If You Sell in May and Go Away, What to do in April?

That is the conundrum facing traders, investors, and individuals as we enter the new quarter. For some hedge fund managers, Q1, 2012 was clearly the quarter from hell.

I have been in the market for four decades, long enough to collect an encyclopedia worth of words of wisdom. One of my favorites has always been ?Sell in May and Go? away. On close inspection you?ll find there is more than a modicum of truth is this time worn expression.

Refer to your handy Stock Traders Almanac and you?ll find that for the last 50 years the index yielded a paltry 1% return from May to October. From November to April it brought in a far healthier 7% return.

This explains why you find me with my shoulder to the grindstone from during the winter, and jetting about from Baden Baden to Monte Carlo and Zermatt in the summers. Take away the holidays and this is really a four month a year job.

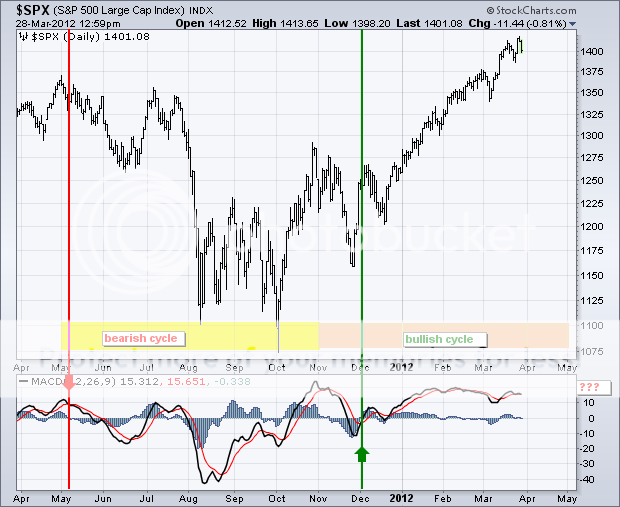

My friends at StockCharts.com put together the data from the last ten years, and the conclusions on the chart below are pretty undeniable. They have marked every May with a red arrow and Novembers with green arrows.

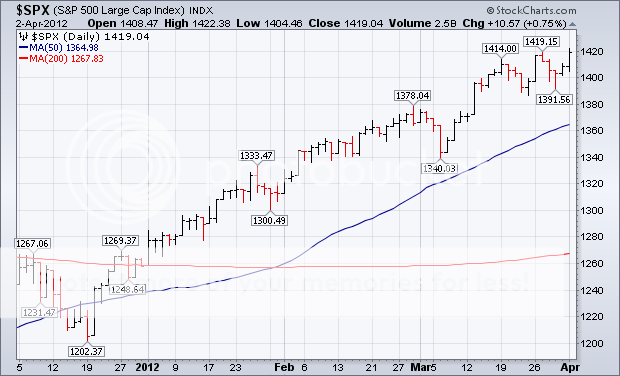

What is unusual this year is that we are going into the traditional May peak on top of a prodigious 12 % gain in the S&P 500, one of the sturdiest moves in history. History also shows that the bigger the move going into the April peak, the more savage the correction that follows. What do they say in golf? Fore?

Being a long time student of the American, and indeed, the world economy, I have long had a theory behind the regularity of this cycle. It?s enough to base a pagan religion around, like the once practicing Druids at Stonehenge.

Up until the 1920?s, we had an overwhelmingly agricultural economy. Farmers were always at maximum financial distress in the fall, when their outlays for seed, fertilizer, and labor were at a maximum, but they had yet to earn any income from the sale of their crops. So they had to all borrow at once, placing a large call on the financial system as a whole. This is why we have seen so many stock market crashes in October. Once the system swallows this lump, its nothing but green lights for six months.

Once the cycle was set and easily identifiable by low end computer algorithms, the trend became a self fulfilling prophesy. Yes, it may be disturbing to learn that we ardent stock market practitioners may in fact be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market.

Are the Bull?s Days Numbered?