How Netflix Can Double Again

The first batch of earnings numbers are trickling in, and on the whole, so far so good.

A spectacular earnings season will further cement tech's position at the vanguard of the greatest bull market in history.

The bull case for technology revolves around two figures indicating "RISK ON" or "RISK OFF".

The first set of numbers from Netflix (NFLX) emanated sheer perfection.

Netflix has gambled on its international audience to drive its growth and unceasing creation of premium content to reach these lofty targets set forth.

It worked.

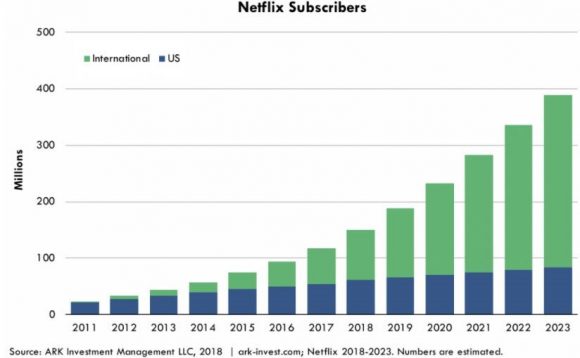

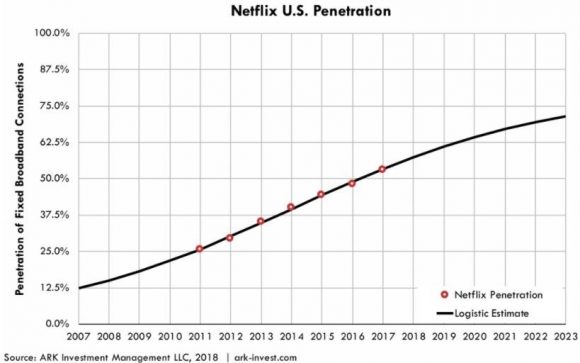

Consensus was that domestic subscription growth had peaked, and Netflix would have to lean on overseas expansion to beat earnings estimates.

American subscription growth knocked it out of the ballpark, beating expectations by 480,000 subscriptions. The street expected only 1.48 million new adds. The 1.96 million shows the American online streamer is resilient, and the migration toward cord-cutting is happening faster than initially thought.

International adds were pristine, beating the 5.02 million estimates by 440,000 million new subscribers.

Content is king as Netflix has proved time and time again (we notice that here at Mad Hedge Fund Trader, too). Netflix plans to fork out about 700 original series in 2018.

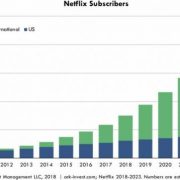

By 2023, Netflix could grow its subscriber base to close to 400 million. The potential for international advancement is immense considering foreign companies are playing catch-up and cannot compete with the level of Netflix's content.

The earnings report coincided with Netflix announcing a forceful push into Europe, doubling its allocated content-related investments to $1 billion.

All of Netflix's estimates take into consideration that it is shut out of the Chinese market. Ironically, the Netflix of China, named iQIYI (IQ), just recently went public on the Nasdaq.

Amazon Web Services (AWS), the cloud-arm of Amazon (AMZN), revenue numbers are the other numbers that are near and dear to the pulsating heartbeat of the bull market.

Jeff Bezos, Amazon's CEO, penned a letter to shareholders that Amazon prime subscribers blew past the 100 million mark.

The positive foreshadowing augurs nicely for Amazon to surprise to the upside when it reports earnings next week on April 26.

Expect more of the same from cloud companies that are overperforming.

The few glitches in tech are minor. It is mindful to stay on the right side of the tracks and not venture into marginal names that haven't proved themselves.

For instance, Oracle (ORCL) had a good, not great, earnings report but shares still cratered after CEO Safra Catz dissatisfied analysts with weak cloud forecasts of just 19%-23% growth.

The street was looking for cloud guidance over 24%. Oracle is still being punished for its legacy tech segments.

The chip sector got pummeled after several chip manufacturers announced weak supply order from Apple.

This is hardly a surprise with Apple slightly missing iPhone estimates last quarter by 1%.

Chip stocks such as Lam Research (LRCX), Micron (MU), and Applied Materials (AMAT) look like affordable bargains. They should be seriously considered after share prices stabilize buttressed by support levels.

The outsized problem is that hardware suppliers have headline risks because of large cap tech's preference toward vertically integrating.

Along with price efficiencies, vertically integration aids design aspects and streamline product production time horizons.

This is not the end of chips.

Consumers need the silicon to generate and extract all the data coming to market.

Particularly, Apple (AAPL) went over its skis trying to push expensive smartphones to a saturated market when all the rip-roaring growth is at the low end of the market.

Apple still managed to sell more than 77 million iPhones, but the trade war rhetoric will deter Chinese consumers from purchasing American tech products. Until now, Apple has counted on China as its best growth prospect. The administration had other ideas.

Any noteworthy Apple supplier has gotten punched in the nose, but crucially, investors must stay out of the SMALLER chip players that rely on narrow revenue sources to keep them afloat.

Bigger chip companies can withstand the shedding of a few revenue sources but not Cirrus Logic (CRUS).

(CRUS) shares have been beaten mercilessly the past year sliding from $68 to a horrifying $37.74 today.

(CRUS) produces audio amplifier chips used in iPhone devices, and weak iPhone X guidance is the cue to bail out of this name.

The company extracts more than 75% of its revenues by selling audio chips used in iPhone devices. Ouch!

Last quarter saw horrific performance, stomaching a 7.7% decline in revenues due to tepid demand for smartphones in Q4 2017.

Cirrus Logic provided an underwhelming outlook, and it is not the only one to be beaten into submission behind the woodshed.

Apple has signaled to its suppliers that it will view production in a different way.

Imagination Technologies, a U.K. company, was informed that its graphic chips are not needed after 2018.

Dialog Semiconductor, another U.K.- based operation, shared the same destiny, as its power management chip was cut out of the production process, sacrificing 74% of revenue.

To top it all off, Apple just announced it plans to manufacture its own MicroLED screens in Silicon Valley, expunging its alliance with Samsung, Sharp, and LG, which traditionally yield smartphone screens for Apple. And Apple plans to make its own chips, phasing out Intel's chips in Apple's MacBook by 2020.

Qorvo (QRVO), Apple's radio frequency chips manufacturer, also can be painted with the same brush.

Apple was responsible for 34% of the company's total revenues in 2017.

Weak iPhone guidance set off a chain reaction, and the trembles were most felt at the bottom feeder group.

Put Infineon Technologies (IFNNY) in the same egg basket as Qorvo and Cirrus Logic. This company installs its cellular basebands in iPhones.

FANG has split into two.

Netflix and Amazon continue producing sublime earnings reports, and Apple and Facebook have hit a relative wall.

It will be interesting if the government's harsh rhetoric toward Amazon amounts to anything.

One domino that could fall is Amazon's lukewarm relationship with the US Postal Service.

Logistics is something the Chinese Amazon's JD.com (JD) and Alibaba (BABA) have successfully adopted. Look for Amazon to do the same.

However, I will say it is unfair that most tech companies are measured against Netflix and Amazon, even for Apple, which earned almost $50 billion in profits in 2017.

It is insane that companies tied to a company that prints money are reprimanded by the market.

But that highlights investors' pedantic fascination with pandemic growth, cloud, and big data.

Making money is irrelevant today. Investors should be laser-like focused on the best growth in tech such as Amazon, Netflix, Lam Research, Nvidia (NVDA), and Microsoft (MSFT), which know how to deliver the perfect cocktail of results that delight investors.

__________________________________________________________________________________________________

Quote of the Day

"$500? Fully subsidized? With a plan? That is the most expensive phone in the world. And it doesn't appeal to business customers because it doesn't have a keyboard. Which makes it not a very good email machine." - said former CEO of Microsoft Steve Ballmer on the introduction of the first iPhone.