Featured Trades: (THE GOLD MELTDOWN), (GLD), (GLL), (DGZ)

3) The Gold Sell Off Accelerates. Two weeks ago, I urged readers to take advantage of the coming collapse in gold. This development is now well in progress, and is accelerating faster than I anticipated. Perhaps I gave it a push?

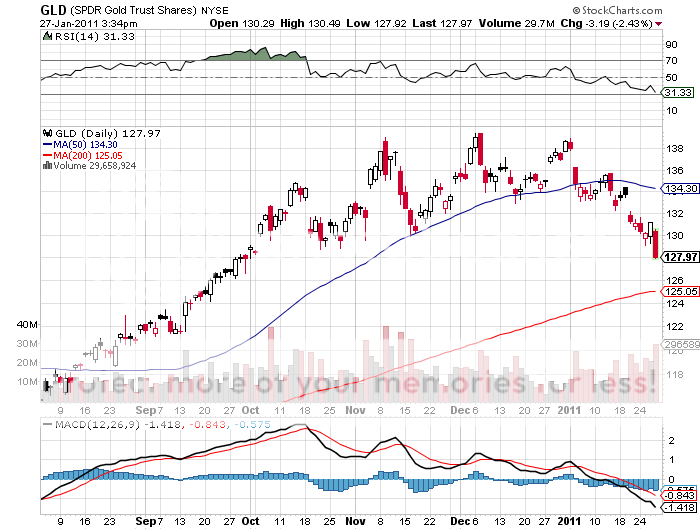

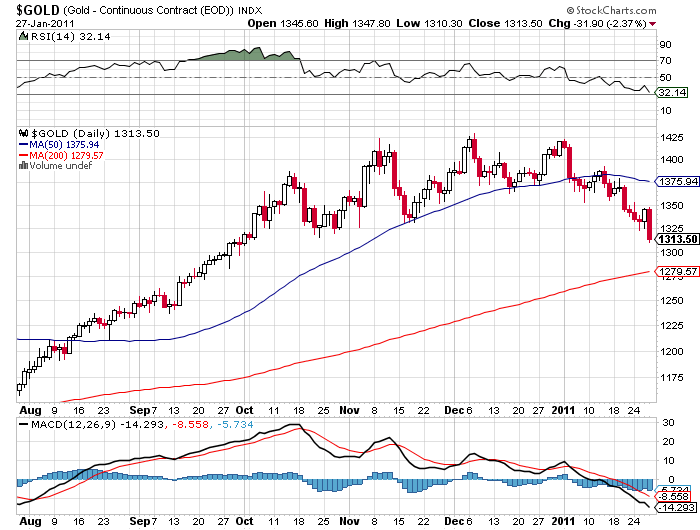

Things are happening so fast in the gold pits that it feels like the clock is on fast forward. The markets were rife today with rumors of margin calls and distressed liquidations by hedge funds and nervous gold bugs alike. The barbarous relic cut through my first support level at $1,325 like a hot knife through butter, and is clearing taking a run at the next support at the 200 moving day average at 1,280, and $125 for (GLD).

This should provide much stronger support, and should hold at the first several attempts. Since market conditions are so wild and chaotic, it would be wise to enter a limit order ahead of time to come out of your bear put spread at $2.80. That way, if there is another sudden $30 spike down in the yellow metal, and then a $30 short covering rally, you'll clean up through buying a the market bottom. Just make it a day order only for Friday, January 28, because next week the world could look totally different.

For the 'Macro Millionaires' who followed my lead and bought the (GLD) bear put spread two weeks ago, you'll be making a quick 87% profit you get filled. That will add 4.33% to the total value of your portfolio. That is better than a poke in the eye with a sharp stick. Those hardy souls who bought the $132 (GLD) puts outright are up 300%.

Good for you. A collapsing market is causing traders to tear their hair out, investors to make anguished calls to their brokers, and margin clerks to go apoplectic. And guess what? You're short! Don't you just wish you knew someone like me in 2008, when these meltdowns were happening almost every day?

-

-

-