January 19, 2011 - Time to Short the Garlic Eaters

Featured Trades: (FXE)

2) Time to Short the Garlic Eaters. The garlic eaters don't want to repay their debts, and the beer drinkers don't want to lend them any more money. That pretty much sums up the financial tensions that exist within Europe right now. The PIIGS countries of Portugal, Ireland, Italy, Greece's, and Spain are lurching from one emergency financing to the next. Never mind that much of that money was borrowed to buy Mercedes, BMW's and Volkswagens, which enriched Germany's economy mightily.

This is one of many reasons why I think the Euro will continue to fall against the dollar, possibly to as low as the mid $1.10's some time this year. The US is growing, and Europe is not. American interest rates are rising, while Europe's are not. This always attracts capital to flow out of the low yielding currency and into the high yielding one, which is creating a rising tide of buyers of greenbacks and sellers of Euro's.

The Euro has just enjoyed a five cent rally against Uncle Buck. Last week, the Spanish and Portuguese bond issues came off better than expected. Germany's Chancellor Angela Merkel hinted they might bend a little on terms. The UK's CPI came in hot. Then China and Japan came in and said they would happily take down a chunk of the high yielding debt. With ten year Japanese Government Bonds yielding a paltry 1.23%, can you blame them?

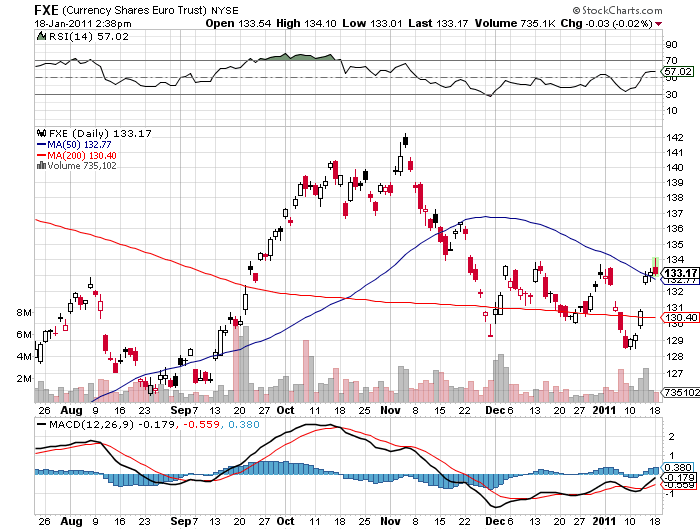

That is the logic behind my recommendation to buy the June, 2011 $132-$129 put spread on the (FXE), the main Euro ETF. This involves buying the June $132 puts and selling short an equal number of June $129 puts for a net cost of $1.18. The recent sigh of relief has taken the Euro up to the top of a two month trading range at $1.34. So I am going to take the gift and put out a small short here. A $100,000 portfolio should put 5% of its capital into this trade, which works out to 42 contracts on each side.

The position reaches its maximum profitability if the Euro closes at or below $1.29 on June 17, 2011. That would pump the value of the spread from $1.18 to $3.00 for a gain of $1.82, or 182%. The June expiration gives this plenty of time to work. Then will bind out if the garlic eaters, and the 'Macro Millionaires' who strapped this baby on, have the last laugh.

-

-

Would You Want to Owe Her Money?