How To Be A Tech Angel Investor

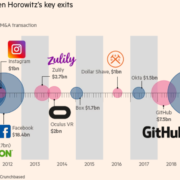

It’s not easy to be the genius who doled out early seed money to Facebook (FB), Foursquare, GitHub, Pinterest (PINS), Lyft (LYFT) and Twitter (TWTR), among others.

These investments turned out to be highly successful. If someone even miraculously hit on one of these, your grandchildren would know about it.

This person even acquired a majority stake in Skype for $2.75 billion which was considered highly risky at the time and offloaded it to Microsoft in 2011 for $8.5 billion.

Not everyone can do this like Silicon Valley tech investment maestro Marc Andreessen.

Behind the public markets is angel investing and the data says that these investments fail over 50% of the time for the best of breed like Andreesen.

There are simply too many variables that can derail these profit models which nobody can predict.

To lose over half the time and claim to be an outsized winner means relying on those 10 or 100-baggers or might I even say 1,000-baggers to drag up the portfolio performance.

These are the guys who were buying bitcoin (BTC) at 10 cents on the dollar.

Truthfully, investing in startup companies is not for everyone considering there is over a 50% chance a company will end at a 0 or pennies on the dollar.

However, it can be highly gratifying if and when the investments do pay off and investors get a front seat to the forefront of the tech innovation cycle, which you simply don’t get by trading Facebook and Google from your Fidelity account on your computer screen.

These investors can also get direct access to the chatter while creating a rich network of tech know-how; and I do believe that’s half the value in it too, since it can propel angel investors to the next super app or guy behind the next super app.

I mean who could have ever predicted a global health crisis that’s going into its 3rd year soon? And who will be able to nail the knock-on effects of climate change.

That is why risking losing one’s shirt is a real possibility if they bet the ranch on an unknown entity.

Everybody wants the next Tom Brady to quarterback their team, but who knows who the next Tom Brady is at 18 years old?

Even though Andreessen hits on less than 50% of his ideas, the industry median is around 17%, showing how superior his performance is.

He definitely has this thing figured out on relative terms.

Let’s define Angel Investor.

An angel investor is a high-net-worth individual who provides financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company.

The funds that angel investors offer could be one-off investments to help the business get off the ground or in drip injection form to support and carry the company through its difficult early stages, which means burning cash.

Most of these companies don’t make money for the first 10-years and that time is usually a referendum on the quality of the idea; very few stand the test of time.

The potential to make 100-baggers is out there with subsectors like fintech already worth half a trillion dollars in 2020 and with a predicted annual growth rate of 35%.

Angel investors typically require a 35-40% return on the money they invest in a company minus costs and inflation to call it a winner.

But Venture Capitalists may take even more, especially if the product is still in development. For example, an investor may want 50% of the business to compensate for the high risk it is taking by investing in a startup.

Angel investors do the jobs of banks.

Traditional banks would never lend to an entity based on a half-built product or even a genius idea.

Proof of income and debt to income ratios are realities at banks.

When net profits are negative, the balance sheet is too ugly for banks to even think about doing any business with these startups.

Therefore, there are limited pathways for entrepreneurs to find capital, and many turn to Angel investors to help startups take their first steps.

Who Can Be an Angel Investor?

Angel investors are normally individuals who have gained "accredited investor" status, but this isn’t a prerequisite. The Securities and Exchange Commission (SEC) defines an "accredited investor" as one with a net worth of $1M in assets.

Essentially these individuals both have the finances and chutzpah to provide funding for startups. This is welcomed by cash-hungry startups who find angel investors to be far more appealing than other, more predatory, forms of funding.

These private funds usually draw up opportunities for a defined exit strategy, acquisitions or initial public offerings (IPOs).

Liquidity events is what makes everyone happy at the end except for the investors who missed the boat.

It’s even possible that an angel investor only sees growth in the first 5 years and unloads the “idea” to another private investor for a profit.

Private market deals are common because of the excess of liquidity brought on by the U.S. Central Bank lowering interest rates for a prolonged amount of time.

What I do know is that America is the framework within which almost all unicorns prosper, and I do not envision any monumental shift to Europe or China, these other places simply have more problems than the U.S.

How does the normal Joe get it on the action?

Andreesen has said the only way he usually does business is with a “warm” introduction which can be hard to come by if one doesn’t rotate in the same social circles as these heavy hitters.

Scoring a warm introduction also means getting boots on the ground in California which is ebbing and flowing between its colossal wildfires and public health issues like many other places.

Honestly speaking, if might be difficult to get the best of the best angel opportunities even if the gunpowder is loaded.

It’s accurate to believe that probably guys like Andreesen get the best of the best ideas in front of them and if they pass on it, the likes of Sequoia, Benchmark, and Softbank have very smart people as well who get similar type of presentations and opportunities.

Like you correctly guessed, this private group of capital is quite incestuous and tight-knit. It’s a copycat league of the ages.

The one avenue that might be of interest is a platform that has democratized angel investing who on the last count had close to 1,000 companies looking for start-up capital.

This platform is called https://angel.co/angel-investing and some are even actively hiring on the same platform.

I won’t stand here saying this is the cream of the crop because it’s not, but I will say that sometimes companies are overlooked, or the industry consensus has shifted too far in one direction offering undiscovered dark horses a chance.

Lastly, this forum of angel companies on offer does give analysts insight into where money is funneled to and the current hot sub-sector of the tech industry.

This platform even offers an Angel index fund if a reader wants to take the aggregate performance of 150-200 companies with a $50,000 minimum.

If a reader wants access to facilitate angel investing by a deal-by-deal offer from the Angel list as a professional investor, then $500,000 is required.