Hopping on the Aussie

We have a fantastic double bottom developing here on the charts for the Australian dollar (FXA). I think that RISK ON will be the order of the day for the next six months, and the currency of the Land Down Under should prosper mightily.

This is a play on the modest recovery of the Chinese economy continuing, as Australia is far and away their largest supplier to them of bulk commodities. It is also a bet that the global synchronized recovery remains on track in 2014, as I expect.

You can see from the chart below that the Australian stock market (EWA) is also reaching this conclusion, putting in a similar short term bottom to the (FXA). For a third assenting vote, look at the chart of copper producer Freeport McMoRan (FCX).

We did well with our last long play in the Aussie. Since then, we have seen a 4.5% pullback, almost exactly a 50% retracement of the entire move since August, from $88.5 to $97.5. This was prompted by more negative comments from the governor of the Reserve Bank of Australia, who is making every effort to talk his currency down and strengthen his own economy.

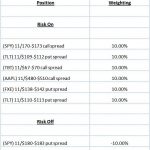

These (FXA) options are fairly illiquid, and trade at double the normal spread found in the foreign exchange options market, so execution here is crucial. Put in a strict limit order for the spread that works for you. If you don?t get done, just walk away and wait fore the next Trade Alert, of which there will be many.