January 24, 2011 - The Choppy Road Ahead

Featured Trades: (DAVID HALE ON THE ECONOMY)

1) The Choppy Road Ahead. Recently, I managed to catch up with my old friend, David Hale of David Hale Global Economics (click here for their site). While swilling a few gin and tonics within the oak paneled walls in the bar at Chicago's exclusive University Club, he outlined his case for the economy for the coming year. Since David is an independent economic advisor to many of the world's top banks and investment firms, I thought his views would be worth passing on.

The economy is currently undergoing a growth spurt, which could deliver an annualized rate of 3% in Q4, 2010. Needless to say, this is hugely bullish for financial markets. Aggressive cost cutting by corporations has taken profitability to record levels. Ben Bernanke's efforts to reflate have also been highly successful.

However, there are storm clouds forming on the horizon. Some $300-$400 billion in financing of state and local governments, the largest portion of the 2008 Obama stimulus package, will soon expire. Given the current make up of congress, it is highly unlikely to be renewed. This could chop some 2.7% off of GDP.

Any truly serious attempt to address our enormous budget deficit will have similar deflationary impacts. The elimination of the tax deductibility of charitable contributions will raise $500 million for the Treasury. Taxing the value of company health insurance benefits will take in another $300 billion. Eliminating the deductibility of state and local taxes conjures up $100 billion in revenues for the feds, while the loss of the home mortgage deduction takes in another $100 billion.

The scary thing about our current predicament is that even if you adopt all of these high contentious proposals, which is unlikely, we will still be left with large annual deficits. That places the sacred cow of defense spending on the altar for sacrifice. Good luck with that. A senior official at Lockheed, the manufacturer of the Hercules C-130 transport plane, once proudly explained to me the firm's strategy of procuring parts in all 50 states, thus creating jobs everywhere and rendering the plane immune to cuts. That's how the Air Force ended up with far more planes that it could ever want or fly. Many other defense programs are similarly dispersed.

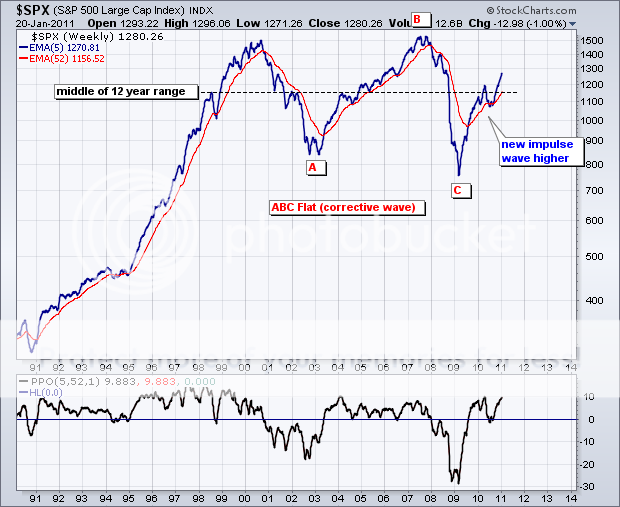

The bottom line is that David foresees a coming decade of choppy and volatile GDP growth, which may average out at a lowly 2.5% rate over the long term. That dovetails nicely with my own view that US stocks have not reentered a secular bull market, but are in the process of probing the upper end of a decade long range. Trade, don't own, date, but don't marry. Buy and hold is dead.

Do You See a Trend or a Range?

-

Don't Touch My C-130 Hercules Contract!