July 1, 2024

(WHAT THE MARKET ACTION MIGHT LOOK LIKE IN THE SECOND HALF OF 2024)

July 1, 2024

Hello everyone,

Week ahead calendar

Monday, July 1

9:45 a.m. S&P PMI Manufacturing final (June)

10 a.m. Construction Spending (May)

10 a.m. ISM Manufacturing (June)

Tuesday, July 2

10 a.m. JOLTS Job Openings (May)

5:00 a.m. Euro Area Inflation Rate

Previous: 2.6%

Forecast: 2.5%

Wednesday, July 3

8:15 a.m. ADP Employment Survey (June)

8:30 a.m. Continuing Jobless Claims (6/22)

8:30 a.m. Initial Claims (6/29)

8:30 a.m. Trade Balance (May)

9:45 a.m. PMI Composite final (June)

9:45 a.m. S&P PMI Services final (June)

10 a.m. Durable Orders (May)

10 a.m. Factory Orders (May)

10 a.m. ISM Services PMI (June)

2 p.m. FOMC Minutes

Earnings: Constellation Brands

Thursday, July 4

Independence Day Holiday

UK General Election

Friday, July 5

8:30 a.m. June Jobs Report

Previous: 272k

Forecast: 180k

Friday is the Labor Report, and this will give us some insight into the consumer. The U.S. economy is anticipated to have added 190,000 jobs in June, down from 272,000 in the prior month, according to FactSet consensus estimates. The unemployment rate is expected to hold at 4%.

The pandemic stimulus has contributed to keeping the economy motoring along. However, I would argue that cracks are starting to appear, now that many consumers have exhausted that stimulus cash injection. The jobs report will take on more significance going forward as it will show a pattern of consumer behaviour.

Let’s delve into history for a moment. According to historical data, a strong first half points to more gains in the second half. And remember, it is an election year as well, which also bodes well for the market. Data analyzed by Sam Stovall at CFRA (Centre for Financial Research and Analysis) shows that whenever a positive first half for the S&P500 eventuated between 1945 and 2023, the second half brought an average rise of 5.3%. The broad index was higher in the second half in more than three out of every four years that it ended the first six months in the green.

The picture gets even better when we dig into detail. The research shows that in the years with the S&P500 rallying more than 10% in the first six months, it climbed 7.9% in the typical second half. The index was positive in the latter half in more than four out of every five of these years. And how much did the S&P500 climb in the first half of 2024? Answer = 14.5%.

Presidential election years also typically result in favourable market returns. Research shows that in all election years since World War II the S&P500 added 0.9% and 2.4% in the average third and fourth quarters, respectively. For the entire second half, the S&P500 has climbed 3.5% on average.

If we take all strategist's forecasts and take the median forecast for the end of 2024, we may see a 1% rise from the close last week.

NEWS IN BRIEF

France votes in an election that could see a significant swing to the far-right. If victorious, Le Pen’s party, National Rally Rassemblement National (RN) may disrupt policy towards EU, and Ukraine.

UK Election on Thursday may result in volatility in GBP pairs.

BRIEF MARKET UPDATE

S&P500 - Risk of a retracement is growing. Downside should see support around 5,000. Then after the correction, the market should continue its upside move.

Gold – has been undergoing a complex correction. If it can hold above $2,290, then we should see a sustained rally above $2,360, to see a retest of the $2,400’s. However, a move to a $2,270/$2,250 area is still a possibility, so don’t rule it out.

Bitcoin – a complex retracement is continuing. Possible downside targets include: $55,000 and $50,000. Scale in all the way down to these levels. Bitcoin may not begin a sustained rally for a month or two.

WHAT IS… Painting the Tape?

Painting the tape is a form of securities fraud where traders create a false appearance of trading activity for a security by buying and selling the security among themselves. Painting the Tape (PTT) can attempt to artificially increase or decrease the price of a security through coordinated trading, or merely give the impression of a high volume of trades without any effort to influence the direction of the price.

PTT is illegal, and the Securities and Exchange Commission (SEC) enforces regulations against PTT and similar attempts at market manipulation.

Probably the simplest and most common form of market manipulation that involves PTT is when traders artificially inflate the trading volume of a security. Many day traders are attracted to securities revealing a sudden spike in volume far above the average. This leads to an increase in the price of the security, which then allows market manipulators to dump their holdings at an inflated price.

PSYCHOLOGY CORNER

Cut Out the Noise

I’m sure I don’t need to tell you that there are tons of supplemental resources and education about trading and investment on the Internet. That’s a good thing – right?

Well, that’s debatable. One of the worst things about all this information is that it is full of “noise” and is likely a distraction that will pull you away from your own confidence in your ability in the market.

Everybody comes to the market with a different approach. There is no one right way to trade the market. What works for one expert might not work for you. It’s always best to develop your own philosophy – your own approach to trading the market that suits your personality, and then shut out the loud voices who claim they have found the very best strategies for trading the market

QI CORNER

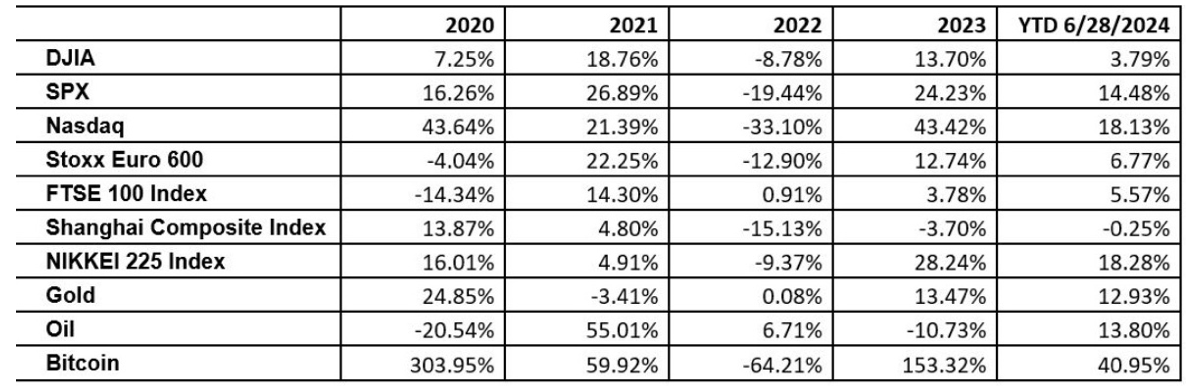

The monthly return table for major asset classes/assets. (Mohammed El-Erian, President of Queens’ College, Cambridge & chief economic advisor at Allianz.

MY CORNER

My new best friend at my present Airbnb.

Cheers,

Jacquie