January 15, 2025

(THE BOND MARKET IS SPOOKED BY TRUMP ERA POLICIES)

January 15, 2025

Hello everyone

WHAT IS THE BOND MARKET SAYING?

Fears that the President-elect’s agenda, which has the rally cry “America First”, will reignite inflation and set in motion a wave of economic damage have unsettled bond markets and sent the US dollar sharply higher.

Last Friday, after the sizzling hot jobs report, bond yields spiked, and the US dollar strengthened. But the US is not unique here. A global surge in yields and a significant appreciation of the US dollar in recent months has unsettled investors and policymakers.

The global sell-off of bonds started in mid-September, days ahead of the US Fed’s 50 basis point cut to the federal funds rate. The Fed followed that with a 25-basis point cut in November and another 25-basis in December.

It seems odd, doesn’t it? Yields are rising as central banks like the Fed and the European Central Bank are cutting their policy rates. However, central banks tend to respond to the data in front of them while markets are more forward-looking.

The US jobs report, which showed 100,000 more jobs added in December than forecast, and unemployment falling, could be read as an indicator that the US economy is growing more strongly than investors had anticipated.

However, the longer-term trend, and the fact there has been a rise in yields globally, strongly suggest there are other factors at play here.

The US Treasury bond market tends to lead global bond yields. While some domestic circumstances might help explain movements in other markets, the underlying shift in yields on the longer-dated bonds in recent months appears to have been driven out of the United States.

In that market, the yield on the 10-year bonds has risen from 3.62 percent in mid-September to 4.76 percent, and the yield on the 30-year bonds from 3.93 percent to 4.95 percent. On Friday, the 30-year yield briefly spiked over 5 percent.

In Australia, the 10-year yield has been quite volatile but has trended up from 3.8 percent to 4.55 percent over that period, and the 15-year yield from 4.04 percent to 4.75 percent, even as the economy has essentially been flat-lining.

When the markets made big bets on the re-election of Donald Trump before the November election, share market investors were very bullish but bond investors appeared cautious about the implications for inflation of Trump’s economic agenda.

Now, it seems that bond investors are essentially pacing the floor far more intensely about Trump’s agenda than they were last year. And equity investors are beginning to share the bond investor’s pattern of angst.

Initially, equity investors were delighted about big tax cuts and deregulation, (which ought to mean more growth), but when Trump’s tariffs and his plans for mass deportation of illegal immigrants are factored in, it creates a definite unease about a new and significant outbreak of inflation.

The movement in the longer-term yields can, therefore, be seen as the pricing in of the risks of the Trump agenda. The tariffs on everyone have a global dimension.

Minutes from the December policy meeting show that the Fed has been pricing in the potential impacts of Trump’s trade, immigration, fiscal and regulatory policies.

The Fed’s own projections reflected an expectation in December of at least two more rate cuts this year. Market pricing agreed.

Fast forward a few weeks, and we get the uneasy realization that some US economic analysts are not only talking about just one rate cut but also the potential for rate hikes.

Not something that any of us want to think about.

Higher long-term interest rates and a higher US dollar increase borrowing costs, increase uncertainty, and certainly have a negative impact on emerging market economies, especially low-income countries.

Since September 2024, the US dollar has powered ahead by more than 9 percent against a basket of its major trading partners’ currencies (more than 12 percent against the Australian dollar).

Trump’s anticipated tariffs and the US dollar rally are linked together. When one country imposes tariffs on another, the imposing country’s currency tends to strengthen, and the currency of the country subjected to the tariffs tends to weaken.

So, with that in mind, if Trump’s words are followed by real actions, the dollar ought to strengthen further. I mean, we could be seeing the Euro at 0.9500, and the Aussie below 0.6000. An ever-strengthening dollar besides higher US interest rates rings alarm bells for the global economy, particularly debt-laden emerging economies.

Now, how do you think share markets are going to respond to this?

An attack of the glums would probably hit quite quickly.

Investors who cheered Trump’s tax cuts deregulation and stretched market valuations have been quietly digesting the implications of getting what they wished for:

An over-heated economy.

A massive increase in US government deficits and debt (with a consequent increase in the supply of bonds and another source of pressure for higher interest rates if the market is to absorb them)

A new round of inflation that forces the Fed to respond.

The above does not seem like a recipe for a continuation of last year’s bull market.

Neither would it lend itself to global economic growth and geopolitical stability.

Bonds are speaking; is anyone listening?

The environment is at the red end of risk.

Uncertainty has gripped markets - Trumps’ agenda seems to be entirely at odds with the anticipated economic effects of its implementation.

We will have to wait and see exactly what Trump’s actions are.

QI CORNER

Some suggested nighttime reading for you.

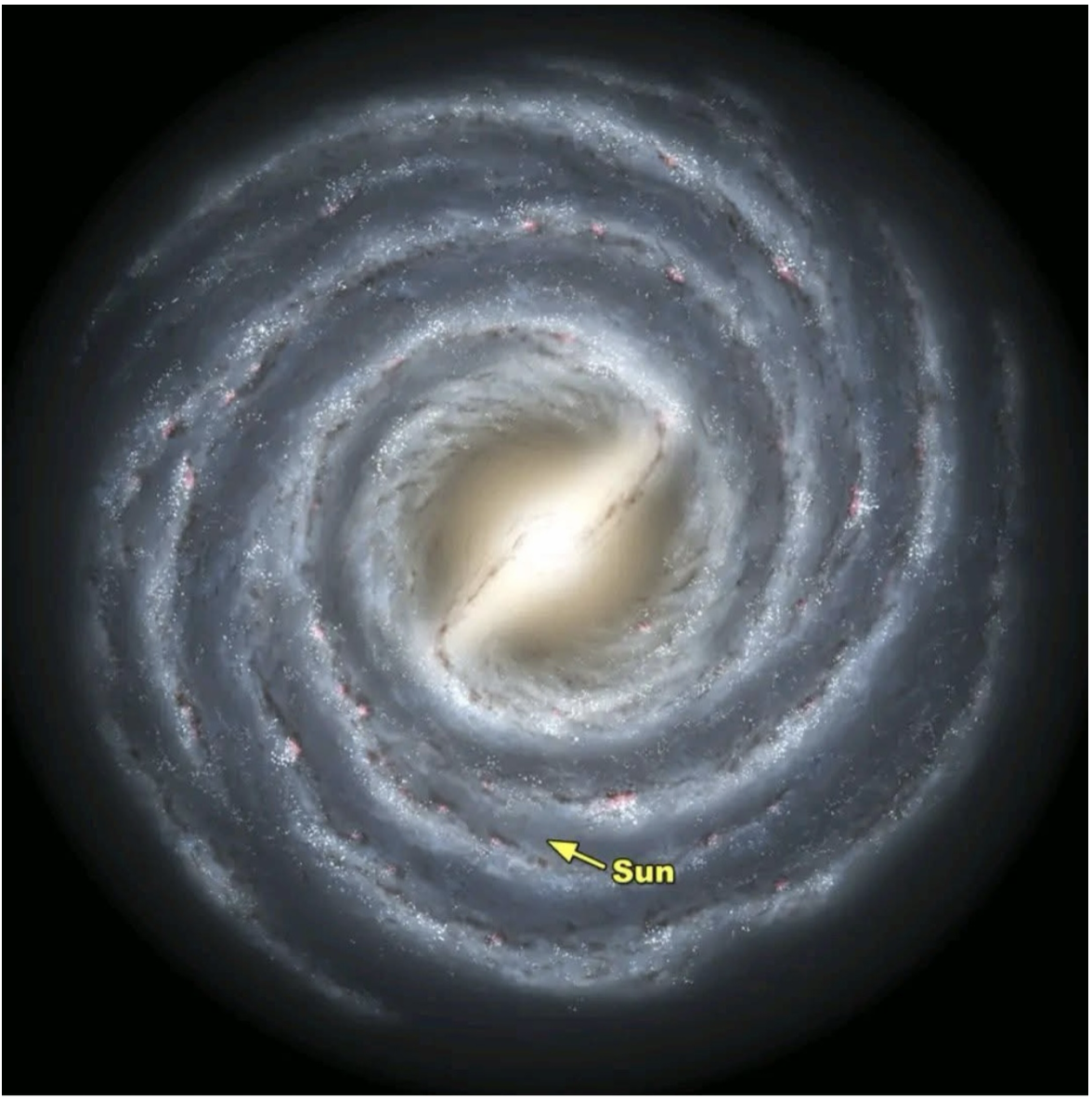

SOMETHING TO THINK ABOUT

Cheers

Jacquie