How Soon Will the Fed Buy Stocks?

The media focused with laser-like intensity on Janet Yellen?s move towards a decidedly more hawkish position on interest rates at her August 26th Jackson Hole speech.

However, they missed her most important comments.

I didn?t.

I am specifically referring to her speculation about what forms Fed stimulus will take during the next recession, whenever that is. After all, that was the principal topic at the confab of central bankers, economists, and academics.

Fed watchers were suitably awed by the prospect of another $2 trillion of quantitative easing that was promised.

And remember, this will take place only after the Fed moves US interest rates to negative numbers, something I expect to take place within the next three years.

But what really caught my attention was her reference to widespread purchases of ?alternative assets.? This is the dog whistle for government buying of US corporate bonds and stocks.

There is a long history of governments investing in their own stock markets during times of financial duress, some of which I have been directly involved with.

During the Asian financial crisis in 1997, initially triggered by the crash of the Thai Baht, the Hong Kong stock market collapsed to the point where several of the colony?s leading companies were at risk of going under.

With the British handover back to China imminent, capital fled the crown colony by the boatload.

Right at the market bottom, the government stepped in with a $15 billion support operation that focused on the largest share listings. Over the following 18 months, the Hang Seng share prices index soared by an incredible 176%.

The government then unloaded its entire holdings through a convertible bond offering with a 5% premium right before the 2000 dotcom bubble bust.

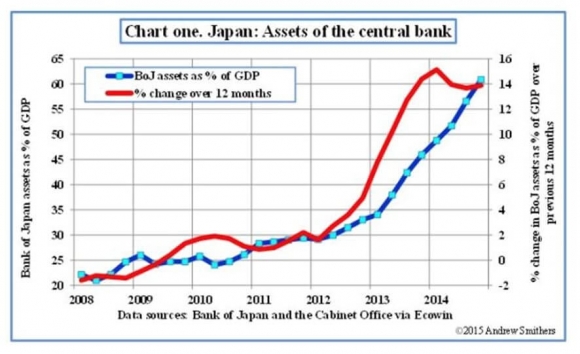

A more recent example can be found in the Bank of Japan?s expansion of its hyper aggressive quantitative easing in March, 2015 to include $60 billion worth of equity backed exchange traded funds.

The program was so ambitious that the government is now the largest shareholder in the top 50 Japanese companies.

Here the results were much less impressive. The Nikkei Index has so far fallen -28%.

But Japan also has faced gale force headwinds in the form of a relentlessly appreciating Japanese yen during this time, which is always bad news for Japanese stocks. Higher prices always mean fewer exports and even fewer profits.

Other countries buy stocks when their bond markets are too small and illiquid for central banks to have any real influence on the economy, such as in the Czech Republic.

And here?s another hint for you. What was Fed vice chairman Stanley Fischer?s last job? He was governor of the Bank of Israel, another country where the central bank has been active in soaking up equities.

So which shares will America?s central bank buy? You can count on the S&P 500 (SPY) shares to be the principal target.

How much could the Fed pour into our $23 trillion stock market? $1 trillion is doable, but it could be more, depending on the severity of the next recession.

And what about the market impact? As the Hong Kong and Japanese experiences have shown, long-term fundamentals are always a much more important driver of equity valuations than any short-term liquidity events.

Even the Fed can only put so much lipstick on a pig.

You could expect a nice ?rip your face off? short covering rally worth 5% when the headline hits.

Believe it or not, this is not a new idea. The George W. Bush administration proposed privatizing Social Security during the 2000s.

If carried out, it would have placed a major portion of our retirement funds into equities just before the 2008 financial crisis and stock market crash.

Thank goodness for small mercies that Bush never got the votes in congress to pull this off.

Future quantitative easing might not be necessary if Clinton wins the House of Representatives in November.

That would end the logjam in Washington, and open the way for $2 trillion in infrastructure spending, which the country sorely needs.

The Fed can then finally put its QE policy to bed, although it will take another eight years for it to run down it?s $3.4 trillion in existing Treasury bond holdings.

But at this point, there is only a 50-50 chance that Clinton can pull off this electoral trifecta.

She is overwhelming ahead in every battleground state (NV, AZ, CO, IA, WI, MI, OH, GA, FL, PA, NH, NC), in some cases by double digits which will give her a huge win in the Electoral College.

But because of gerrymandering in several key states, Clinton needs to win 57% of the national vote to win a majority of House seats.

Ask me again in November how doable this really is. I?ve only been watching presidential elections for a half century, so I?m still getting the hang of it.

Still, given my prediction that US stocks could rise by 17 times over the next 20 years, government purchases of stocks might not be such a bad idea.

It certainly would have merit if they step into the market after a long valuation slide. Price earnings multiples bottomed out at 9X in 2009 during the financial crisis, compared to 20X today.

?It could then unwind its positions going into the next bubble top.

Buy low, sell high, it sounds like a plan to me. It is a performance that could put the old Hong Kong colony government?s market timing to shame.

In fact, it could be the best investment the government ever makes.

And if the Fed is buying stocks, the European Central Bank won?t be far behind, if it doesn?t get there first. The ECB is already near to exhausting markets with bond purchases as part of its own QE.

Stocks could be the new, rising asset class of not just the US, Japan, and Europe, but ALL central banks.

Did someone just mention the term ?global synchronized bull market?

To learn the fundamental economic arguments behind my bullish two decade forecasts, please read my just released book, ?Stocks to Buy for the Coming Roaring Twenties?.