July 10, 2009

July 10, 2009 Featured Trades: (TBT), (TLT), (SPX)

1) The incredible melt up in Treasuries yesterday tells you that traders are dumping the global reflation trade like a hot potato. The ten year yield spiked up to a high of 3.28%, down from 4% only a month ago. Yesterday?s auction of ten year Treasury notes saw an amazing bid to cover ratio of 3.28, the highest in 15 years. When traders don?t want to play, they flee to government paper. The music has stopped playing, so it?s time to sit down. It looks like the deflationistas are going to have the upper hand over the inflationistas for the next couple of months. See my interview with Janet Yellen . This certainly puts my TBT trade on hold (see ?Sell in May and Go Away? and ?The Viagra is Wearing Off?. It?s best to read the writing on the wall, especially when it is in ten foot high, in fluorescent block letters, like this.

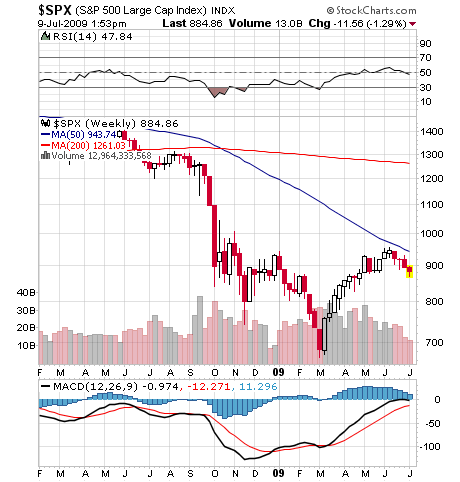

2) CNBC held a dynamite interview with David Rosenberg, former Merrill Lynch chief economist and current strategist at Gluskin Sheff, who offered the kind of big picture, 30,000 foot view that I love. We are well into an epic post bubble credit collapse. Deleveraging in the private sector is dramatically overwhelming any fiscal stimulus Obama can throw at it. The $50 trillion US household balance sheet is shrinking at an unprecedented rate. The unemployment rate will easily sail through 10.8% to a new high and spill over to a higher foreclosure rate. We?ve had two decades of baby boomers living beyond their means, and it is now time to revert to the mean. The stock market has already priced in an earnings recovery which we won?t see until 2012 at the earliest. Bull markets move in perfect 18 year cycles, and we are only half way through a generational washout in equity ownership that started in 2000. ?Buy and Hold? is dead. An S&P 500 trading around a 13 multiple means will be stuck in a 650-950 range for years, and that?s being generous. Rent, don?t own stocks. The one place to be is commodities, because they will be underpinned by the undeniable demand coming from Asia, and have benefited greatly from consolidation. The big ?Tell? here is that in last year?s huge sell off , they all bottomed at the previous cycle?s peak prices. It?s nice to hear someone reading from the same sheet of music as I. Too bad Merrill Lynch didn?t listen to David. Wow, do you think I should be selling rallies here at 886?

3) I was somewhat tickled to see the New York Times piece on the collapse of the Nantucket Island real estate market, which says there are 600 homes for sale on the tiny, windswept island, about 6% of the total housing stock. My family was the first western owner of the island, one Thomas Mayhew having bought it from the Wamponoag tribe for three ax heads and a cow in the 1600s. A great, great, great, great, great uncle, Owen Coffin, was a cabin boy on the Essex, which was rammed by a giant whale and sunk in the Pacific in 1820 (read In the Heart of the Sea by Nathaniel Philbrick). He spent 99 days in a tiny whaleboat, and then, after drawing straws,?? was eaten by his shipmates. The story became the basis for Herman Melville?s Moby Dick, written 31 years later, whose pages mention the Coffin name?? in seven places. The Times estimates that the value of property on the island has dropped from $20 billion to $14 billion since last year. Gee, do you think we sold too soon?

4) Here?s another great Chart of the Day from Clusterstock showing that we have fallen back to 2000 levels of total employment. Only one out of 2.4 Americans now has a job. Stocks, real estate, and many other asset classes have also given up the decade?s gains. In the meantime, the US population has grown by 26 million to 307 million. Has the 21st century happen yet?

?When all the experts agree, something else is usually going to happen,? said David Rosenberg, former Merrill Lynch Chief Economist and current strategist at Gluskin Sheff.