January 19, 2011 - Time for a Victory Lap

Featured Trades: (IBM), (AAPL), (CSCO), (SSO),

(TBT), (GLD), (DIG)

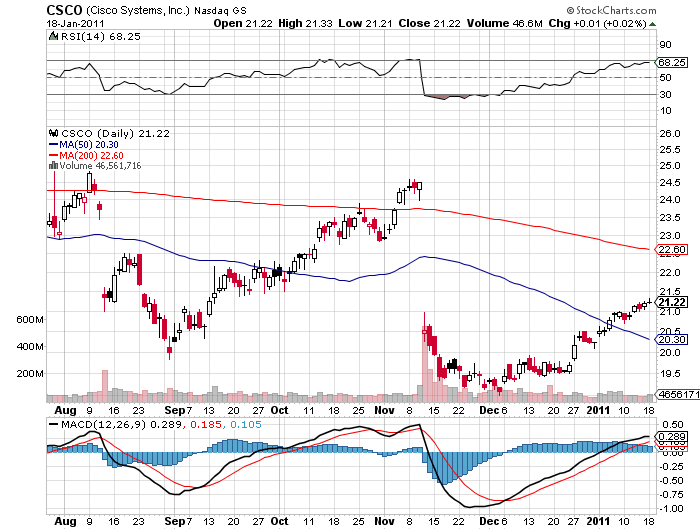

1) Time for a Victory Lap. I'm sorry I'm late with the letter today, but I am out of breath, having run victory laps all morning. IBM (IBM) reports blowout earnings, and Apple (AAPL) absolutely knocked the cover off the ball. It kind of makes my Cisco Systems (CSCO) options position look pretty good, which has already doubled from my cost. It looks like my friend, technical analyst to the stars, Charles Nenner, owes me a case of 80 proof Bols.

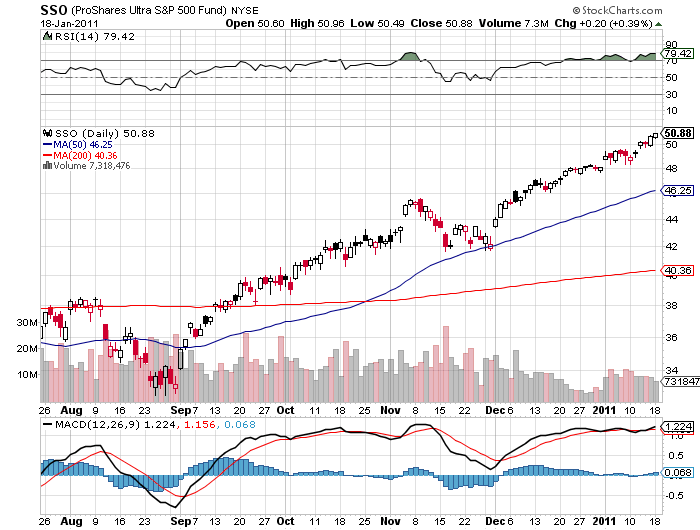

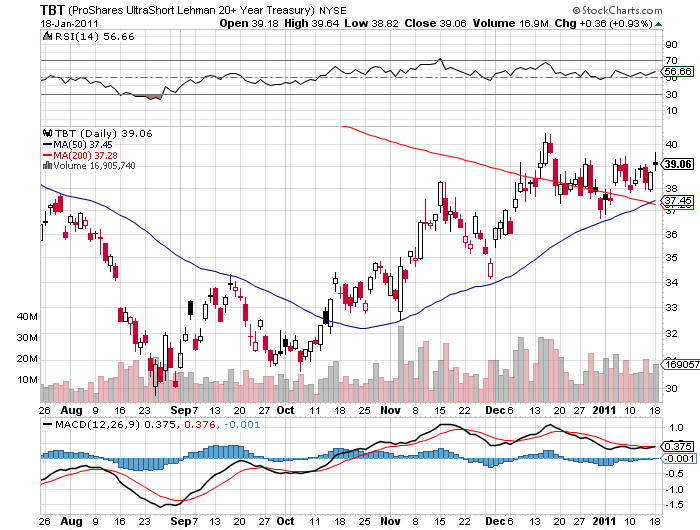

It also looks my hefty long in the (SSO) look sweet, the 200% leveraged long in the S&P 500. Huge earnings surprises in global multinational technology stocks ought to give some oomph to the dollar, and provide some juice for my new short in the Euro. I guess this all will make Treasury bonds suck more, much to the benefit of my (TBT) long, the leveraged bet that these debt instruments will fall.

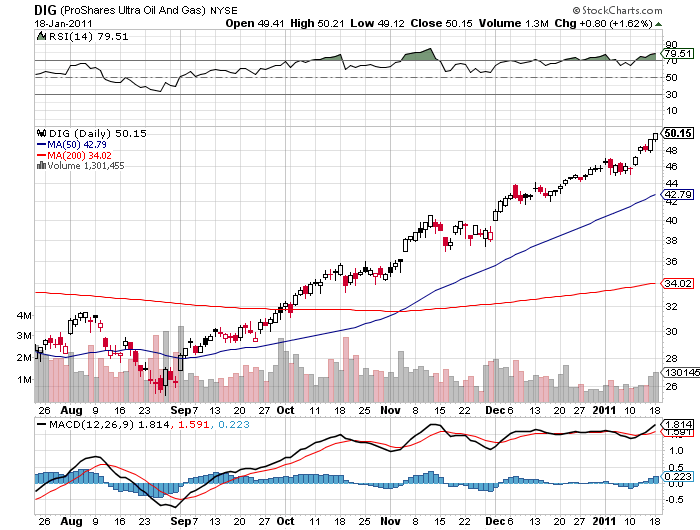

A stronger than expected economy certainly make the argument for stronger oil prices even more compelling, which is why the (DIG) hit a new two year high today. Investors' newfound love with paper assets is preventing gold from rallying, despite an $80 plunge in the barbarous relic in just two weeks, which is why I am short the barbarous relic.

Only the Japanese yen is out there mooning me big time, reminding me to be humble. It is grinding around my cost, instead of dropping like a rock, like it should. But I'll take a push over a loss any day.

All of this explains why my new 'Macro Millionaire' service followers are up 25% in their first 7 weeks of trading, bagging 11.5% in January alone.

Please allow this old fart his delusions of grandeur. Was it something I said?

-

-

-

-

Check Out My Yen Position