How the Mad Hedge Market Timing Algorithm Works

Since we have just taken in a large number of new subscribers from around the world, I will go through the basics of my Mad Hedge Market Timing Index one more time.

I have tried to make this as easy to use as possible, even devoid of the thought process.

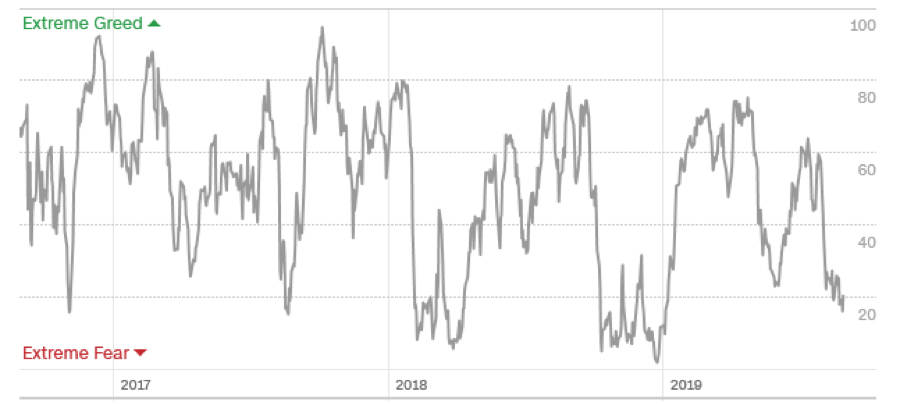

When the index is reading 20 or below, you only consider “BUY” ideas. When it reads over 80, it’s time to “SELL.” Everything in between is a varying shade of grey. Most of the time, the index fluctuates between 20-80, which means that there is absolutely nothing to do.

To identify a coming market reversal, it’s good to see the index chop around for at least a few weeks at an extreme reading. Look at the three-year chart of the Mad Hedge Market Timing Index.

After three years of battle-testing, the algorithm has earned its stripes. I started posting it at the top of every newsletter and Trade Alert two years ago and will continue to do so in the future.

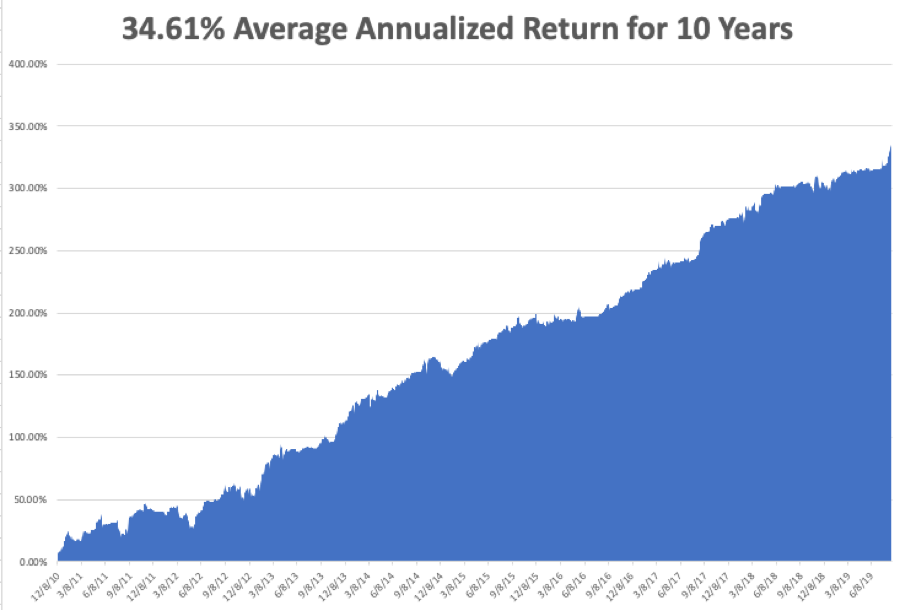

Once I implemented my proprietary Mad Hedge Market Timing Index in October 2016, the average annualized performance of my Trade Alert service has soared to an eye-popping 34.61%.

As a result, new subscribers have been beating down the doors trying to get in.

Let me list the highpoints of having a friendly algorithm looking over your shoulder on every trade.

*Algorithms have become so dominant in the market, accounting for up to 90% of total trading volume, that you should never trade without one

*It does the work of a seasoned 100-man research department in seconds

*It runs real-time and optimizes returns with the addition of every new data point far faster than any human can. Imagine a trading strategy that upgrades itself 30 times a day!

*It is artificial intelligence-driven and self-learning.

*Don’t go to a gunfight with a knife. If you are trading against algos alone,

you WILL lose!

*Algorithms provide you with a defined systematic trading discipline that will enhance your profits.

And here’s the amazing thing. My Mad Hedge Market Timing Index correctly predicted the outcome of the presidential election, while I got it dead wrong.

You saw this in stocks like US Steel, which took off like a scalded chimp the week before the election.

When my and the Market Timing Index’s views sharply diverge, I go into cash rather than bet against it.

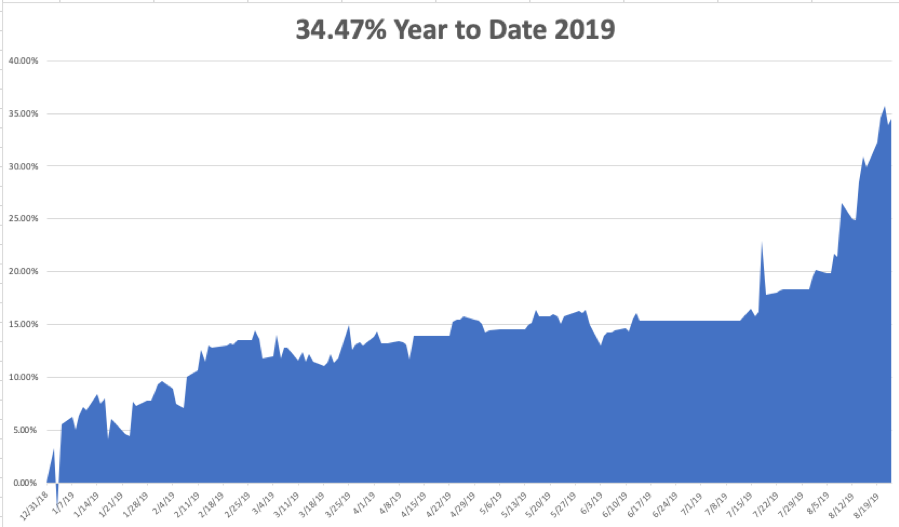

Since then, my Trade Alert performance has been on an absolute tear. In 2017, we earned an eye-popping 57.39%. In 2018, I clocked 23.67% while the Dow Average was down 8%, a beat of 31%. So far in 2019, we are up 18.10%.

Here are just a handful of some of the elements which the Mad Hedge Market Timing Index analyzes real-time, 24/7.

50 and 200-day moving averages across all markets and industries

The Volatility Index (VIX)

The junk bond (JNK)/US Treasury bond spread (TLT)

Stocks hitting 52-day highs versus 52-day lows

McClellan Volume Summation Index

20-day stock bond performance spread

5-day put/call ratio

Stocks with rising versus falling volume

Relative Strength Indicator

12-month US GDP Trend

Case Shiller S&P 500 National Home Price Index

Of course, the Trade Alert service is not entirely algorithm-drive. It is just one tool to use among many others.

Yes, 50 years of experience trading the markets is still worth quite a lot.

I plan to constantly revise and upgrade the algorithm that drives the Mad Hedge Market Timing Index continuously as new data sets become available.