January 15, 2010

January 15, 2010 Featured Trades: (BILL MILLER), (JPM), (IBM), (VENEZUELA), (US TREASURY)

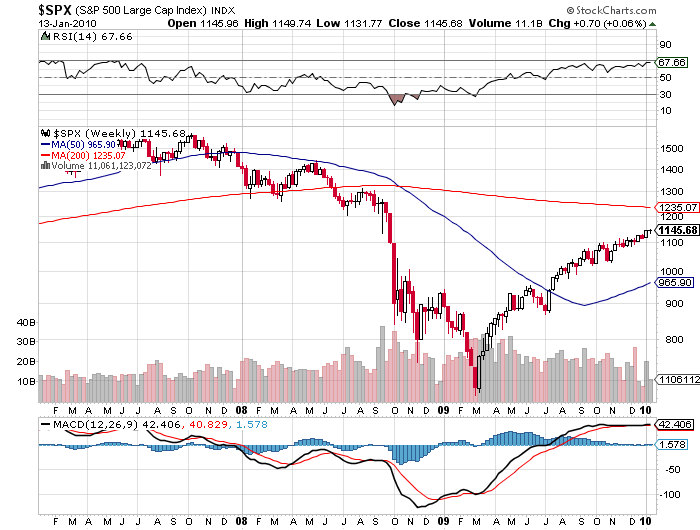

1)?Keep your friends close, and your enemies closer,? said the ancient Chinese general Sun Tzu. I read the diminutive book, Art of War, written in 400 BC, every year and am always astounded by how much applies to trading the markets. So when Legg Mason?s Bill Miller outlined his wildly bullish case for equities this year, I was all ears. You know Bill, the brilliant value manager who beat the S&P 500 for 15 consecutive years until 2006, who clocked a sizzling 80% return last year, and who now runs $16.9 billion. Bill believes that US GDP growth will surprise to the upside at 3.5%-4.5% this year, versus a consensus 2.7%, taking corporate profits up 25%. The financial crisis is over. The top ten stocks in the index traded at a 30 multiple in 2000, and are down to a 12 multiple now, but should be trading at 14-18 times. Dividend restoration will be an important feature of the bull market going forward, since the healthiest firms overdid it in cutting payouts in the dark days of last winter. His favorite stocks are JP Morgan (JPM), regional banks, and big global technology stocks like IBM. I totally agree with the last pick, as it is a wonderful back door emerging markets play, with more than 50% of its earnings coming abroad. Bill is clearly no dummy. I would love to sit down with him and discover what I am missing. Maybe I?m just a naturally cautious guy, and maybe Bill is just talking about his value universe. When refining a global view across 100 markets, you always have to keep an open mind and consider all alternative scenarios, whether you agree with them or not.

2) I was shocked when I saw Venezuela announce a surprise 50% devaluation of the Bolivar against the dollar last week. You would not normally expect a country that is the third largest foreign supplier of oil to the US to have a plunging currency. Mismanagement of the country?s economy on a massive scale is to blame, with socialist leader Hugo Chavez rapidly earning a reputation as the Robert Mugabe of Latin America. Nationalizations of key companies have been rampant, capital is fleeing the country, and foreign investors are staying away in droves. Despite incredible oil riches, production is falling through mismanagement. The middle class promptly emptied out their bank accounts on word of the devaluation, and splurged on any consumer goods they could get their hands on before prices doubled. GDP fell 2.9%, inflation came in at 25%, and is now expected to soar to 40% in 2010, the second highest in the world after Robert Mugabe?s Zimbabwe. Chavez responded by threatening to seize any business that raised prices. Recovering oil prices and inflationary expectations helped the Caracas IBX Index nearly double in local currency terms since the March lows. I mention all of this because oil should make Venezuela one of the wealthiest countries in South American, on par with Brazil. It clearly isn?t now, but could in the future. Voters will get their first chance to dump Chavez in the September elections, unless some generals get impatient first. Latin leaders who thumb their noses at the US as frequently as Chavez has have notoriously short lifespans. Just ask Noriega. Buy Venezuela when Chavez is hanging by his heels from a tree in the Caracas? Parque Los Caobos.

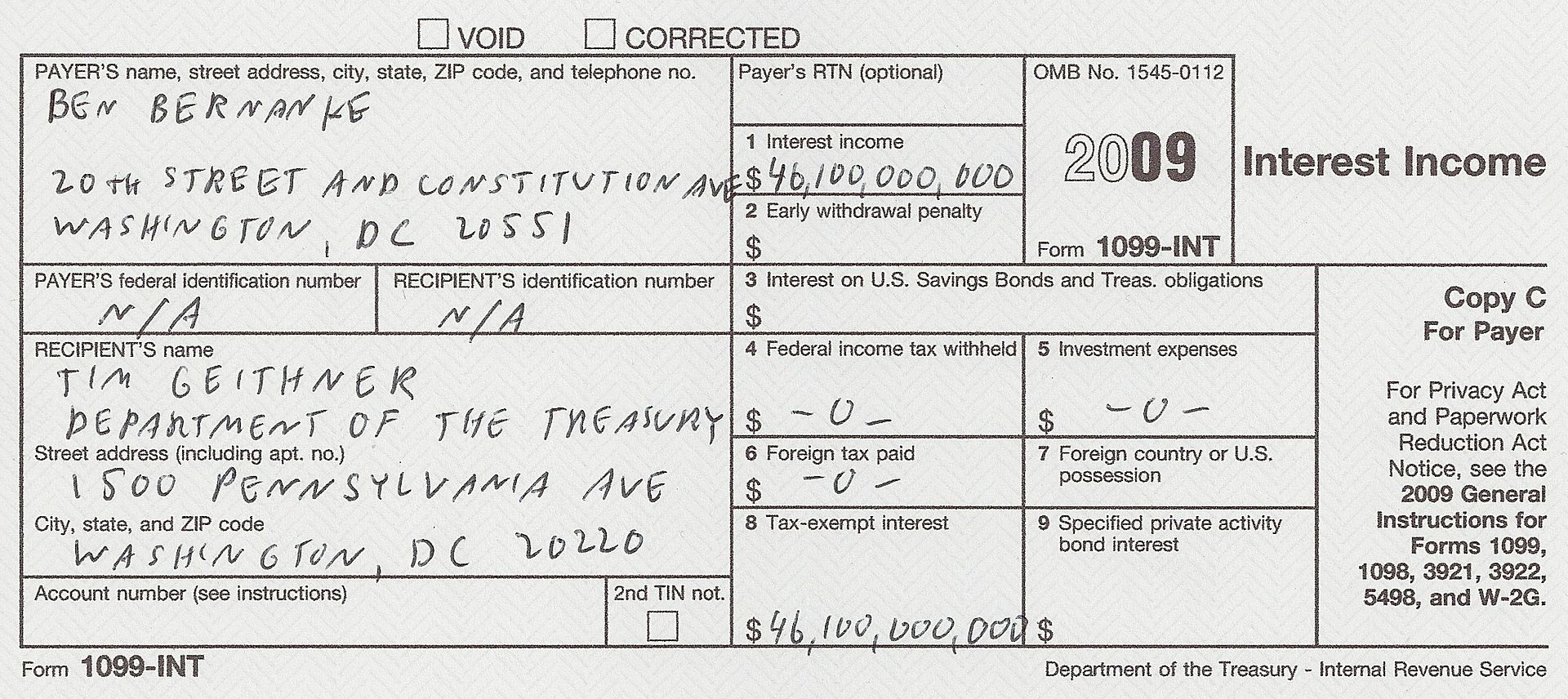

3) The world?s largest hedge fund, the Federal Reserve, earned a profit of $46.1 billion on the many bail out programs it carried out in 2009. That is the interest on $175 billion in government backed mortgage companies, $300 billion in straight government debt, and a whopping $1.25 trillion in mortgage backed securities. Also contributing are other instruments invented by Ben Bernanke to stave off the collapse of the financial system, which are too complex to describe here. Sure, interest rates were low last year. But the Fed made up for this like any good hedge fund would, with tons of leverage. Even Maiden Lane LLC, which holds securities from Bear Stearns and AIG, made $5.5 billion. This is a return far in excess of what Pollyanna?s were predicting when these safety nets were put out. That works out to $153 per person in the US. If you toss in unrealized capital gains and mark these positions to market, the unrealized paper profits would be several times larger. Of course, this will ultimately all get wiped out when General Motors and AIG submit their final bills. I wonder if the Fed owes the Treasury a 1099? Do you suppose they pay any taxes?

4) My guest on Hedge Fund Radio this week is Yra Harris, a global macro hedge fund manager who has been a fixture of the futures community for over three decades. Yra cut his teeth in the foreign currency markets during the violent days of the seventies, just as that industry was entering a period of explosive growth. His career took him though Solaris Capital, Praxis Trading, and James Sinclair & Co., among others, and has served on several committees at the Chicago Mercantile Exchange. Yra writes a daily blog on macro investing called Notes From Underground, which you can find at www.yrah53.wordpress.com?? . Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com , click on ?Listen Live!?, and click on ?Houston 1110 AM KTEK.? For archives of past Hedge Fund Radio shows, please go to my website by clicking here.

?The error of optimism dies in the crisis. But in dying, it gives birth to the error of pessimism, and that error is born not as an infant, but as a giant,? said Cambridge neoclassical economist Arthur C. Pigou.