January 26, 2011 - Watch out for the Black Swans

Featured Trades: (WHAT OUT FOR THE BLACK SWANS)

1) Watch out for the Black Swans. It is not my intention to ruin your day. But I may well do that if you read this piece. While traders pile on their longs with reckless abandon, and retail flows into equity mutual funds turn positive for the first time in two years, I am hearing a rising tide of negativity from the jungle telegraph. There are 'black swans' circling out there everywhere, and the risk is that they alight upon us in great unexpected flocks, like a scene out of Alfred Hitchcock's classic film, The Birds.

Let me give you a list of things that can go wrong this year:

*The ten year Treasury bond spikes to 5% and money gets expensive.

*Crude soars to $120 a barrel and gasoline rises to $4 a gallon.

*Europe blows up again, sending the dollar through the roof.

*Seeing stock prices soar, Ben Bernanke ends QE2 early, paring it down to QE 1?.

*The high frequency traders and quants hungry for a mean reversion smell blood in the water and trigger another 'flash crash.'

*Retails investors conclude they were right to stay away and bail on what they have remaining.

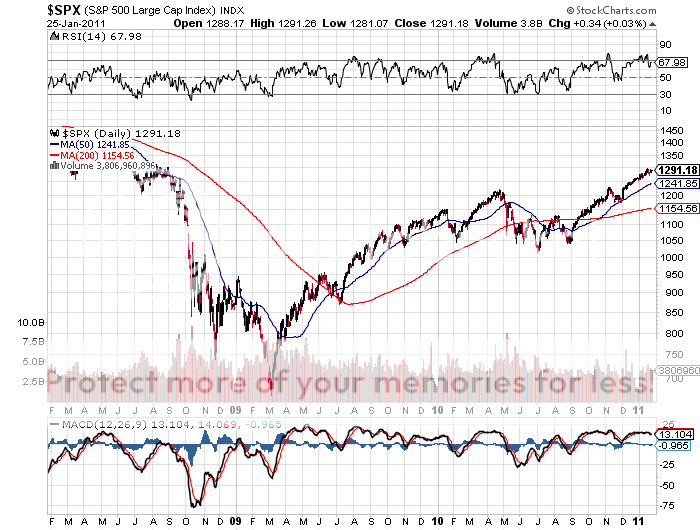

And here is the scariest thing of all. All of these black swans could hit at the same time and reinforce each other, possible around March or April, triggering the recurrent double dip fears. Could this be the third consecutive 'sell in May and go away' year? This conjures up the vision of a 'ground hog year', where 2011 is a carbon copy of 2010.? A strong first quarter is followed by two dead quarters, and then a strong year end finish. This is what 'lost decades' look like. Look at the 20 year chart of the (SPY) below and tell me this isn't happening.

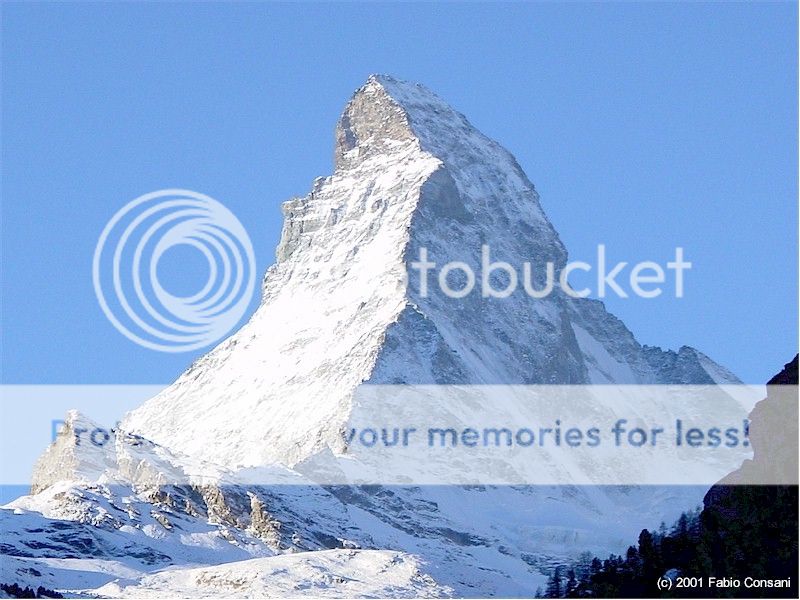

Of course, this is just one of many possible scenarios that could play out this year. As for me, I'm booking my chalet in Zermatt in the Swiss Alps now to beat out the rest of you.

-

Will the Black Swans Come Like This?

-

Or This?

-

A Much Nicer Alternative