July 13, 2011 - China's Great Grain Robbery

Featured Trades: (CHINA'S GREAT GRAIN ROBBERY), (CORN), (JJG)

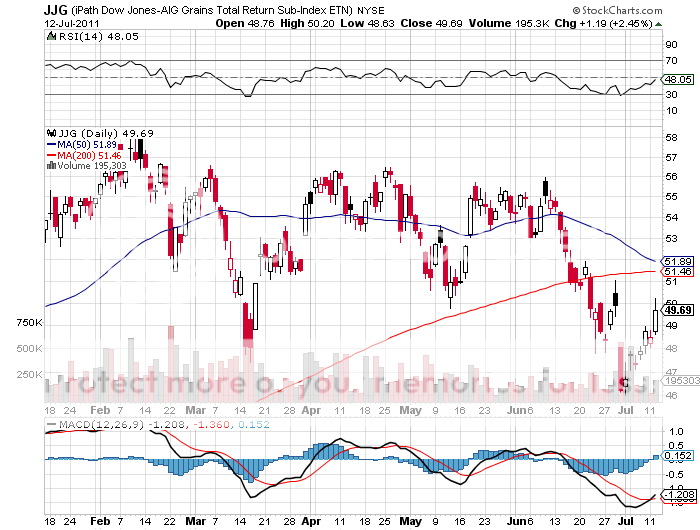

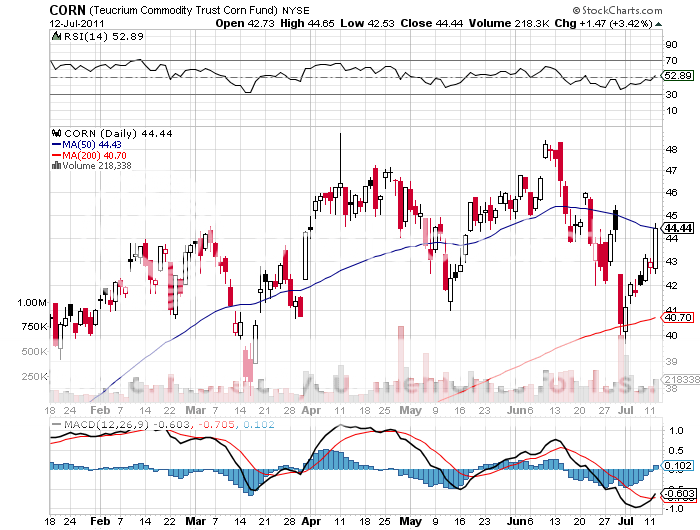

2) China's Great Grain Robbery. The Chinese are nothing if not opportunistic. You may recall that a shocking increase in this year's corn crop predicted by the US Department of Agriculture triggered a series of limit down moves in the grain markets only 12 days ago (click here for 'The Great Grain Massacre'). The corn ETF (CORN) was down by a gut churning 13.2% by the time the crying was over, while the grain ETF (JJG) was off by 9.8%. Despite terrible weather and soil conditions, farmers planted anyway, leading to a 1.52 million bushel increase in the forecast crop.

Last week, The Chinese came in and bought over 500,000 bushels, some one third of the surprise excess, and more than they buy in a normal year. Indications are that the buying may continue, with senior Chinese government officials openly doubting the veracity of the USDA figures.

All I can say is 'Great Trade'. The Middle Kingdom is no doubt driven by serious draughts in the western part of the country which has forced them to become a major importer for the first time in years.

I believe that there is something much bigger going on here. I refer you to the piece I sent you last week, 'The Bull Market in Food is Only Just Starting' (click here). The improving Chinese diet is starting to take a big bite out of the global grain market, with the total number of calories per person nearly doubling over the past two decades. Expect this to continue for the rest of your investment lifetime. The moral here is to use any serious dips in the ag space to pick up exposure to this sector.

-

-