July 13, 2010 - How to Become One of the Rich Who Are Getting Richer

Featured Trades: (ROB)

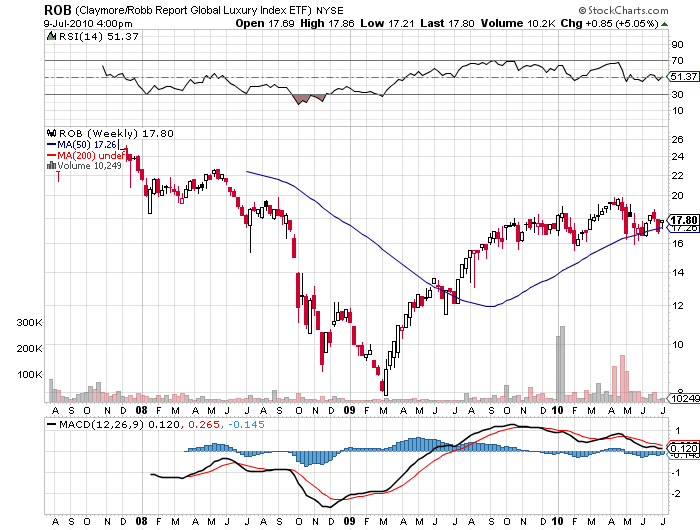

Claymore/Robb Report Global Luxury Index ETF

4) How to Become One of the Rich Who Are Getting Richer. One of the great certainties in our economy is that the rich are getting richer, no matter who is running the country. Despite the worst business conditions in 80 years, there was a 17% increase in millionaires in the US last year. Far greater increases were seen in China and other emerging markets. Indisputable proof that there will eventually be an ETF for everything can be found in the Claymore/Robb Report Global Luxury Index ETF (ROB), which seeks to cash in on this trend. The fund is modeled on an index of the producers of international luxury brands put together by the Malibu, California based Robb Report. If you were ever looking to buy a mega mansion, the ultimate customized Lamborghini, or that over the top piece of jewelry for your mistress, you know The Robb Report well (click here for their site at http://www.robbreport.com/ ). The top five holdings are The Swatch Group AG-B, BMW, Hermes, Daimler, and Pernod Ricard. You get some decent international diversification with France and the US accounting for 27% each, Switzerland 14%, and Germany 11%. After hitting bottom last year at $9, the ETF rocketed 122%. So it seems the fund is essentially a retail play on steroids. Keep in mind that this is the last thing on the planet I want to touch right now. I think retail is currently going to hell in a hand basket. But once we get to hell, and the ETF is at $9, let's talk, especially if the Euro is also cheap.