Featured Trades: (URANIUM), (CEI:FP), (PDN:AU), (CCJ)

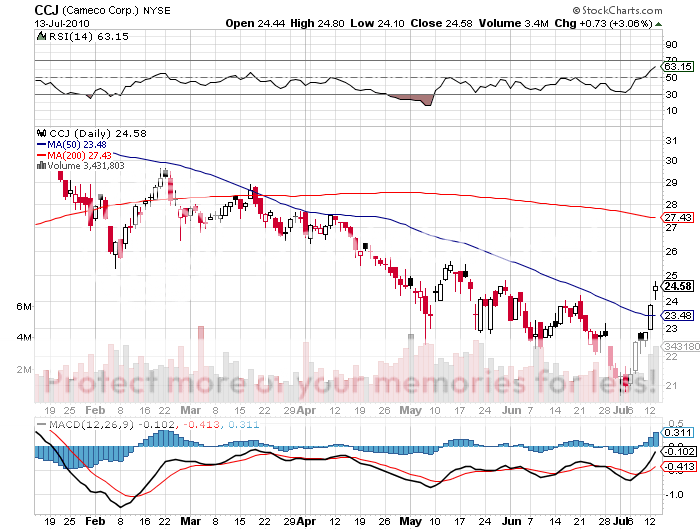

3) Serve Yourself a Piece of Yellow Cake. Uranium traders have been stunned by a sudden Chinese effort to corner the supplies in an effort to fuel the world's most ambitious nuclear program. The once moribund market now suddenly sees buyers everywhere as the Chinese ramp up their purchases to 5,000 tonnes this year, double their current consumption. The emerging nation plans to build ten new plants a year for the next decade, boosting their electricity supply up from 9.5 to a massive 85 gigawatts. That will make China the world's largest nuclear power generator. Uranium peaked at $136 a pound in 2007, and collapsed during the financial crisis to as low as $26. High prices also brought a flood of new mines, with 27 coming on line in the past decade. Last year, the total uranium market amounted to 50,572 tonnes. China will need a third of that in ten years, and India another fifth. Prices have since crawled back up to $31/pound, and some analysts are predicting a double or more in five years. Producers have seen share prices pop in the last few days. I have been a long term bull on uranium and the entire nuclear industry, predicting that it was only a matter of time before the Middle Kingdom's immense appetite for yellow cake overwhelmed supplies (click here for my piece). It may be time to add some new names to your watch list, like Paris listed Areva SA (CEI:FP), Australia's Paladin Energy Ltd. (PDN:AU), and my favorite, Cameco (CCJ). Or you can take a shot at trading the illiquid uranium futures directly on the NYMEX.

How the CIA Views China's Nuclear Program