(SUMMARY OF JOHN’S OCTOBER 9, 2024, WEBINAR)

October 11, 2024

Hello everyone

TOPIC

Goldilocks on Steroids

TRADE ALERT PERFORMANCE

+720.99% since inception

+51.62% average annualized return for 16 years

+62.77% Trailing One-Year Return

PORTFOLIO

Risk On

(NEM) 10/$47-$50 call spread 10%

(TSLA) 10/$200-$210 call spread 10%

(DHI) 10/$165-$175 call spread 10%

Risk Off

No Positions

Total Aggregate Position = 30.00%

THE METHOD TO MY MADNESS

Hot September Nonfarm Payroll influences all trades.

All interest rate plays get hit – bonds, foreign currencies, gold, silver, home builders down.

Use this dip to load the boat in all these sectors.

We are unlikely to see a more than 5% drop in indexes for the rest of 2024.

Technology stocks regain the lead.

Energy spikes on Mideast and China recovery.

Buy stocks and bonds on dips, but now in ALL sectors.

THE GLOBAL ECONOMY – CHINA SURPRISE

Nonfarm Payroll reports come in hot, as US employers added 254,000 jobs in September.

Unemployment Rate fell to a three-month low of 4.1%.

US GDP revised up to 5.5% growth since the second quarter of 2020.

The port strike is settled with a 62% six-year settlement. The Strike cost the U.S. economy $5 billion/day, and it will take a month to restart.

EC imposes 45% Tariffs on Chinese EV’s.

ISM Services PMI rose to 54.9 in September from 51.5 in August.

Europe to cut interest rates by 25 basis points in October.

Blockbuster China Stimulus sets stocks on fire.

STOCKS – FROM STRENGTH TO STRENGTH

Stocks race to new all-time highs despite rising rates and Middle Eastern War.

Interactive Brokers starts US Election Forecast Trading. The opening bids were 49% for Harris and 50% for Trump.

Vistra Energy (VST) tops Nvidia as the top S&P 500 stock this year.

Spirit Airlines (SAVE) may file for bankruptcy.

Hedge Funds stampede into China on news that government agencies promised to pour $1 billion into local stock markets.

Super Micro (SMCI) splits, joining a growing list of semiconductor companies that have split their stocks.

US Car Makers get slaughtered. Avoid (GM) and (F)

Caterpillar (CAT) rallies on China stimulus and housing recovery.

Electrification is the latest hot investment theme.

BONDS – DEMOLISHED

Hot September Nonfarm Payroll demolishes bonds.

Every interest rate play gets hit hard.

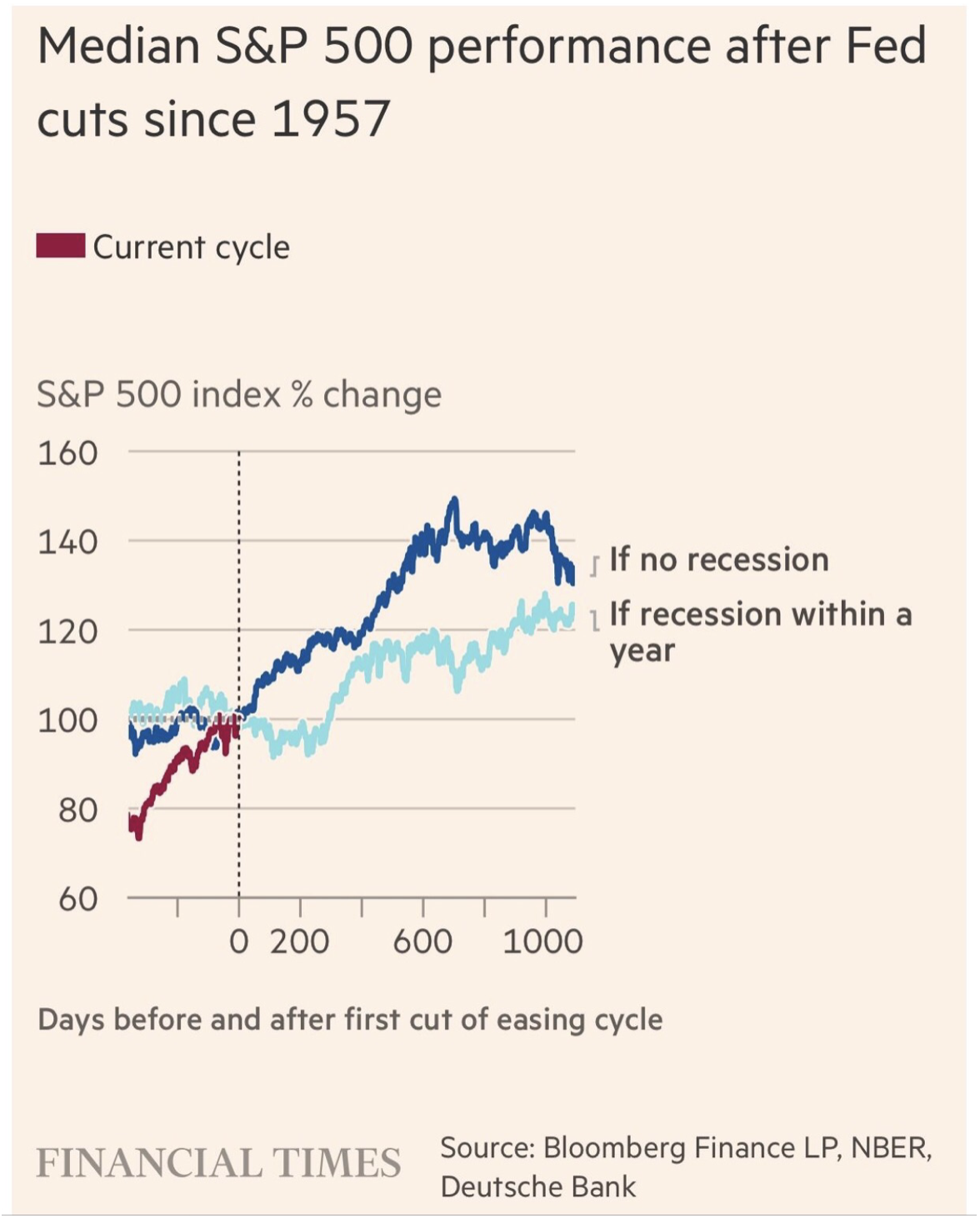

Bonds will return to the long-term uptrend when we start to discount the November Fed interest rate cut.

The Yield Curve has De-Inverted, meaning that short-term interest rates have fallen below long-term ones.

Buy (TLT), (JNK), (NLY), (SLRN), and REITS on dips.

FOREIGN CURRENCIES – DOLLAR REBOUND

Dollar gets a sudden new lease on life, as hot September Nonfarm Payroll causes interest rate spike.

Higher interest rates make the US $ much more attractive to traders and investors.

This is a short-term rally only and may be the last chance to sell short the US$.

The long-term downtrend in the dollar is still intact.

There is no way the dollar can stand up to cuts down to 3.0% by summer.

Buy (FXA), (FXE), (FXB), and (FXY).

ENERGY & COMMODITIES – OIL SPIKE

Middle East war plus Biden comments on possible Israeli bombing of Iran oil facilities give oil best week in years.

Iran produces 3 million barrels a day, 90% of which goes to China.

Its sudden loss would take oil to $95 overnight.

Saudi Arabia has 3 million barrels/day in reserve production, but it would take months to bring online.

That’s why Israel won’t attack Iran’s oil supplies, so its weapon suppliers don’t see energy supplies disrupted.

Nuclear facilities and missile factories are much more likely targets.

John’s Cameco (CCJ) trade alert rallied strongly, up 25% in two weeks.

The nuclear trade is still on, with all plays hitting new highs.

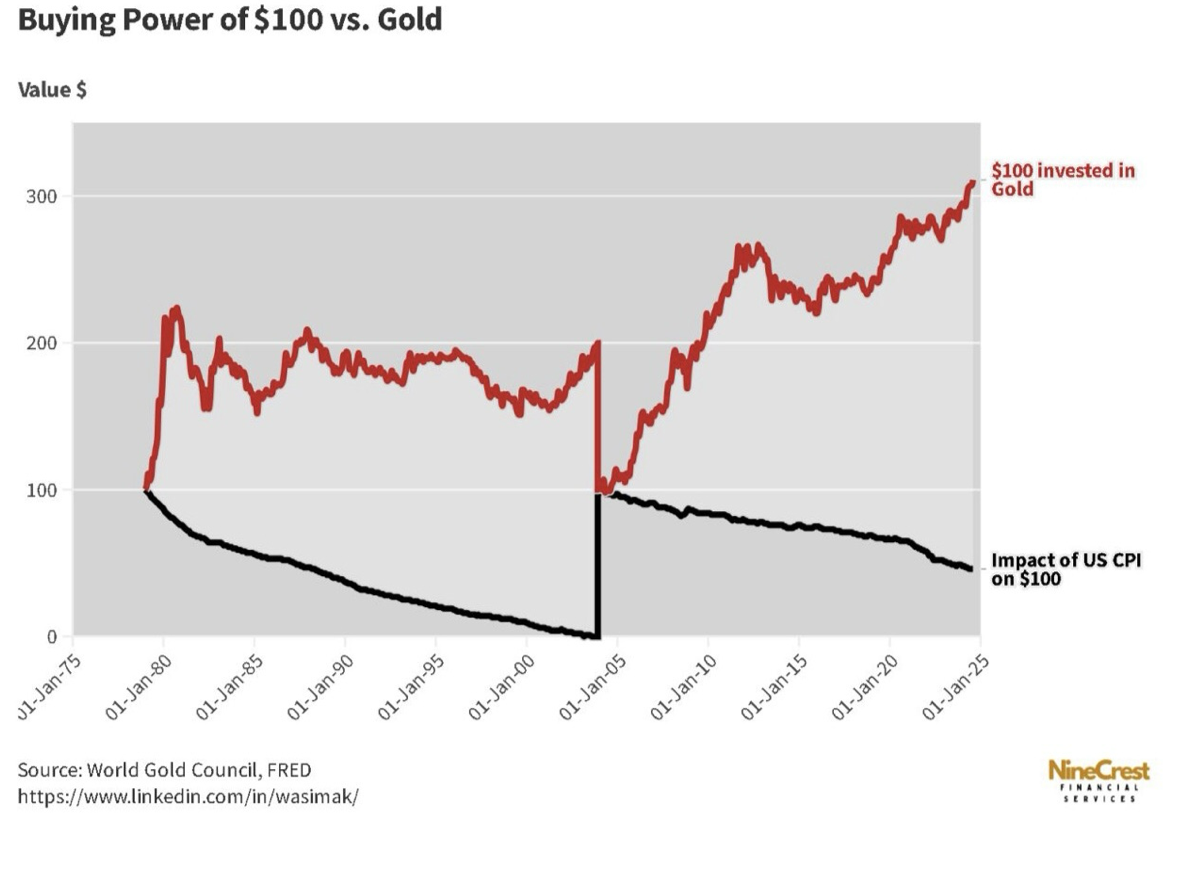

PRECIOUS METALS – NEW HIGHS

Gold hits a new high at $2,668 an ounce as hedge funds pour in.

Seasonals for the barbarous relic are now the most positive of the year.

Gold holding up in the face of big interest rate rises shows it only wants to go up.

Escalation of Middle East war is very pro-gold.

Will This Crisis Take Gold to $3000? Almost certainly, yes.

The next problem? What to do when gold hits $3000?

Most likely, it keeps going up to $4,500, as the Chinese have nowhere else to save.

Buy (GLD), (SLV), (AGQ), and (WPM) on dips.

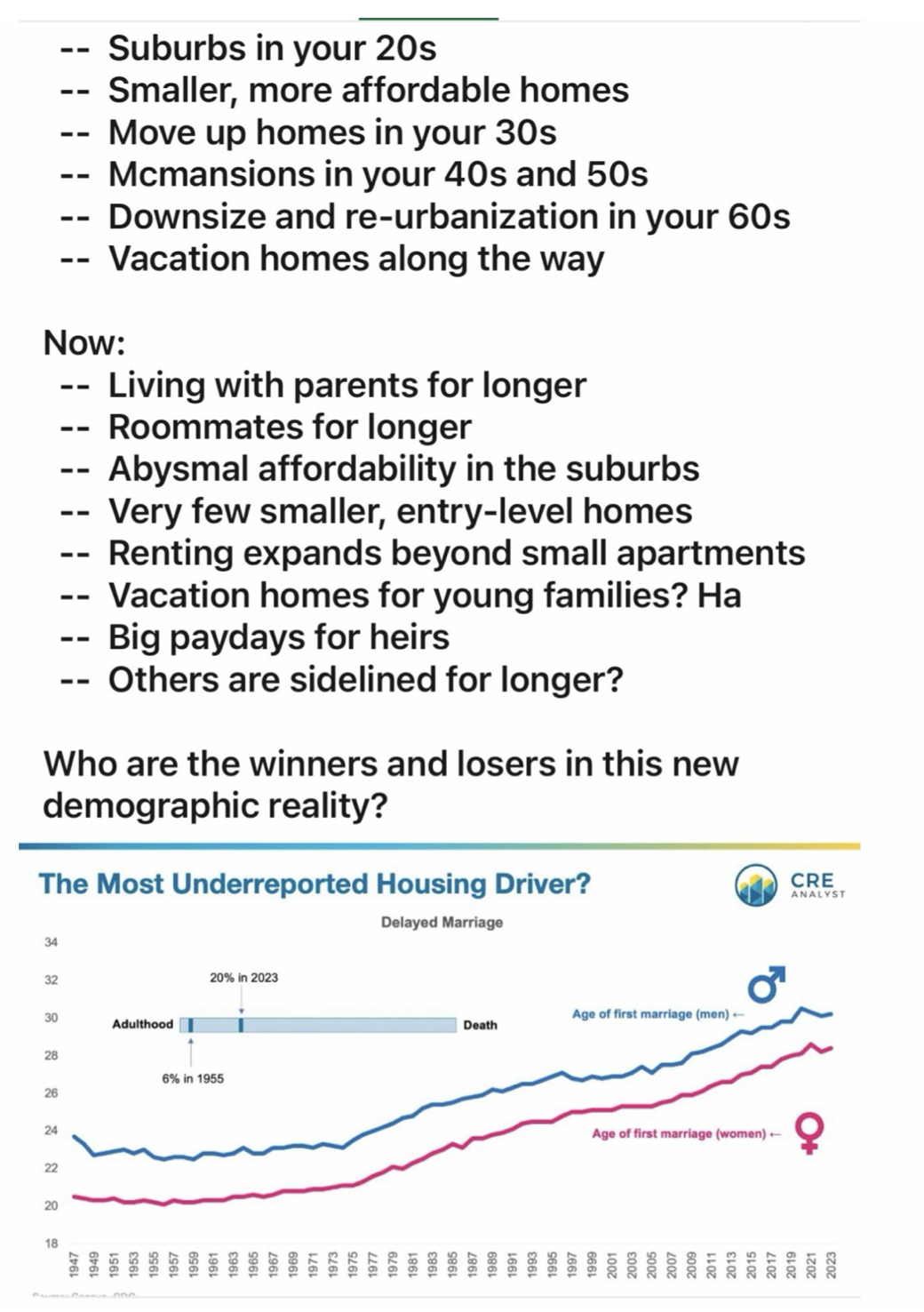

REAL ESTATE – GUT PUNCH

US Home Sales Plunge, down 4.7% in August.

Mortgage Interest rates made it down to 6.07%, then popped to 6.50%.

Buyers are clearly remaining patient amid steadily declining mortgage rates.

New single-family home sales decreased last month to an annualized rate of 716,000 after rising at the fastest pace since early 2022.

The median sales price, meantime, decreased 4.6% from a year earlier to $420,000.

That marked the seventh straight month of annual price declines, extending what was already the longest streak since 2009.

Real estate should pick up once lower interest rates feed through again.

TRADE SHEET

Stocks – buy the next big dip

Bonds – buy dips

Commodities – buy dips

Currencies – sell dollar rallies, buy currencies

Precious Metals – buy dips

Energy – buy dips

Volatility – sell over $30

Real Estate – buy dips

NEXT STRATEGY WEBINAR

12:00 EST Wednesday, October 23, from Lake Tahoe, Nevada.

RECORDING OF JACQUIE’S POST OCTOBER 6, 2024, ZOOM MONTHLY MEETING.

https://www.madhedgefundtrader.com/jacquie-munro-meeting-replay-september-2024/

Cheers

Jacquie