It's Groundhog Day

It is always the sign of a great hedge fund manager when he makes money while he is wrong.

I have seen this throughout my life, trading with clients and friends like George Soros, Julian Robertson, Paul Tudor Jones, and David Tepper.

And wrong I certainly was in 2024.

I thought Trump would lose the election.

Then, I thought that markets would rocket no matter who won. Only the sector leadership would change.

How about one out of two?

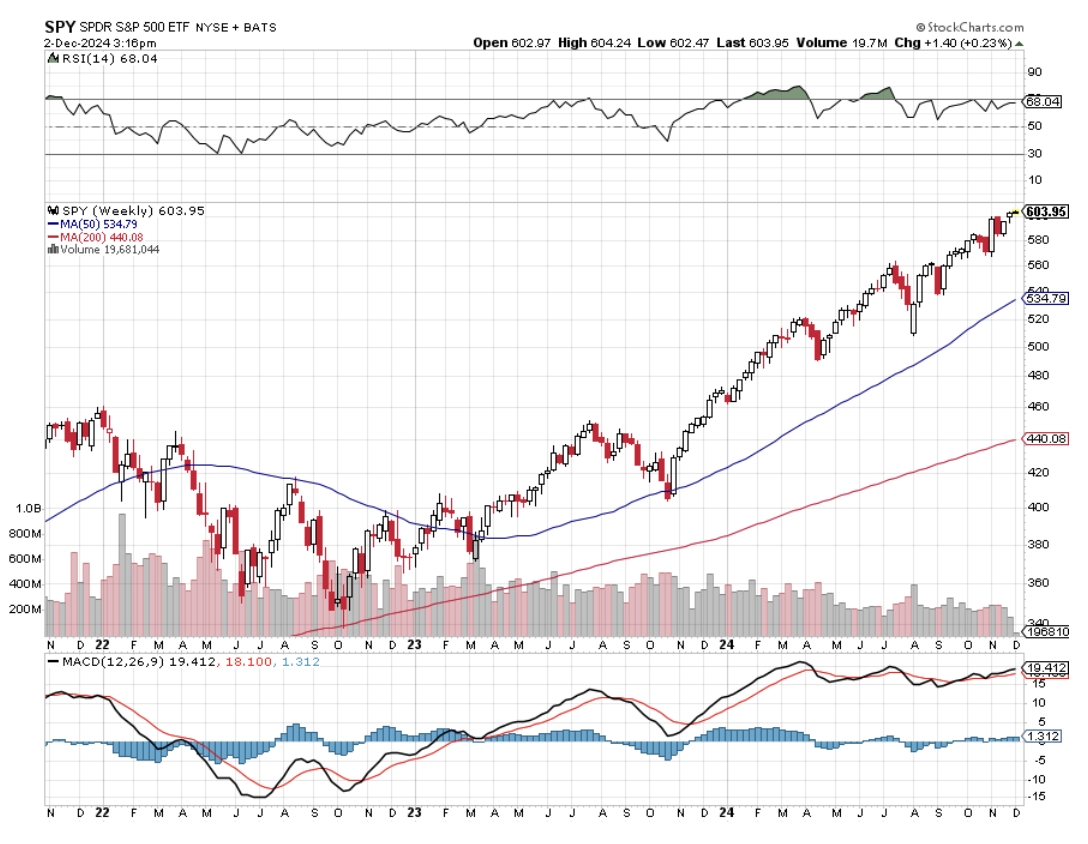

The big question is: “Is a stock market crash now in front of us?” The answer is absolutely yes. It’s only a question of how soon.

At this point, we only know what Trump said. And as we all know, what Trump says and does, or can do are totally different things. It all adds a new and constant source of unknowns for the market.

Of course, it helps to have a half-century of trading experience, too. I like to tell my beginning subscribers, “Don’t worry, after the first 50 years, this gets easy.”

Except easy it is not, going into the next several couple of years.

In a few months, it will be Ground Hog Day, and Punxsutawney Phil will call the weather for the next six weeks from his hilltop in Gobbler’s Knob, Pennsylvania.

For the financial markets, it could mean six more MONTHS of winter.

Nobody wants to sell because they believe in a longer-term bull case going into yearend.

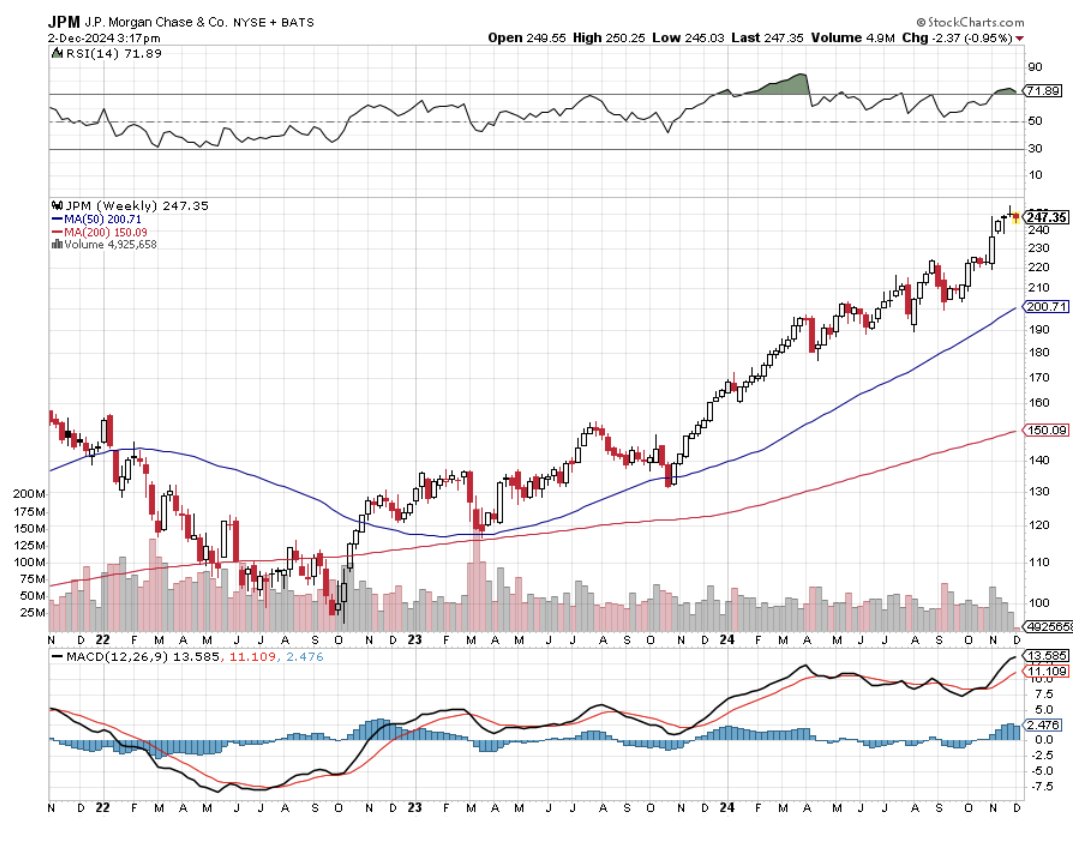

In the meantime, they are buying deregulation plays (JPM), (GS), (BLK), and Tesla (TSLA) as a hedge against the next Tweet.

We could see a repeat of the first half of 2017 when markets rocketed and then died.

This is what a Volatility Index (VIX), (VXX) is screaming right in your face, kissing the $13 handle.

The never-ending tweets are eroding the bull case by the day.

So, we’re at war with Canada now? Wait! I thought it was Mexico? No, it’s France. If it’s Tuesday, this must be Belgium.

And our new ally? Russia!

Even the Federal Reserve is hinting in yesterday’s statement that it is going into “RISK OFF” mode, possibly postponing a December interest rate cut indefinitely.

Unfortunately, that completely sucks the life out of our short Treasury bond trade (TLT), (TBT) for the time being, a big earner for us earlier this year.

Flat to rising interest rates also demolish small caps and other big borrowers (homebuilders, real estate, REITs, cruise lines).

The market is priced for perfection, and if perfection doesn’t show, we have a BIG problem.

All of this leads up to the good news that followers of the Mad Hedge Fund Trader enjoyed almost a perfect month in November.

Trade Alert Service in November

(DHI) 11/$135-$145 call spread

(GLD) 12/$435-$340 call spread

(TSLA) 12/$3.90-$400 put spread

(JPM) 11/$195-$205 call spread

(CCJ) 12/$41-44 call spread

(JPM) 12/$210-$220 call spread

(NVDA) 12/$117-$120 call spread

(TSLA) 12/$230-$240 call spread

(TSLA) 12/$250-$260 call spread

(TSLA) 12/$270-$275 call spread

(MS) 12/$110-$115 call spread

(C) 12/$60-$65 calls spread

(BAC) 12/$41-$44 call spreads

(VST) 12/$115-$120 call spread

(BLK) 12/$950-$960 call spread

The net of all of this is that 2024 is looking like a gangbuster year for the Mad Hedge Fund Trader, up 18.96% in November and 72.00% YTD, compared to only 26.62% for the S&P 500.

It seems that the harder I work, the luckier I get.

Hanging With David Tepper