How Low Will Biotech Go?

Long-term readers of this letter prospered mightily from my addiction to biotech stocks, one of the top performing sectors in the stock market during the first half of last year.

Readers made three round trips in hepatitis C drug developer Gilead Sciences (GILD) in the past four months, adding 5.77% to the value of their portfolios. I believe the company?s blockbuster drug will become the most profitable in history. So do a lot of others.

Longer-term investors bought the Biotech iShares ETF (IBB) on my advice, which gained an impressive 45% last year.

They certainly were getting downright frothy by June.

No less a figure than Federal Reserve governor Janet Yellen has indicated then that she thought valuations in the biotech sector were getting ?substantially stretched.? The Fed doesn?t single out stocks for commentary very often.

?Sell in May and go away,? turned out to be a brilliant strategy in 2015 because it got out of these stocks at all time highs with huge profits.

It was after that when the rot began.

It started when presidential candidate, Hillary Clinton, sent out the Tweet that sank biotech, warning that price controls and international drug competitions would be a high priority in her administration.

Then the bad boy antics of Martin Shkreli were exposed, who raised the price of an AIDS drug, Daraprim overnight by 55 fold. Nothing like focusing a spotlight on a big open sore. Shkreli is now under Federal indictment for operating a Ponzi scheme.

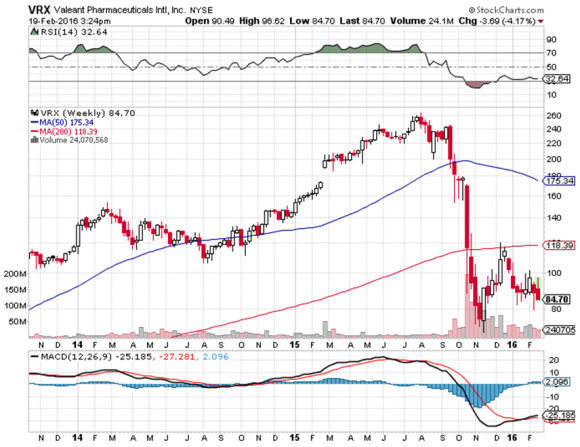

Then Valient (VRX), a target of activist Bill Ackamn, imploded.

The industry has barely had an up day since then.

My favorite, Gilead Sciences suffered a 33% nosedive, while the Biotech IShares ETF (IBB) sank by a gut churning 40%. Favorite Celgene (CELG) gave back 34%.

Is biotech gone for good? Is this once loved sector headed for the dustbin of history to join coal and 3-D printing?

I don?t think so. Far from the truth.

Big institutional investors and hedge funds that had the wisdom to raise cash at the end of 2015 are starting to circle in on this faded beauty, making lists, and taking names. And (GILD), the (IBB), and (CELG) are at the top of those lists. (VRX) isn?t.

Biotech has always been a hedge fund favorite.

That means hot money regularly flows in and out, giving the sector more than double the volatility of the main market. A 10% correction in any other stock is worth at least 25% in biotech. Now is one of the ?out? times.

This also makes biotech stocks great ones to buy on a dip. My last foray into (GILD) occurred after cautious guidance took the shares down a heart stopping 10% in a single day.

This is a great example of how unusually sensitive biotech stocks are to headline risk. I?ve ridden stocks to tremendous heights, watching them pour billions into a single treatment, only to see them crash and burn on failed stage three trials.

That is just the nature of their business. It?s all about ?all or nothing bets.?

Biotech is a high-risk sector that should only be held within a well diversified portfolio. You may notice that in the Mad Hedge Fund Trader?s model trading portfolio I never have more than 10% in biotech at any given time. I figure I could handle a total blow up and lose the whole 10% and still stay in business.

When I speak at conferences, strategy luncheons, and on TV, I tell listeners of my lazy man?s guide to long-term investment. Only follow three sectors, technology, biotech, and cyber security, and ignore the other 97. You?ll save yourself a lot of time reading pointless research.

Biotech currently accounts for a mere 1% of US GDP. It is on its way to 20%, about where big technology is today. That means that a disproportionately large share of earnings growth will spring from biotech over the coming decades.

One way to protect yourself is to stick with the big caps, which are undervalued relative to the sector as a while, and are expected to haul in 20% earnings growth this year.

Many smaller companies are at prices assuming a total certainty of the success of a single drug. The reality is that this only happens about half the time.

If you do go with small caps, I would take a venture capital approach. Buy a dozen with the expectation that many will go under, a coupled do OK, and one goes through the roof. Never put all your eggs in one basket. Or just buy the (IBB) which does this neat trick for you.

It also helps that you have someone with a scientific background making your picks, like myself.

Because drug companies promise such amazing results, like curing cancer, the sector has always been prone to hype and over promotion. I never met a biotech CEO who didn?t believe his company was about to deliver the next panacea, taking his shares up 100-fold, and delivering him a Nobel Prize.

One plus for biotech is that it has unusually strong patent protection, which usually extends out 20 years for new products. There are not a lot of Chinese companies that can imitate their drugs.

That means earnings can be predicted far into the future, and are largely immune from the economic cycle. If you?re sick, you want to get cured, regardless of whether the GDP is growing or shrinking, or whether interest rates are low or high.

And much of this cost is borne by the US government, through Obamacare and Medicare.

Make sure that your investments have plenty of new developments in the pipeline. Expiring patents on past winners with no replacements can spell certain death for a stock price.

I tell my kids that they will never suffer my medical maladies, as everything important will be cured within 20 years.

A century from now, historians will look back on our era and think ?Those poor people. They were so ignorant and helpless. They new nothing about medicine.? Our most modern treatments will appear to them like the application of leaches.

Publicly listed drug companies are now venturing into research fields that were only science fiction when I was in the lab 45 years go. ?Gene editing,? whereby genes can be repaired, edited, and then turned on and off at will, is now becoming a burgeoning new science.

It promises to cure the whole range of human maladies, including heart disease, cancer, obesity, and a whole range of degenerative diseases (including some of mine).

Expect to hear a lot more about TALENs (transcription activator-like effector nucleases) and CRISPR (clustered regular interspaced short palindromic repeats). You heard it here first.

What is truly fascinating is that hybrid computer science/biochemical scientists are now taking algorithms developed by the National Security Agency hackers and using them to decode human DNA. (I hope I?m not speaking too much out of school here).

Gene editing is the natural outcome of the discovery of recombinant DNA technology developed during the 1970?s by Paul Berg, Herbert Boyer, and Stanley Cohen, all early heroes of mine.

Since none were the equity participants of private companies, the initial rewards for the breakthrough were minimal. I remember that one received a new surfboard for his efforts.

Berg went on to found Genentech (GENE) in 1977 and got rich. If I hadn?t gone into the stock market, that is almost certainly where I would have ended up.

How things have changed.

The short answer here is that biotech does have further to run. A lot further.

The rate of innovation of biotechnology is accelerating so fast that it will continue to spew out fantastic investment opportunities for the rest of our lives.

So expect to receive many more Trade Alerts

in this area in the years to come.

But it is definitely an ?E? ticket ride. So fasten your seatbelt on your path to riches.

As for me, I am thrilled that I got to live so long to see his stuff happen. At times, it was a close run race.