January 5, 2011 - A Perfect Storm is Settling Up for the Grains

Featured Trades: (A PERFECT STORM FOR THE GRAINS)

2) A Perfect Storm is Settling Up for the Grains. I bet I'm the only guy you know whose wedding was filmed by the KGB. In the seventies, my friend, the TASS correspondent, Yuri, shot the entire assembled foreign press at the event at The Foreign Correspondents Club of Japan, undoubtedly for their files in Moscow. What a waste of resources. No wonder they lost the cold war! We've stayed in touch through the years, through the collapse of the Soviet Union and the many wars, revolutions, booms, and busts that followed. He now advises a Russian hedge fund. What else?

When he called me the other day he was in a somewhat agitated state. He said that the damage caused to the Russian wheat crop last year by the draught and fires was so severe that they were unlikely to recover next year. As a result, Russia was likely to swing from a net exporter to a net importer in 2011, possibly requiring as much as 3 million metric tonnes. If his analysis is correct, this would be hugely bullish news not only for wheat, but corn, soybeans, and rice as well.

Russia was once known as the bread basket of Europe, which is why it was invaded by Napoleon in 1812 and the Germans in 1942. They still have a sizeable impact on global prices. In recent years, the country has been a major supplier of the low grade wheat favored by emerging markets, like Egypt and India. Taking them out of the market could trigger the food riots in emerging markets that many analysts have feared.

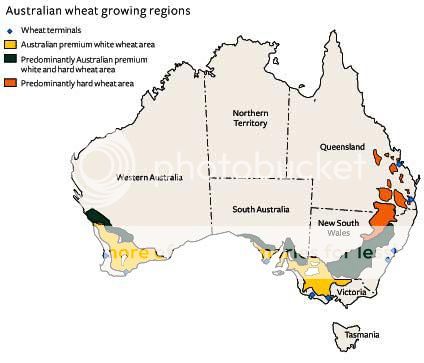

The Russian news could be the tipping point towards what could become a perfect storm for the grains in 2011. Torrential rains and a typhoon have recently drowned much of the wheat crop in Southeast Australia, and mold and rot have forced farmers to downgrade much of what is left to animal feed. Scorching heat in Argentina, another major exporter, is sending yields plummeting. Even in the US, the lack of a protective snow cover in the Midwest is exposing fields to damaging cold temperatures. This will inevitably lead to downward revisions of output here. On the demand side, the Chinese continue to upgrade both the quantity and quality of caloric content of their diet by the day.

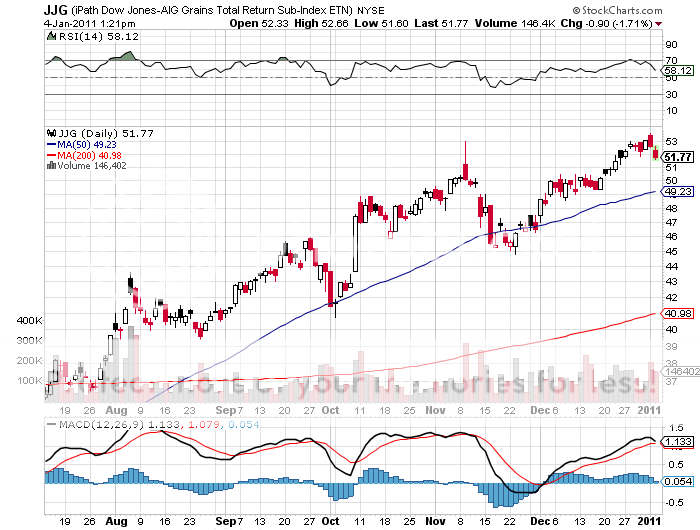

All of this is making my trade alert to buy the grain ETF JJG look like a stroke of genius. While much of this news is already in the price, JJG was on an absolute tear in December, barely pausing to let anybody in. Yet, gain prices are still a shadow of their 2008 highs. To match those highs, wheat needs to rise by 57%, corn 20%, and soybeans 18%. So we could have much further to run. Elevate grain prices to those altitudes, and JJG could rocket by 30% to $67. That is something to sink your teeth into.

The next possible entry point into the grains could come on January 12, when the US Department of Agriculture releases its crop forecast for 2011, one of the most important of the year. Last year's January report painted a surprisingly positive picture, which sent prices plummeting and took months to recover. That report was later shown to be wildly optimistic, as the doubling of prices later proved. Will the government agency similarly err this year? Not if my friend Yuri has anything to say about it.

-

-

-

-

-