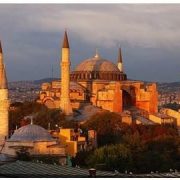

I am writing this to you from the veranda of the presidential suite at the Ciragan Palace Hotel in Istanbul. The former palace of an Ottoman prince, the commerce of the Straights of Bosphorus plays out before me.

Empty supertankers lumber up the narrow waterway to pick up another load of Russian crude at Baku, followed by full containerships loaded with consumer goods to pay for it. Peripatetic ferries rapidly crisscross its course laden with passengers fleeing Istanbul?s traffic nightmare. Amid the mix are dozens of racing yachts, the chief status symbol of Turkey?s new elite.

It?s amazing that you don?t read about more Turkish maritime disasters!

The first thing you learn about Turkey these days is that it is no longer an emerging economy. It has emerged! It now ranks 17th in GDP, and could be tenth in another decade. Per capita income has soared to $11,000, compared to $48,000 in the US and $6,000 in China. Once overly dependent on Europe for trade, Turkey has ramped up its shipment of goods to much of the emerging world.

A runaway property boom has placed it fourth in the world in the number of billionaires, with 28. It is the fourth largest shipbuilder, a major auto manufacturer and boasts an important defense industry. If you are eating cherries, hazelnuts, olives, or figs in Europe, chances are that they came from a farm in Turkey.

Turkey joined the European customs union in 1996. It is now negotiating for full European Community membership, becoming the first Asian member, an event expected to occur in the next 5-10 years.

I have taken great pleasure in recent years returning to old haunts I first saw 46 years ago. That was when I lived on $1 a day, carried my worldly possessions in a Kelty backpack and slept under bridges, in bombed out farmhouses, or the local Youth Hostel. I remember that Istanbul?s had a thriving population of bedbugs and a permanently blocked sewer line.

However, this time around I?m staying at five star hotels, like the Kempinski, and the first decision of the day is whether or not to have French Champagne with my fresh squeezed orange juice.

Buy when there is blood in the streets!

That is the time-honored tradition of traders and investors everywhere when it comes to emerging markets (EEM). I had a friend who reliably bought every coup d?etat in Thailand during the seventies and eighties, and he made a fortune, retiring to one of the country?s idyllic islands off the coast of Phuket.

Blood is certainly flowing in Turkey these days. You have the real kind flowing in Istanbul?s Taksim Gezi Park, the country?s own Democracy Square, where students and labor leaders have been protesting the conservative, mildly Islamic policies of Prime Minister Recep Tayyip Erdogan. The violence led to 3,000 arrests and 11 dead.

The fat then fell into the fire with the latest round of instability in the Middle East.? A new terrorist group called ISIS (Islamic State of Iraq and the Levant), even more violent and extreme than its Al Qaida parent, took over the northern portion of that country.

Iraq is Turkey?s second largest trading partner, supplying services, infrastructure, food and consumer goods in exchange for oil. That business completely ceased, and more than 50 Turkish hostages were taken, mostly truck drivers. The oil price spike that followed delivered yet another blow to an already fragile Turkish economy, which depends heavily on imported energy.

This brought a plunge by two thirds in Turkey?s economic growth, from 4.7% annualized rate in the first quarter of 2014, to only 1.6% in May. That was well off from the heady days of 9% growth seen in 2010-2011, when Turkey was one of the fastest countries to bounce back from the 2008-2009 financial crisis. This does not auger well for the future.

The new civil war in Iraq and the endless fighting in Syria have prompted 1 million refugees to flee to Turkey. You see them everywhere in Istanbul, living in abandoned buildings or trolling the streets for handouts. I gave ten Turkish lira to the children below to take their picture. The resulting burden on the country?s nascent social services is immense.

If this were the only problem the country was facing, you might conclude that the timing was ripe to ramp up your investments here.

Better to lie down and take a long nap first.

Turkey is sitting atop a massive property bubble. While GDP has risen by 400% over the past decade, property prices are up by an incredible 900%, and stocks 1,000%. Much is financed by undercapitalized local Turkish banks or by foreign debt.

That is a huge problem when the Turkish lira is weak, as it leads to rising principal amounts and interest rate payments in dollars, Euros and Swiss francs. You see abandoned construction projects all over the country, the casualties of just such a squeeze.

These conditions are about to worsen. We learned from the general collapse of emerging markets (EEM) last year that they are the most sensitive to US Federal Reserve tightening. That tightening has only just begun.

Fed governor, Janet Yellen, has indicated that the central bank?s monthly Treasury bond buying will get tapered down from a high of $80 billion a month down to zero by October. Actual interest rate increases are likely to follow next year.

This is all likely to suck more money out of Turkish financial markets into US ones, to the detriment of Turkish prices everywhere. This is one of the reasons that the Turkish stock market plunged a gob smacking 50% from its highs last year.

European weakness, far and away Turkey?s largest trading partner, caused the country to run a massive $56.8 billion current account deficit in 2013. A borrowing binge to finance speculative real estate projects was another contributing factor.

Consumer prices are also raging away at 9.2% a year. This is often a problem with what I call the ?advanced? emerging markets. Economic growth brings uncontrolled inflation, which raises its cost of labor in the international marketplace and erodes its competitiveness. You see this in Turkey, China and India.

The only way a country can fight back is to devalue its currency. But that frightens away foreign investors, a large factor in the country?s economic miracle.

This is the conundrum in which the Turkish Central Bank finds itself today: High interest rates, a strong currency, and no growth? Or low interest rates, a weak currency, and no foreign investors. It?s a choice that would vex Solomon.

For the short term, Turkey has clearly chosen the latter, ratcheting up short-term interest rates by a gob smacking 4.75% during one night last winter. That caused the Turkish Lira to rally smartly, some 10%. But ten-year government bond rates now hover just above 9.0%, hardly a business friendly rate, removing yet another leg supporting precarious Turkish real estate prices.

Still, conditions today are a vast improvement over the bad old Turkey of decades ago. For 40 years, the military controlled weak elected governments, and one cruel fact that I have learned over the years is that generals are lousy at running economies.

Perennial financial crises scared off foreign investors and the International Monetary Fund had to come in and bail out the country as often as I change my socks. The US turned a blind eye to these abuses, as Turkey was the only NATO member bordering the old Soviet Union and an unstable Middle East.

The potential was always there. Turkey has a highly positive population pyramid, with a large, dynamic and young population only needing to support a miniscule aging population. All that was needed was leadership and confidence.

Prime Minister Erdogan, riding a wave of popularity with his AKP, or Justice and Development Party, delivered that in spades after his election as prime minister in 2003. Pursuing a no nonsense, technocratic, pro business approach, a Turkish economic revival ensued, delivering meteoric results for the country. Yet, he was just Islamic enough to keep the religious hard liners, the Army and terrorist groups at bay.

I had a chance to hear the prime minster speak, attending what turned into a political rally on the first day of Ramadan, in front of the storied Blue Mosque in Istanbul. The only words I understood were ?God is great.? But his support among his conservative base, who were ebullient over his surprise appearance, is undeniable.

Yet, another problem is that this man behind the curtain who has delivered so much is about to leave the stage. Term limits prevent Erdogan from running for Prime Minister again, so he is seeking the presidency instead, a largely ceremonial post under Turkey?s constitution.

That will likely make the current president the next Prime Minister, Abdullah Gul, a close political ally of Erdogan?s. But he is not the same guy.

Even with his impending diminished status, Erdogan is charging ahead with public works projects, the scale of which would impress Franklin Delano Roosevelt. He wants to build a third bridge connecting Europe with Asia. He is planning a tunnel under the Bosphorus. He wants Istanbul?s airport to become the largest in the world. The price tag for all of this is enormous.

So has Turkey suffered enough?

I have to admit that I came to revisit the exotic playground of my impetuous youth to issue the mother of all Trade Alerts and jump back into the ETF (TUR). What I heard in the bazaars, outside mosques and speaking to local businessmen suggests that the pain has only just begun.

As discretion seems to be the better part of valor this year, I think I?ll pass on that Trade Alert.

The US Dollar?s Ten Year Rise Against the Turkish Lira

The US Dollar?s Ten Year Rise Against the Turkish Lira