Why the January Nonfarm Payroll Was a Big Deal

Economists were blown away by the January nonfarm payroll numbers, announced on Friday.

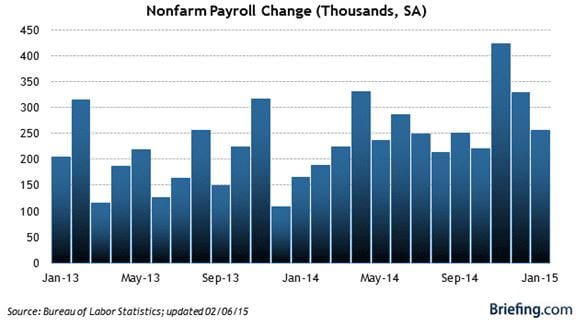

Some 257,000 jobs were added the previous month, holding the headline unemployment figure at 5.7%. Far more important were the revisions for earlier months, which saw December increased to a robust 329,000 and November bumped up to a breathtaking 423,000.

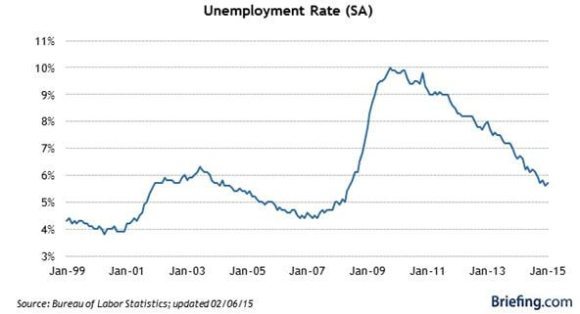

These numbers are almost back to ?normal.? Are ?normal? interest rates to follow?

All told, the January report, the revisions and the additions to the work force means that 703,000 jobs were added to the economy, taking the year on year increase to a positively boom time 3 million. The last quarter has seen the fastest jobs growth rate since 1997. Yikes!

A major part of the new jobs were in retail, proof that our windfall tax cut in the form of falling gasoline prices is finally kicking in.

Needless to say, this is all a bit of a game changer.

It totally vindicates the high-end forecasts for the US economy of 3% plus I made in my New Year forecasts (click here for my ?2015 Annual Asset Class Review?).

The data confirms my thesis that investors are substantially underestimating the strength of the US economy. Furthermore, they have yet to understand the enormously positive impact of cheap energy prices.

It also means that the bull market in stocks is alive and well. It is only resting.

To understand why, let me highlight the major points brought to the fore by the Bureau of Labor Statistics report.

1) The US Economy Has Entered a Self Sustaining Recovery

The trend line for many economic data points are now moving so convincingly upward that they can no longer be treated as statistical anomalies. Nor can they be ascribed to temporary artificial overstimulation by the Federal Reserve in the form of quantitative easing.

Count on Treasury Secretary, Jack Lew, to announce ?mission accomplished? when he address congress later on this week (click here for my one-on-one with Jack, ?Riding With the Treasury Secretary?).

My bet is that this is not our last blockbuster revision. Next to come will be the Q4 GDP, from the just reported flaccid 2.6% annual rate back towards the red hot 5% seen in Q3.

2) The Date for the Next Fed Rate Hike has Been Moved Up

The bond market certainly believed this last week, giving up 9 full points in a couple of days, taking yields from 2.62% to 2.92% in a heartbeat.

I still think this is a 2016 story. The pernicious effects of deflation are still advancing, not retreating, and are not exactly an argument for raising interest rates. But there is no doubt that the desire among the Fed governors to return rates to normal levels is growing, especially if the impact on the economy will be minimal. So call the next rate rise an early, rather than a later, 2016 eventuality.

3) The Strong Dollar is Becoming a Factor With Earnings

The Euro (FXE) has depreciated 31% against the dollar from its 2008 peak, and the yen (FXY) 38% from its 2011 apex. Yet the impact on corporate earnings so far has been marginal at best.

Where will it really start to hurt?

When these currencies approach my final targets of 87 cents and 150, or down another 22% and 18%. It is safe to say that a strong dollar will command an increasing amount of our attention going forward.

This is the argument for investing in small cap US stocks (IWM), where the currency exposure is minimal. Hedge European (HEDJ) and Japanese (DXJ) stocks start to look pretty good too.

4) Wages May Finally Be Rising

The biggest structural impediment facing the US economy has been wage inequality, where virtually all of the benefits of growth accrue to the risk investors of the 1% at the expense of the working class. Hyper accelerating technology and dreadfully imbalanced tax policies are to blame.

January brought us an increase in wages that was miniscule, incremental and modest at best, but it was an increase nonetheless. Average hourly earnings fell by 5 cents in December and then rose by 12 cents the following month.

If this continues, consumer spending will see a big revival, giving us yet another leg to a rising stock market, and creating a win-win situation for all.

One can only hope.

5) More Americans Are Looking for Work

The really amazing thing about the January numbers that they occurred in the face of a large increase in the work force. The participation rate, which has been plummeting for a decade, rose smartly. Long-term U-6 unemployment stayed high, but is down a quarter from peak levels.

To me, this is all a warm up for my ?Golden Age? in the 2020?s. The best is yet to come.