A month ago, I sent you a research piece about the merits of long-term LEAPS in the major technology stocks (click here for the link).

They included:

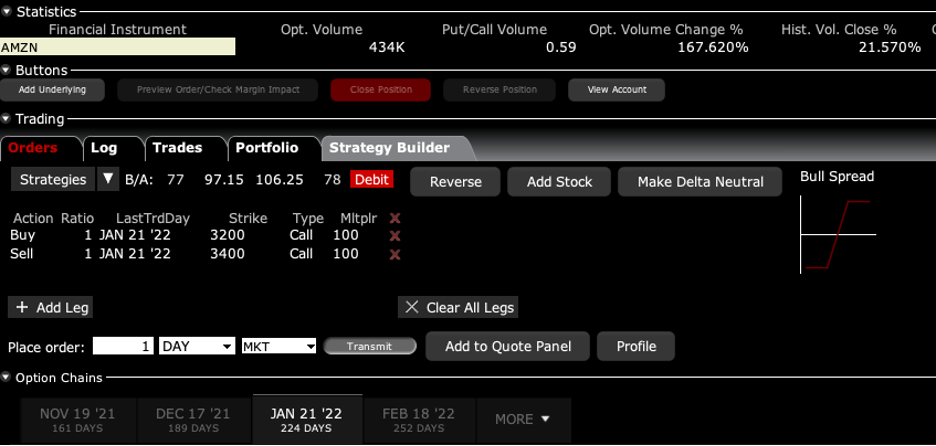

Amazon (AMZN) January 2022 $3,200-$3,400 vertical bull call spread

Microsoft (MSFT) January 2022 $240-$270 vertical bull call spread

Apple (AAPL) January 2022 $120-$130 vertical bull call spread

So, how did those work out? Here is the stock performance and the LEAPS performance for each position:

Amazon (AMZN) stock +11.40% LEAPS +26.79%

Microsoft (MSFT) stock +7.69% LEAPS +35.38%

Apple (AAPL) stock +13.38% LEAPS +30.92%

In other words, the LEAPS outperformed the stock to the upside by anywhere from 2.5X to 5X. All three positions are now deep-in-the-money. As long as the stocks close at or above the upper strike prices by the January 16, 20222 option expiration day, they will all produce profits of 100% or more in only seven months!

It goes to confirm the strategy that I have been vociferously arguing in recent months, that LEAPS offer far and away the best risk/reward of any investment in current market conditions. Whenever I have a payday, I pour the money straight into my retirement funds and into the most attractive LEAPS.

The liquidity for long-dated options is not that great. That is why entering limit orders in LEAPS only, as opposed to market orders, is crucial.

These are really for your buy-and-forget investment portfolio, defined benefit plan, 401k, or IRA.

Like all options contracts, LEAPS give its owner the right to exercise the option to buy or sell 100 shares of stock at a set price for a given time.

LEAPS have been around since 1990, and trade on the Chicago Board Options Exchange (CBOE).

To participate, you need an options account with a brokerage house, an easy process that mainly involves acknowledging the risk disclosures that no one ever reads.

If LEAPS expire "out-of-the-money" on expiration day, you can lose all the money you spent on the premium to buy it. There's no toughing it out waiting for a recovery, as with actual shares of stock. Poof, and your money is gone.

Note that a LEAPS owner does not vote proxies or receive dividends because the underlying stock is owned by the seller, or "writer," of the LEAPS contract until the LEAPS owner exercises.

Despite the Wild West image of options, LEAPS are actually ideal for the right type of conservative investor.

They offer vastly more margin and more efficient use of capital than traditional broker margin accounts. And you don’t have to pay the usurious interest rates that margin accounts usually charge.

And for a moderate increase in risk, they present hugely outsized profit opportunities.

For the right investor, they are the ideal instrument.

So, let’s get on with my specific math for the (AMZN) LEAPS to discover its inner beauty.

By now, you should all know what vertical bull call spreads are. If you don’t, then please click this link for my quickie video tutorial (you must be logged in to your account). Warning: I have aged since I made this video.

A month ago, Amazon closed at $3,346.83.

The cautious investor should have bought the (AMZN) January 2022 $3,200-$3,400 vertical bull call debit spread for $102. One contract gets you a $10,000 exposure. This is a bet that (AMZN) shares will close at $3,400 or higher by the January 22, 2022, option expiration, some 1.6% higher.

Sounds like a total no-brainer, doesn’t it?

Here are the specific trades you needed to execute this position:

expiration date: January 21, 2022

Portfolio weighting: 10%

Number of Contracts = 1 contract

Buy 1 January 2022 (AMZN) $3,200 call at………..….……$374.00

Sell short 1 January 2022 (AMZN) $3,400 call at…………$272.00

Net Cost:………………………….………..………….............….....$102.00

Potential Profit: $200.00 - $102.00 = $98.00

(1 X 100 X $98.00) = $9,800 or 96.07% in six months.

In other words, your $10,200 investment turned into $19,800 with an almost sure bet giving you a profit of 96.07%.

Why do a vertical bull call debit spread instead of just buying the January 2022 (AMZN) $3,400 calls outright?

You need a much bigger upside move to make money on this trade. (AMZN) would have to rise all the way to $3,674 to break even on the calls, and all the way up to $3,772 to match the profit of the call spread.

While I think it is possible that (AMZN) could rise that much by January, it is vastly more probable that (AMZN) will be over $3,400 by then. That is what hedge funds do all day long, and that is to find the most probable trade out there and then leverage up like crazy.

Remember, one call option gives you the right to buy 100 shares. That means over $3,400 your call spread that cost $10,200 will enable you to control 100 shares of Amazon worth $340,000. The potential upside leverage over $3,400 is 33.33X!

By paying only $102 for the spread instead of $274.00 for an outright call-only position, you can increase your size by 2.68 times, from 1 to 3 contracts for the same $10,200 commitment. That triples your upside leverage on the most probable move in (AMZN), the one above $3,400. That increases the upside leverage over $3,400 to an impressive 100X compared to the outright call buy.

How could this trade go wrong?

There is only one thing. We get a new variant on Covid-19 that overcomes the existing vaccines and brings a fourth wave in the pandemic.

In this case, (AMZN) doesn’t rise above $3,400 but crashes down to the $1,700 low we saw during the 2020 pandemic. We go back into recession. Both of the above positions go to zero. But if we get a fourth wave, you are going to have much bigger problems than your options positions.

So there it is. You pay your money and take your chances. That's why the potential returns on these simple trades are so incredibly high.

If you are interested in getting a more dedicated LEAPS service from the Mad Hedge Fund Trader, you might consider our Concierge service, which costs $10,000 a year and is by application only. If interested, please email support@madhedgefundtrader.com and put Concierge candidate in the subject line.

Enjoy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Tech LEAPS are the Way to Go