January 5, 2024

(TECHNOLOGY SECTOR SET FOR MORE GROWTH IN 2024)

January 5, 2024

Hello everyone,

Happy New Year!

We are all on the lookout for where to put our money in 2024. Will it be technology or another sector or perhaps a variety of sectors that provide good value?

I believe technology will be a growth area in 2024 and beyond. Artificial intelligence will be the catalyst that propels stocks on an upward trajectory for many years to come. There is a tailwind here too, as investors are betting on easing financial policy, including several cuts from the Federal Reserve in 2024. (Are they locked in as a definite? – not yet). In late 2023 the market read the writing on the wall regarding future Fed policy found its legs and brought great profits to many who were disciplined and patient.

So, let’s look at the stocks to start scaling into this year.

Your toolbox should have some of the following:

Google (GOOGL)

Microsoft (MSFT)

Nvidia (NVDA)

Oracle (ORCL)

Amazon (AMZN)

Arista Networks (ANET)

Meta Platforms (META)

Advanced Micro Devices (AMD)

Super Micro Computer (SMCI)

Dell (DELL)

Broadcom (AVGO)

Micron Technology (MU)

Palo Alto Networks (PANW)

Salesforce (CRM)

The technology sector may not mirror the performance of 2023, but many portfolio managers are optimistic about another rosy year for the sector as rates fall, sentiment improves, AI matures and investors hunt for growth. AI may be where all the action is.

Stock giants are funneling money into new businesses and initiatives within the AI sector. Alphabet has rolled out Gemini and Microsoft has launched the Co-pilot tool, which adds AI capabilities to its Office 365 suite. The data networking infrastructure provider, Arista Networks, - one of my recommendations last year - gained 94% in 2023. Average into this stock.

It’s worth remembering that the 2024 election cycle could prove another major boon for mega caps Meta Platforms, Alphabet, and Amazon as candidates and companies increase advertising spending to capture voters.

Consensus targets for the big names imply more upside in 2024. For example, Analysts believe Meta could rally 8% after almost tripling in 2023. Additionally, analysts see Microsoft rallying 11% and Amazon 18% this year after huge moves in 2023.

Do you think Nvidia has run too hard? Don’t ignore it. There is still gas in the tank for this stock. Wall Street targets imply another 35% upside for this stock. The chipmaker is trading at about 25 times earnings over the next 12 months versus about 34 times at the end of December 2022.

Don’t ignore other opportunities out there. Advanced Micro Devices (AMD) and Super Micro Computer (SMCI) rallied 128% and 246%, respectively, in 2023. Dell (DELL) and Hewlett Packard Enterprises (HPE), like the aforementioned, are stocks to scale into this year.

Security will never go out of fashion as there will always be cybercriminals launching cyberattacks on companies. Optus in Australia was just one of the companies that fell victim to a cyber-attack in 2023. MGM Resorts was another that got hit. These crimes will become more sophisticated as AI develops. While it’s a major pain in the neck for companies and consumers, it could prove a major positive for cloud and cybersecurity companies offering tools to repel these attacks.

This puts Palo Alto Networks (PANW) in prime position. Crowdstrike (CRWD) is also another stock that should be in your kit in this area.

AI has become a growth engine for Salesforce (CRM). We are at the beginning of decades of innovation in software. The sector is well positioned in 2024. Improving IT budgets and a general recovery in spending should assist the software space as companies will need to set aside funds to spend on infrastructure to prepare data for harvesting in the AI world.

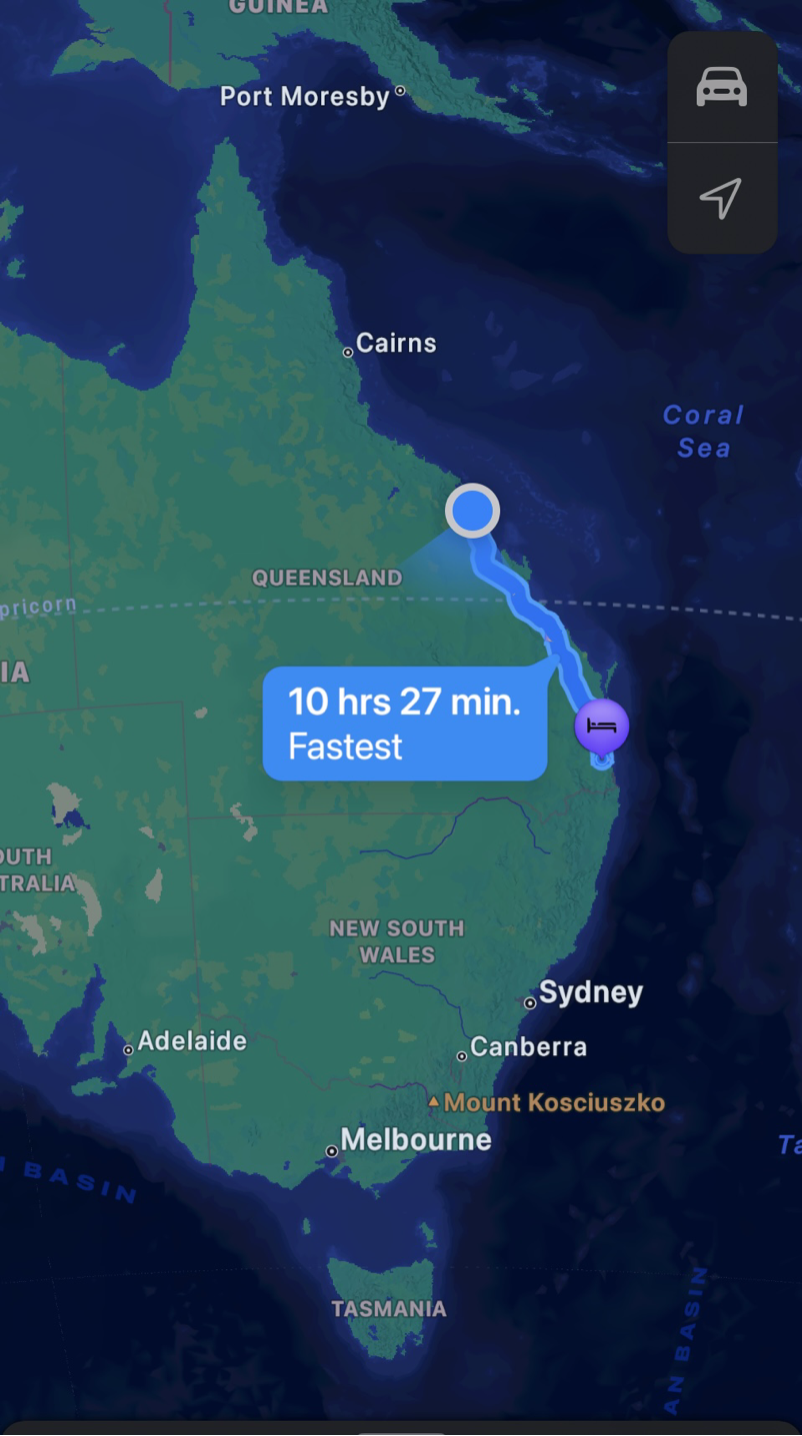

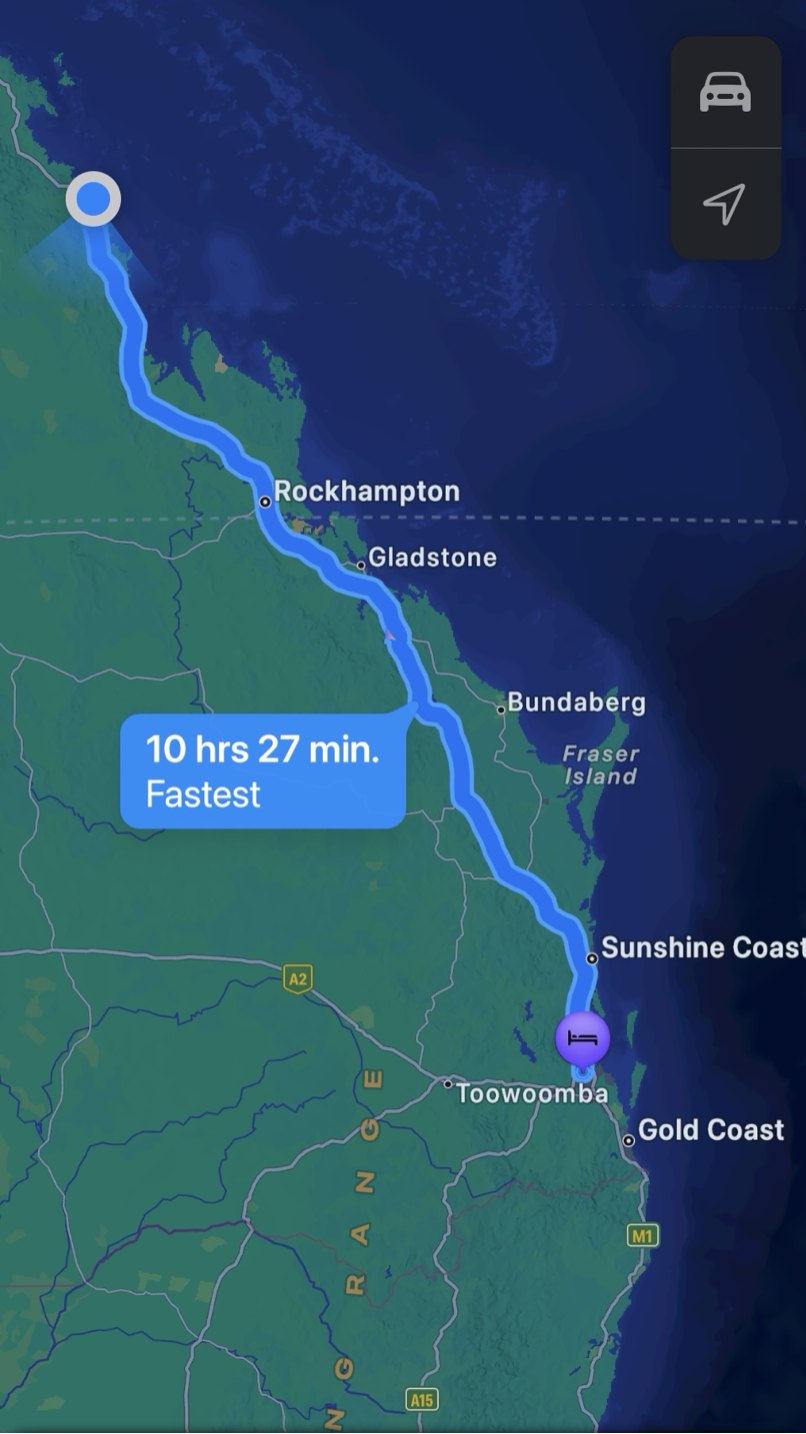

Our Road Trip

My son, Alex, and I have been on a road trip for the last week. We are driving up the Queensland coast to Mackay. We drove from Brisbane up to Bororen (about a four-hour drive), which is just west of Maryborough, and stayed the night there in a beautiful homestead. On the way, we drove through some very heavy downpours, but after the rain cleared, we enjoyed some very picturesque scenery.

A stunning rainbow to signal the end of the rainstorm.

The rain cleared but the clouds still hugged the mountain tops.

A lone cockatoo atop a dead tree after the downpour.

On the coast at the township of 1770.

The lookout in 1770.

Behind our homestead in Bororen – one hour west of 1770.

Koumala Hotel – 50 minutes south of Mackay in central Queensland.

Cheers,

Jacquie