I Nailed It

It’s Washington D.C.

That’s what I thought two months ago when I guessed where Amazon (AMZN) would place their new headquarter, please click here to read the story.

It all makes sense and Founder and CEO of Amazon Jeff Bezos clearly has a lot of sense.

Why would you build a second headquarter far away from the home away from home Bezos purchased in the posh Kalorama neighborhood of Washington DC for $23 million in 2016?

The reason Softbank’s CEO Masayoshi Son bought the most expensive home in California was because he hates staying in hotels.

Men of this ilk are beyond hotels and have the resources to recreate a Taj Mahal to recharge their batteries in.

Hotels fail to deliver the same comforting effect, and perpetually feeling like an outsider isn’t the environment that breeds success or high-level inspiration.

Divine inspiration fuels earth-changing ideas to these visionaries.

Bezos’ estate was already the biggest home in Washington DC before he commenced a $12 million expansion last year.

With his wife MacKenzie, the couple has targeted the use of the home for socializing with the global elite just a stone’s throw away from the White House.

The 27,000 square feet reconfigured to wine and dine is about to be the hottest party ticket in Washington.

It’s ideal timing for Amazon as regulation could have gnarly teeth like Dracula and it is entirely logical to place yourself a degree of separation from Capitol Hill to put out any potential legislative fires.

Bezos’s 11th hour decision flipped the script somewhat as he decided to split the headquarter between New York.

The abundance of big data possessed by the richest man in America indicated that finding the necessary technical talent would be a big ask for one place and bifurcating the operation into two would ensure streamlined execution of recruiting the best talent on earth.

Unsurprisingly, Bezos pinpointed New York as the lucky sub-winner and Bezos’s other house is conveniently located in Central Park West purchased in 1999 for $7.7 million from former Sony Music executive Tommy Mottola.

Washington DC and New York were always going to be the first two choices because places like Nashville and Atlanta are bereft of the amount of talent Amazon needs to fill these headquarters up with.

The more than $2 billion in tax incentives from state and local governments is a nice bonus too.

As a side note, Amazon announced a new “Operations Center of Excellence” in downtown Nashville and will fill it up with 5,000 employees, meaning they approved of some of these smaller cities, but not at the grand scale Amazon’s ambitious expansion requires.

It is a consolation prize that is still quite a reward as second-tier cities augment its attempt to morph into legitimate regional tech hubs.

Amazon also threw a bone to the local governments allowing them to brace for a tsunami of gentrification and an affordability crisis at a slower pace.

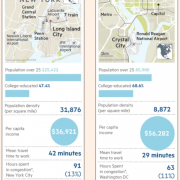

Real estate prices, standard of living, upheaval of the local lower class, and quality of jobs are about to explode in Long Island, New York and Crystal City, Virginia.

On the back of the Amazon news, Google announced its intentions to expand its New York headcount by up to 14,000.

Consequently, New York real estate and its crumbling infrastructure effectively receive no reprieve from an onslaught of tech capital, high-income jobs, and gentrification about to shower down on its urban core.

The most powerful American tech players have essentially given smaller American cities the middle finger.

This could have the unintended effect of exacerbating income inequality and social division that have been at the forefront of this 10-year economic recovery.

That is basically why Bezos absolutely needs to be in the middle of Washington D.C.

He wants to cut off the snakes of Medusa before his brainchild is venomously bitten.

Make no mistake, one of Amazon’s unintended effects is massive job loss in the retail sector that has caused companies like Sears, Toy “R” Us to shutter and has set up JC Penny (JCP) for a TKO.

What does my crystal ball say next?

Amazon’s gargantuan expansion has its sights set on one thing – the domestic logistics industry.

Bezos wants to become totally vertically integrated to control every movement of the supply chain.

That is his end goal, and nothing will stop him.

To carry this out, he needs headquarters on both coasts and in megacities that can execute his strategic plan to algorithmic precision.

Amazon death star’s next casualties are his logistics competitors FedEx (FDX), UPS (UPS), and the United States Post Service.

They have been a weakness in Amazon’s next-gen supply chain for years.

These services are constantly underperforming, slow to modernize, and worst of all charge too much for their service.

The access to cheap capital and superior talent base means Amazon’s next Christmas list of an in-house logistical service could be plausible.

It certainly would solve the backbiting of the administration criticizing Amazon for manipulating the post service. That argument is nullified if Amazon goes totally in-house which in all likelihood was the premise and roadmap for creating two new headquarters.

Amazon needs to snatch enough delivery capacity to marry it up with the rapid growth of their e-commerce division as Amazon secures a bigger market share of retail sales.

Amazon has already bitten off 50% of domestic e-commerce sales and rising fast.

You don’t need the data in your face, I can tell you right here that USPS, FedEx, and UPS cannot deliver this extra capacity at the low costs Amazon desires.

While building their new logistics arm, they will still be reliant on these current legacy offerings but will start to divert deliveries into their own in-house options as they quickly come on line.

This game plan mirrors the strategy for Amazon Basics brand that learns to crawl before it walks from 3rd party sellers.

Amazon absorbs enough to build a comparable product for half the price then sticks it up at the top of their own website’s product search magically relegating the competition down the product search page.

If you think Amazon doesn’t copy other’s ideas, then you are mistaken. They learn what they can then apply the massive swath of data to do the same for cheaper and with better execution.

Amazon is already in the testing phase for the new Amazon delivery program offering rates that are 50% cheaper than UPS.

This pilot program is being tested in the Los Angeles area and could be a material benefit to 3rd party seller’s cash flow.

One of my favorite Jeff Bezos quotes is “your margin is my opportunity,” and he is set to roll out the same playbook on UPS and FedEx.

FedEx and UPS cannot compete when Amazon is taking a calculative loss delivering products with an in-house service that is focused on grabbing market share and not extracting profits.

Amazon has one priority and that is the end customers who receive their shiny Amazon packages at the front door with an ear to ear smile.

They couldn't care less about the logistics providers they work with and I can guarantee you that upper management has made dominating logistics a focal point of the next step of expansion.

The optics test certainly proves my point as every time I go into a United States post office, the service is slow, inefficient, and coated with a transparent disregard for performance.

Even worse, there are usually two or three customers complaining about misplaced packages off to the side looking to find a manager who is out on a perpetual lunch break. Such is the state of the USPS for better or worse.

Amazon has also introduced its own Amazon-branded delivery vans that partner companies can lease, and the testing phase is swiftly accumulating enough data for Amazon to feel they can go forward with wide-scale adoption.

Management will never vocally concede that they are about to wipe out FedEx, UPS, and the USPS. As usual, the focus is laser-like on the end customer with Amazon management explaining that “to support growth, we went back to our roots to share the opportunity with small- and medium-sized businesses.”

Offering best in class service with unbeatable prices is the formula for customer retention. Amazon knows this, and they don’t care who they wipe the floor with on the way to achieve their ultimate mandate.