the line in the sand.

It has rallied $170 since the last try a few weeks ago. (GDX) has performed even better, popping 20%. For the last month, the entire precious metals space has traded like it was a call option on global quantitative easing (see yesterday?s piece). Dramatically worsening economic data is increasing the likelihood of further monetary easing generating a nice bid for gold.

Now the calendar is about to ride to the rescue as a close ally. It turns out that in recent years, there has been a major seasonal element to the gold trade, almost as good as the November/May cycle that drives the stock market. Gold typically sees a summer low. Then traders start anticipating the September Indian wedding season when the purchase of gifts and dowries become a big price driver. That explains why India, with a population of 1.2 billion, is the world?s largest gold buyer.

Next comes the Christmas jewelry buying season in western countries. That is followed by the gift giving and debt repayments during the Chinese Lunar New Year, during which we see multi-month peaks in the yellow metal. That is exactly what we saw this year. The only weakness in this argument is that a slowing Chinese economy could generate less demand this time.

These are heady inflows into such a small space. All of the gold mined in human history, from King Solomon's mines, to the bars still in Swiss bank vaults bearing Nazi eagles (I've seen them) would only fill 2.5 Olympic sized swimming pools. That amounts to 5.3 billion ounces, about $8.6 trillion at today's prices. For you trivia freaks out there, that is a cube with 66 feet on an edge. China is the largest producer (13.1%), followed by Australia (10%) and the U.S. (8.8%).

Peak gold may well be upon us. Production has been falling for a decade, although it reached 94 million ounces last year worth $153 billion at today?s prices. That would rank gold 5th as a Fortune 500 company, just ahead of General Electric (GE). It is also only .38% of global public debt markets worth $40 trillion.

That is not much when you have the entire world bidding for it, governments and individuals alike. Talk about getting a camel through the eye of a needle! We may well see the bull market end only when those two asset classes, government bonds and gold, see outstanding values reach parity, implying a major increase in gold prices from here. That is well above my own personal target of the old inflation adjusted high of $2,300. No wonder buying is spilling out into the other precious metals, silver (SLV), platinum (PPLT), and palladium (PALL).

The thumbnail technical view here is that we have broken the 200-day moving average at $1,649, so we may have a clear shot at a new high. There may be an easy $100 here for the nimble, and more if we break that. The current global mood for more quantitative easing and lower interest rates certainly help. If you had any doubts for the need for such easing, taking a look at the chart below showing global Purchasing Manager Index?s heading in a clear southerly direction.

Not that it needs it, but gold is about to get some free advertising at this week?s Republican national convention in Tampa, Florida. The right wing of the party has long advocated a return to the gold standard, and a Romney win could take us closer to that goal. I don?t think there is a chance in hell of this ever happening, as it would be hugely deflationary. Still a vocal and very public discussion of the topic can?t be bad for gold prices.

When playing in the gold space, I always prefer to buy the futures or the (GLD), the world?s second largest ETF by market cap, either outright or through a longer dated call spread. The dealing costs are far too high for trading physical bars and coins, and can run as high as 30% for a round trip.

Having spent 40 years following mining companies, I can tell you that there are just way too many things that can go wrong with them for me to risk capital. They can get nationalized, suffer from incompetent management, hedge out their gold risk, get hit with strikes or floods, or get tarred by poor equity market sentiment. They also must endure the highest inflation rate of any industry, around 15%-20% a year, which hurts the bottom line.

Better just to stick with the sparkly stuff.