January 10, 2025

(PORTFOLIO PERFORMANCE FOR 2024)

January 10, 2025

Hello everyone

Firstly, I’m deeply sorry for anyone who has been affected by the L.A fires. Losing everything in a fire is traumatic; I do hope the community comes together to give comfort and people support each other during this devastating time.

The market is expressing a topping pattern. So, we would be wise to take some funds off the table. As I said in my Monday newsletter, there is a real possibility that we could expect movement towards $5000 and under in the S&P500. So, let’s bank some profits.

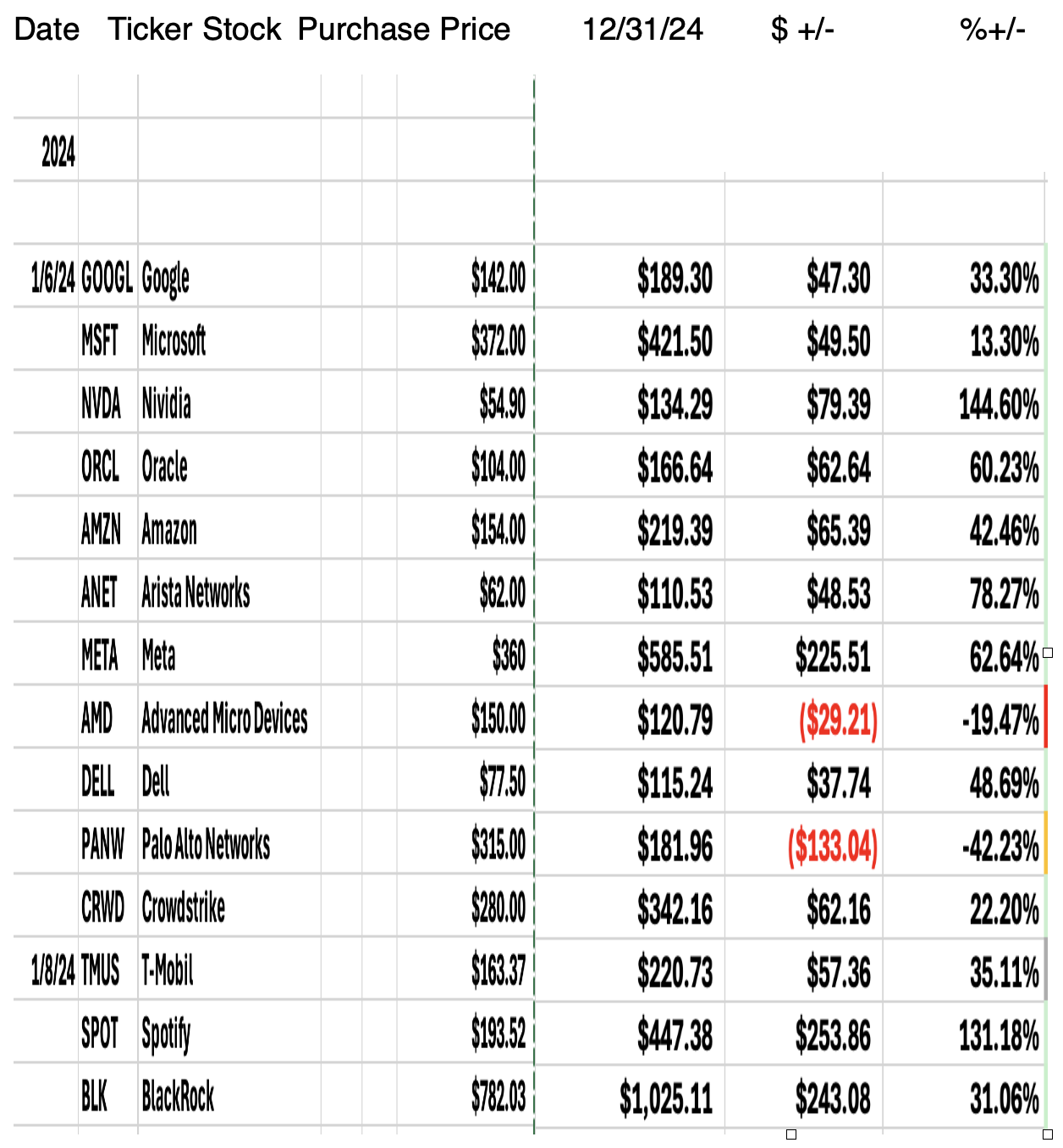

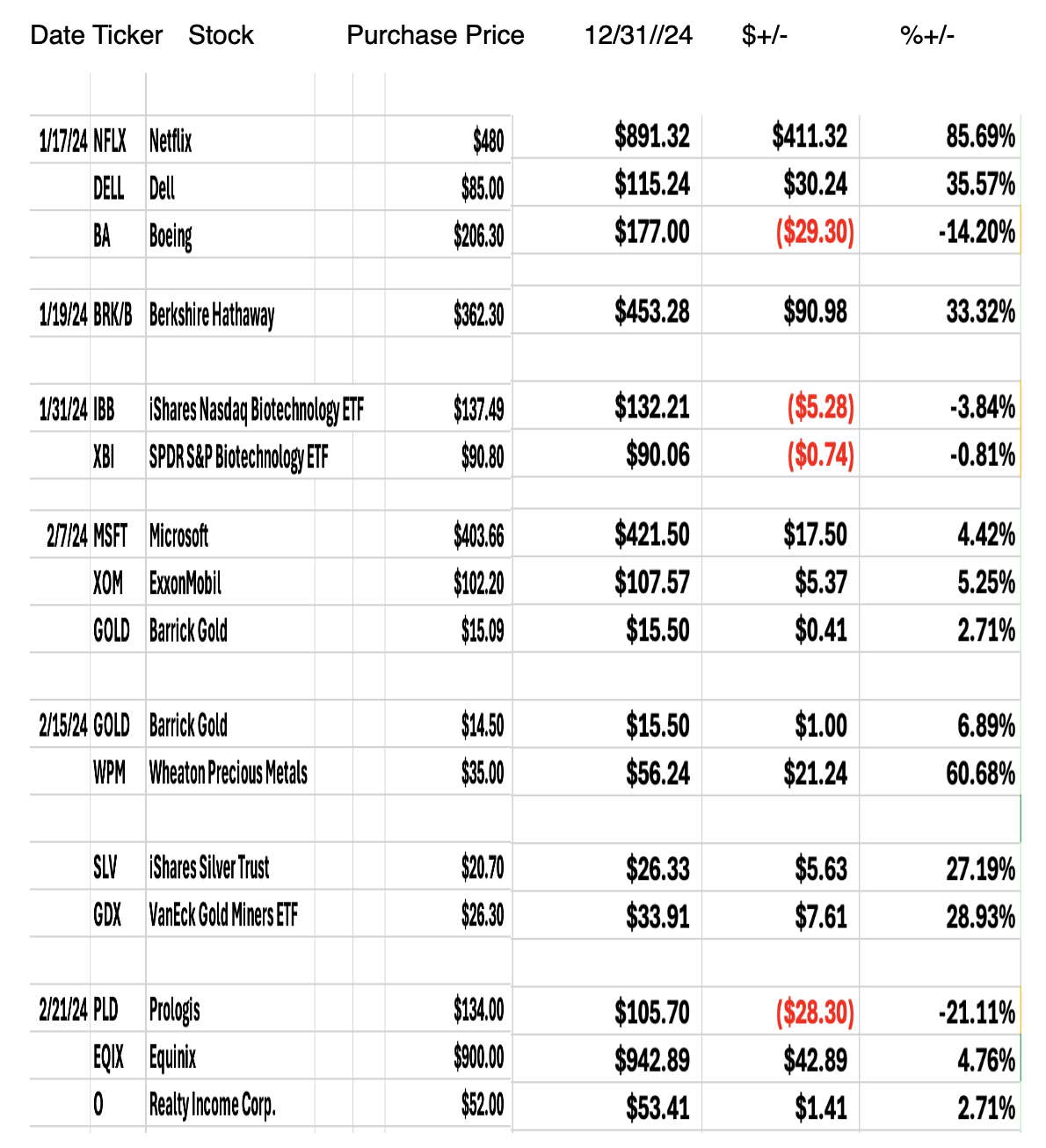

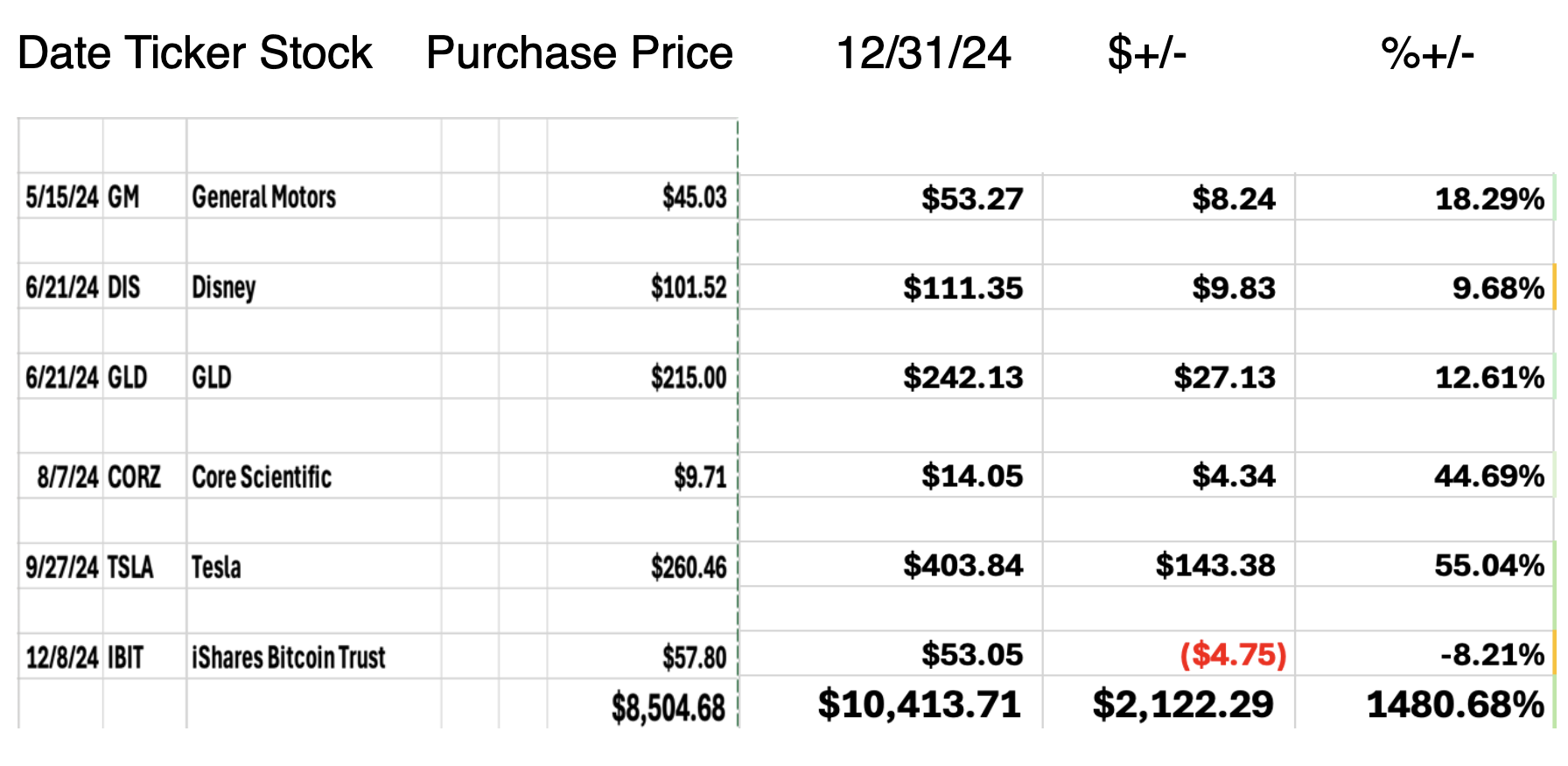

Below I’m showing our portfolio and our end-of-year performance.

On the left, I show the date, ticker symbol, stock, and purchase price, and on the right, I show the price of the stock on December 31, 2024, + the $ gain/loss and the % gain/loss for the year.

Energy was our worst-performing sector. We can expect further lightning bolt movement in oil followed by a low and then a move up. The timing of these moves is hard to nail down.

I have cut and pasted from my Excel spreadsheet, instead of sending the whole thing out to you.

So, if you had bought one stock in each of the above companies when I suggested, you would have been ahead by $2,122.29 or 1480% for the year. (Two people have checked these numbers besides me).

Let’s take some profits now on the following stocks:

On November 8, 2023, we bought Digital Ocean (DOCN) at $26.30. On January 8, 2024, the stock sits at $34.48. Sell the stock and take profits.

Profit = $8.18 OR 31.10%

On November 27, 2023, we bought Dell (DELL) at $75.00.

On January 6, 2024, we scaled in again at $77.50.

Again, on January 17, 2024, we scaled in at $85.00.

On January 8, 2024, the stock sits at $119.31. Sell the stock and take profits.

Profit = $75.00 -$119.31 = $44.31 OR 59.08%

Profit =$77.50 - $119.31 = $41.81 OR 53.94%

Profit = $85.00 -$119.31 = $34.31 OR 40.36%

If you bought any of the Home Builders: Lennar, Pulte Group, D. R. Horton, Toll Brothers, I advise you to sell out of them. Interest rates will stay on the high side.

On October 10, 2024, I presented a list of stocks where you could add weight. The Home Builders were part of this list and looked promising with the prospect of many more interest rate cuts. Now, however, that does not look likely to happen, so we need to cut this sector from our portfolio. On October 10, the stocks were at the following prices. On January 8, 2025, the stocks listed these prices. I advise to scale out on days when the market and these stocks show an uptick.

D.R. Horton $183.39 - $139.90

Lennar $178.20 - $133.54

Toll Brothers $149.07 - $127.03

Pulte Group $138.66 - $110.46

On April 3, 2024, we bought Taiwan Semiconductor (TSM) at $140.22. On January 8, 2024, it’s at $207.12

Profit = $66.90 OR 47.71

QI CORNER

Cheers

Jacquie