January 25, 2011 - Buying Straw Hats in the Dead of Winter

Featured Trades: (VOLATILTIY INDEX), (VIX), (FFIV), (SPX)

2) Buying Straw Hats in the Dead of Winter. I am one of those demented people who buys flood insurance when the sun is shining and sun tan lotion by the gallon from Costco in the dead of winter. I am such an inveterate bargain hunter that I even buy Christmas ornaments during the January sales when retailers are unloading inventories for pennies on the dollar.

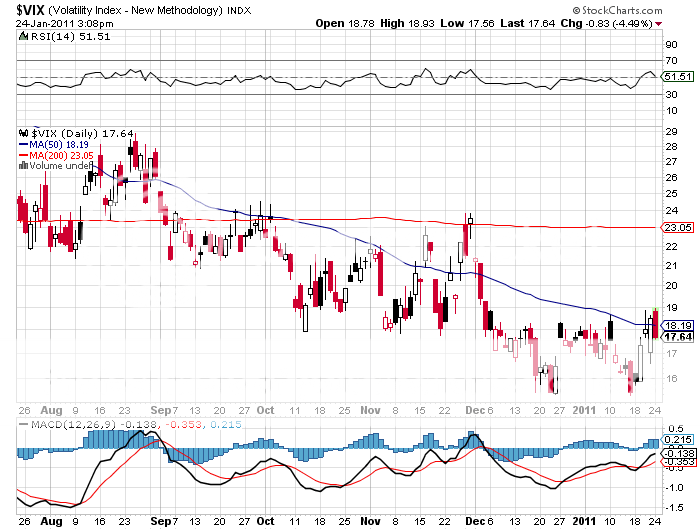

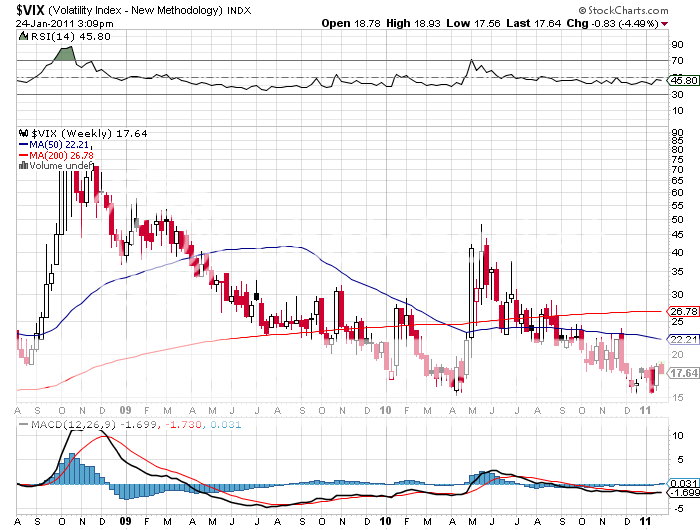

It is such instincts that drive me to take a look at the CBOE Volatility Index (VIX), a measure of the implied volatility of the S&P 500 stock index, which has been in a death spiral since it peaked nearly three years ago at the $80 level. You may know of this from the talking heads and beginners who call this the 'Fear Index'.

For those of you who have a PhD in higher mathematics from MIT, the (VIX) is a weighted blend of prices for a range of options on the S&P 500 index. The formula uses a kernel-smoothed estimator that takes as inputs the current market prices for all out-of-the-money calls and puts for the front month and second month expirations. The (VIX) is the square root of the par variance swap rate for a 30 day term initiated today. To get into the pricing of the individual options, please go look up your handy dandy and ever useful Black-Scholes equation.

For the rest of you who do not possess PhD in higher mathematics from MIT, and maybe scored a 450 on your math SAT test, or who don't know what an SAT test is, this is what you need to know. When the market goes up, the (VIX) goes down. When the market goes down, the (VIX) goes up. End of story.

The (VIX) is expressed in terms of the annualized movement in the S&P 500. So today's (VIX) of $17.64 means that the market expects the market to move 5.01%, or 64 S&P 500 points, over the next 30 days (17.62/3.46 = 5.01%). It really doesn't care which way.

It gets better. Futures contracts began trading on the (VIX) in 2004, and options on the futures since 2006. Since then, these instruments have provided a vital means through which hedge funds control risk in their portfolios, thus providing the 'hedge' in hedge fund.

Now, erase the blackboard and start all over. Why should you care? If you buy the (VIX) here at $17.64, you are buying a derivative at a multiyear low at a technically oversold level. Buying (VIX) here is the equivalent of taking out an insurance policy on the long side of your portfolio. If you don't want to sell you stocks in order to avoid capital gains taxes, you can insure yourself against losses through buying the (VIX) to match your portfolio. You can also use options strategies to create a cheap entry point and to limit your risk.

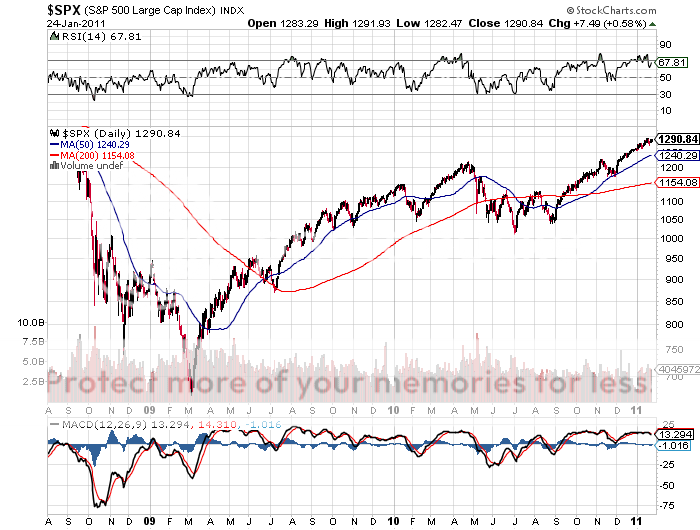

I am not saying you should rush out and buy this thing today. But you might tomorrow. We have gone up virtually in a straight line for five months now, taking the S&P 500 up 28%. A number of technical programs are giving 'SELL' signals. The great New Year's asset allocation, which I managed to grab hold of with both hands, is now done. An awful lot of people have crowded on to the same side of the boat, assuming that Ben Bernanke will keep printing money forever. Remember what happened to the Titanic?

-

-

-

Does This Come in a 42 Gallon Drum?

-

See Any Connection?