Happy Birthday IRS!

Some taxpayers have been sending birthday cards in with their tax returns this year. That?s because the International Revenue Service, the collector of America?s tax revenues, is 102 years old this year.

Although the wealthy have been paying income taxes since the 1861-65 Civil War, they did not apply to the rest of us until the passage of the 16th Amendment.

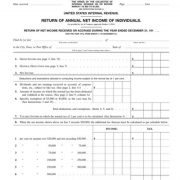

The original form 1040, of which I have included a copy below, was one page long and imposed a starting tax rate of 1% over incomes of $3,000. The maximum tax rate was 7%. It included a deduction for shipwrecks.

When WWI broke out, that rate was taken up to 77%. Only 3% of the population had tax liabilities, compared to 54% today.

Since 1913, the pages of instructions and deductions have soared from one to over 73,000. Today, some 6.6 billion man hours are spent preparing US tax returns. That works out to keeping 3.3 million people on the job full time. Talk about a growth business!

According to the Pew Research Center, 56% of Americans dislike taxes, but 71% feel they have a moral responsibility to pay what they owe. Yet, 34% say they pay more than their fair share of taxes, while 60% believe they are paying the right amount.

In 1775, the American Revolution first started as a tax revolt, with American merchants protesting the special exemptions enjoyed by British ones. That led to the Boston Tea Party whereby Americans masquerading as Indians dumped competing duty free imports overboard.

Fairness of the system has been a recurring theme ever since. That is why Mitt Romney?s 13.9% tax rate was such a big deal in the 2012 presidential election.

About 1% of taxpayers are audited each year, with the wealthiest 12 times more likely to get audited than the middle class. This brings a famous Willy Sutton quote to mind: ?Why rob banks? Because that?s where the money is.?

Where are residents least like to be audited by the IRS? The Aleutian Islands in Alaska. And the most likely? Beverly Hills, California. Small businesses top the list, with those in the real estate and construction industries dominating.

The Justice Department brings about 1,000 criminal tax evasion cases a year. Jail times have only been required since 1987 (thank you Ronald Reagan!).

That works out to one return out of every 150,000, so play audit roulette if you will. Their success rate in obtaining convictions is a mathematically impossible 98.5%. Some 70% of jurors believe the defendant is guilty before the case is even heard.

Today is probably the best time ever to cheat on your taxes. The IRS is wilting from millions of fraudulent tax returns returns filed by Internet scammers to obtain stolen refunds. I got hit by one of these myself, and it took six months for me to get my rightful refund (click here for ?The Letter From the IRS You Should Dread?).

There is also a major offensive underway to close down illicit offshore bank accounts. The agency is gaining traction on this with a reward program that offers snitches 10% of the funds recovered.

If you have one of these operated by a shell company in the British Virgin Island or Belize, you?re better off fessing up now. Remember that the Justice Department can track the movement of a dollar anywhere in the world at any time, whether a foreign country cooperates or not.

The burden to deliver the data always traces back to an American bank, when funds are transferred, even between foreign countries.

What is the most common error committed on tax returns? Divorced parents both claiming the same children as dependents. The mistake is automatically caught by electronic filing with the earliest filer getting the tax savings. So don?t bother.

Now how much did I lose on that shipwreck last year?