How to Spot a Market Top

After the sharpest move up in stock prices, you have to ask the question of whether the market is topping?

I have a laundry list of items to check off before I draw that harsh conclusion:

1) Retail buyers enter the stock market on a large scale. So far, they are missing in action. Nobody believes in this rally.

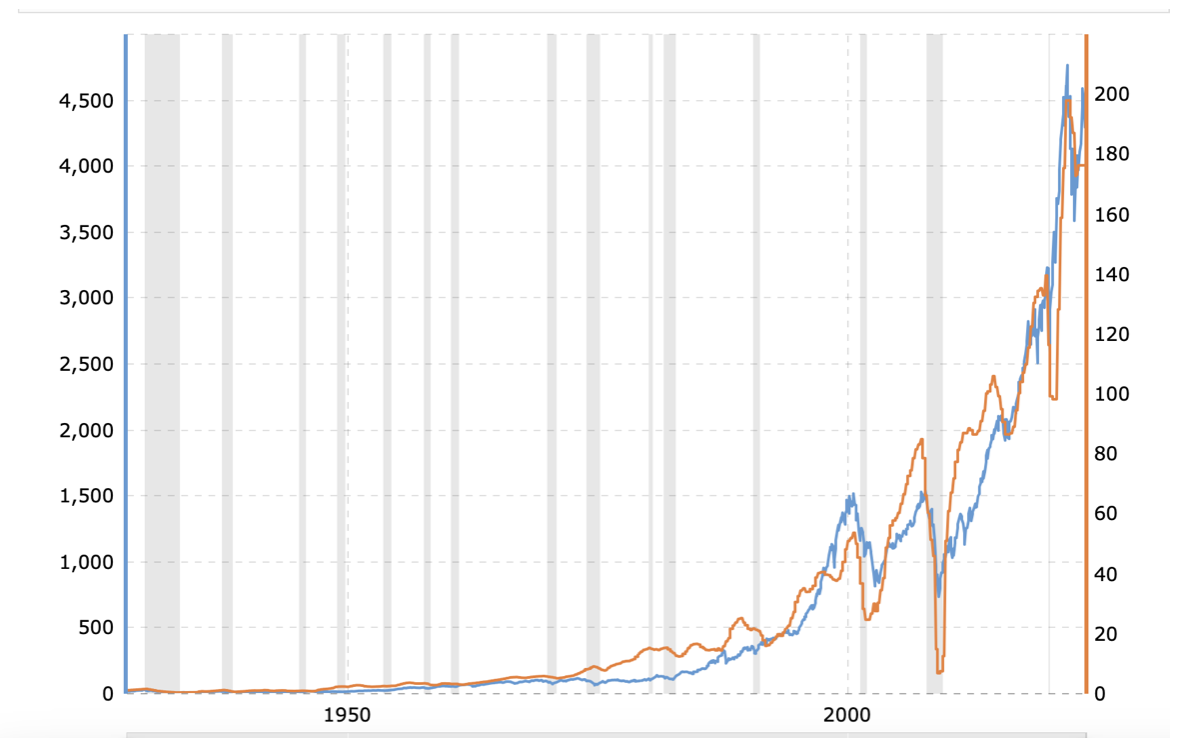

2) S&P 500 profits historically peak at 50% above the old high. In the last cycle, they got to $200 a share. So we still have room to soar to $300/share, some 50% above today’s probable $200/share.

3) The yield curve is always inverted at a market top (short term interest rates are higher than long term ones.) In actual fact, this relationship is about to reverse. Interest rates are about to de-invert.

4) Stocks are always more expensive than bonds on a relative basis at bubble tops. Currently, both stocks and bonds are historically cheap.

5) Even if the Fed does raise 25 basis points one more time, the next big trend is down, probably 200-300 basis points.

Add all of this up together, and not only are stocks not topping, they have just launched on a years-long bull market.

The party is only just getting started.

I just thought you’d like to know.

S&P 500 Earnings per Share

The party is only just getting started