July 12, 2011 - The Skinny on Lithium

Featured Trades: (THE SKINNY ON LITHIUM)

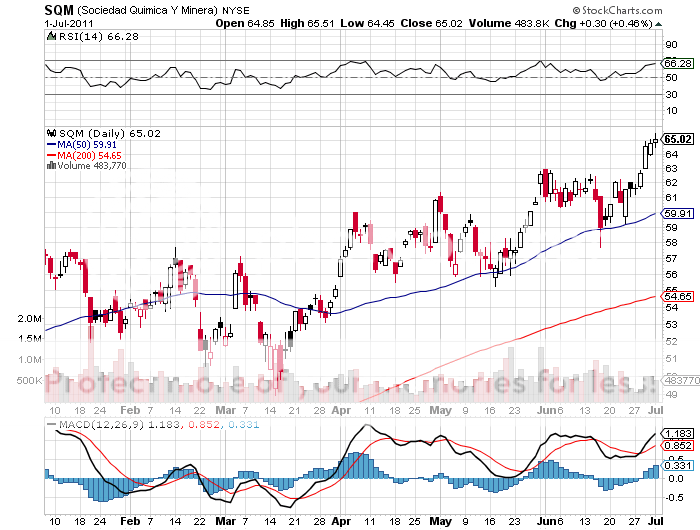

2) The Skinny on Lithium. Long time readers of this letter know that I have been a bull on lithium plays, my pick in the sector, Chile's Sociedad Quimica Y Minera (SQM), bringing in a handy 440% pop off the lows in 2009. You couldn't lose, because if the car battery boom faded, they always had a great fertilizer business to fall back on.

Since I'm in a report reading mood, I thought I would sit back in my Aeron office chair, put my feet up on my polished beech desk, and plow through the numerous submissions forwarded to me by readers who attended the first 'Lithium Supply and Markets Conference' in Santiago, Chile.

The bad news is that a truly economic, price competitive lithium battery is still some ways off. Prices for lithium-ion batteries for hybrid electric vehicles (HEV) need to drop by 50% and those for plug-in hybrid electric vehicles (PHEV) by 67%-80% in order to compete on a level playing field with carbon based fuels.

Gasoline has 64 times more energy per unit of weight than lithium batteries, but this advantage is partially offset by electric motors that are four times more efficient than conventional piston engines. Lighter weight cars and other design improvements, like recapturing power when braking, shrink the lead further.

Dr. Steven Chu's Department of Energy is pouring money into research on an amazingly wide front, and strides are being made with different electrodes (silver, sulfur, manganese), leading to rapid advances in inorganic chemistry. The challenges are formidable, with overcharged large lithium ion batteries prone to explode or catch on fire, or internally or externally short circuit.

The conservative big car companies, Toyota and Honda, have stuck with proven nickel metal hydride batteries offering half the power per weight, and are understandably reluctant to make the needed multibillion dollar investments until more is known about the long term life of lithium batteries.

Another wrinkle is that Bolivia, the Saudi Arabia of lithium salt reserves, has effectively nationalized the industry before it got off the ground, limiting its investment in development to $350 million. As the production of EV's, HEV's, and PHEV's is expected to ramp up to 5 million vehicles a year by 2020, this could be a problem.

Many in the industry expect that lithium prices will not be driven by demand from car makers, but by the price of oil. Take crude up to $150 again, and all of a sudden, everything works.

The intelligent way to approach the industry now is to invest in low cost producers of proven battery technology, like Enersys (ENS), Exide Technologies (XIDE), C&D Technologies (CHP), and ZBB Energy (ZBB). Leave the pie in the sky stuff for later.

Unlike past battery car movements, this one is not going to end up crushed in a junkyard. I'll let you know how my lithium battery powered all electric (EV) Nissan Leaf works out, which I just took delivery of last week.