January 17, 2024

(THE U.S. CONSUMER IS IN THE SPOTLIGHT THIS WEEK)

January 17, 2024

Hello everyone,

In the U.S. January 15 is a federal holiday – Martin Luther King Jr. Day. The market is closed.

Week ahead calendar – All times ET

Monday Jan. 15, 2024

Martin Luther King Jr. Day (U.S.)

Australia Consumer Confidence Chg.

Previous: 2.7%

Time: 6:30 p.m. ET

Tuesday, Jan 16, 2024

8:30 a.m. Empire State Manufacturing Survey (January)

Earnings: Morgan Stanley, Goldman Sachs

Canada Inflation Rate

Previous: 3.1%

Time: 8:30 a.m. ET

Wednesday, Jan 17, 2024

8:30 a.m. Export Price Index (December)

8:30 a.m. Import Price Index (December)

8:30 a.m. Retail Sales (December)

10 a.m. Business Inventories (November)

10 a.m. NAHB Housing Market Index (January)

2 p.m. FED Beige Book

3 p.m. New York Federal Reserve Bank President and CEO John Williams delivers an opening remark in an event “An economy that works for all: Measurement Matters”, New York Fed

Earnings: Discover Financial Services, U.S. Bancorp, Citizens Financial Group, Charles Schwab

UK Inflation Rate

Previous: 3.9%

Time: 2:00 a.m. ET

Thursday, Jan. 18, 2024

8 a.m. Building Permits preliminary (December)

8:30 a.m. Housing Starts (December)

8:30 a.m. Initial Claims (week ended Jan. 13)

8:30 a.m. Philadelphia Fed Index (January)

Earnings: J.B. Hunt Transport Services, PPG Industries, Fastenal, KeyCorp, M&T Bank, Northern Trust, Truist Financial

Japan Inflation Rate

Previous: 2.8%

Time: 6:30 p.m. ET

Friday Jan. 19, 2024

10 a.m. Existing Home Sales (December)

10 a.m. Michigan Sentiment NSA preliminary (January)

Earnings: State Street, SLB, Fifth Third Bancorp, Regions Financial, Huntington Bancshares, Comerica

U.S. Consumer Sentiment

Previous: 69.7

Time: 10:00 a.m. ET

The holiday-shortened week will focus on the U.S. consumer, with retail sales and bank earnings to be reported. Stocks continue to digest the hot inflation data as they skirt near record highs.

Retail sales data for December – due for release Wednesday. Some economists expect an increase of 0.2% for the month, slightly less than November at 0.3%.

So far, the U.S. consumer has been resilient, but when savings deplete, we may see a significant slowing in the economic data.

Some analysts are seeing the U.S. tip into recession this year and the S&P500 tumbling below 4,000 in 2024. Others, however, see the market churning on to new highs for the year.

December housing starts and building permits data will also be released on Thursday, giving insight into whether activity in the sector has increased as mortgage rates declined.

More bank earnings are also on deck, which could give insight into how consumers are spending, and whether there are elevated delinquencies. Big banks, Goldman Sachs and Morgan Stanley will report Monday, as well as several regional banks such as Citizens Financial and M&T Bank.

Another government shutdown deadline greets us this week on January 19. Let’s hope an agreement can be reached on a funding decision. Failure to reach a deal could spark a major risk-off move for markets, however, a shutdown is unlikely, as the major players in the government appear to always reach agreement at one minute to midnight. The market tends to give this government shutdown possibility a sideways glance as it has more important data to monitor. Treasury yields come to mind here.

Last week’s inflation data was hotter than expected, but stocks appear to be shrugging off concerns about higher rates. The market is still expecting that the Fed will eventually cut rates later this year. Some investors are questioning whether the data will eventually nudge the Fed into action the market is not expecting.

In other news:

Microsoft tops Apple as the world’s most valuable public company.

Bitcoin ETF approved. Chart analysts agree that new highs are ahead, even though the crypto may decline initially.

Middle East crisis – U.S. & U.K. strike Houthis. The U.S. and Britain carried out dozens of air strikes on Houthi military targets last week, widening a wave of regional conflict, ignited by Israel’s war in Gaza.

Big tech layoffs are taking place.

Stocks to scale into for the long term:

Netflix (NFLX): 23 million users, up from 15 million in November and 5 million in May 2023. Several analysts have raised their price targets on Netflix to $600 from $475, which means shares could rally 21.8% from last week’s close. Shares have surged 48% during the last 12 months. Analysts argue that over the medium term, the pace of acceleration will show growth in 2024.

Dell (DELL): best positioned in the hardware sector - to benefit from investment in Gen-AI technologies; the company will also benefit from an acceleration in storage demand in the hardware space, which should further benefit Dell. Morgan Stanley has an overweight rating on shares. The stock has nearly doubled over the last 12 months and was up 1.8% last Friday during premarket trading.

Boeing (BA) is in oversold territory with an RSI of around 34 as investors ditched the stock after a door plug blowout during an Alaska Airlines flight over a week ago raised broader industry alarm. Shares were battered last week finishing more than 12% lower, which is the stock’s worst performance since May 2022. The Federal Aviation Administration ordered the temporary grounding of more than 170 Boeing 737 Max 9 aircraft for inspections over a week ago. Boeing stock has dropped more than 16% over the first two weeks of 2024. However, most analysts see a turnaround ahead, with an overweight rating and price target implying shares can rally nearly 25%. Boeing is one of the largest aerospace companies globally, and this is a compelling factor driving growth. Its history, technological expertise, as well as its market presence, give the company an important competitive edge. Price target = $280-$300.

Microsoft (MSFT) Just keep scaling into this stock on all pullbacks. A must-have in your kit.

I hope some of you took my advice and bought into Spotify, BlackRock, and T-Mobile. They rallied well last week and will be great holds for the long term.

Our Trip to Eungella.

We drove up to Eungella last weekend. It is a World Heritage National Park. Quite stunning. Many international visitors stop at the Pinnacle Pie shop on the way to Eungella – a now famous landmark. We bypassed the Pie shop as we wanted to spend the time enjoying the National Park.

We enjoyed an early dinner and coffee here after our day out at Eungella.

Looking towards Mackay and the Pacific Ocean in the background. Eungella is about an hour’s drive from Mackay.

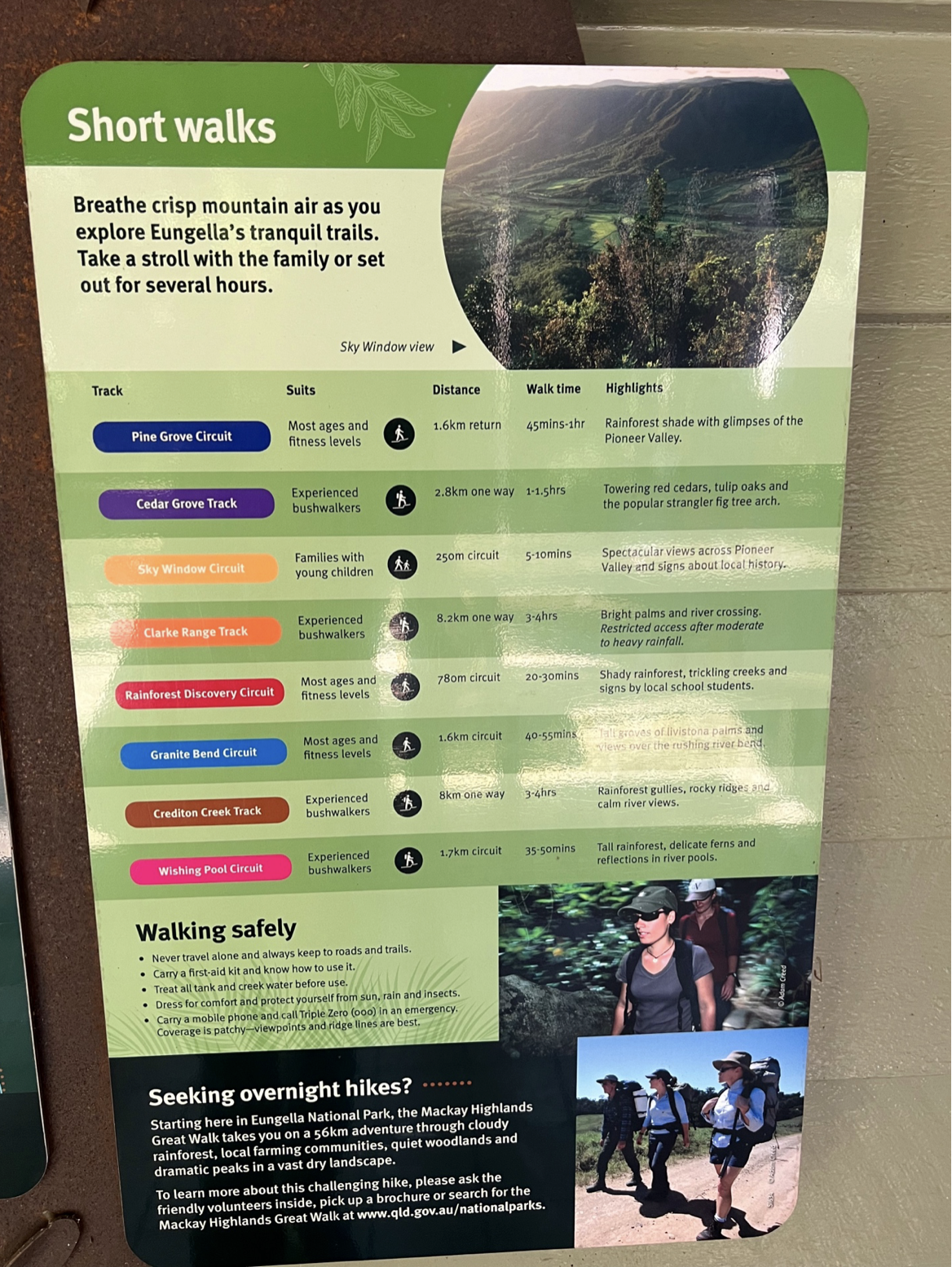

Eungella National Park information board

We spotted a platypus in the water – the first time I have seen one in the wild.

Hikes in Eungella.

Walking along Eungella tracks.

Sculptural features in the National Park.

Cheers,

Jacquie