How to Handle the Friday February 16 Options Expiration

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own five deep-in-the-money options positions that expire on Friday, February 16 and I just want to explain to the newbies how to best maximize their profits.

This involves the:

Current Capital at Risk

Risk On

(MSFT) 2/$330-$340 call spread 10.00%

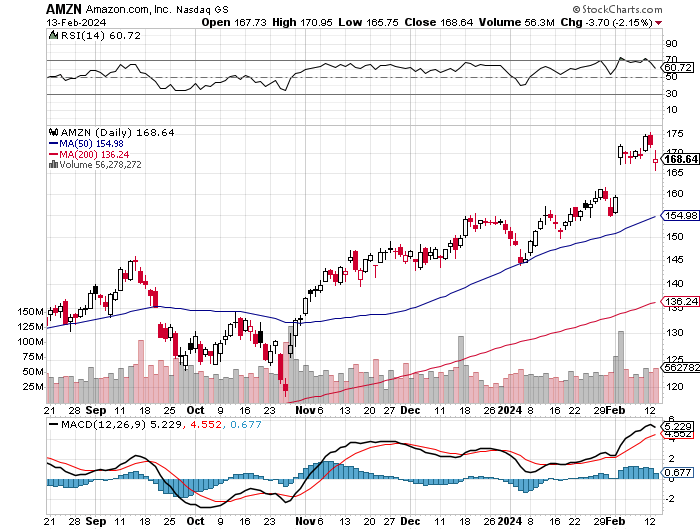

(AMZN) 2/$130-$135 call spread 10.00%

(V) 2/$240-$250 call spread 10.00%

(PANW) 2/$260-$270 call spread 10.00%

(CCJ) 2/$38-$41 call spread 10.00%

Risk Off

NO POSITIONS

Total Net Position 50.00%

Total Aggregate Position 50.00%

I’ll do the math for you on our deepest in-the-money position, the Amazon (AMZN) 2/$130-$135 call spread which I will almost certainly run into expiration.

Provided that we don’t have another monster move down in the market in two trading days, this position should expire at its maximum profit point.

So far, so good.

Your profit can be calculated as follows:

Profit: $5.00 expiration value - $4.30 cost = $0.70 net profit

(25 contracts X 100 contracts per option X $0.70 profit per option)

= $1,750 or 16.28% in 27 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning February 19 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next quarter's end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade.

You Can’t Do Enough Research