July 16, 2010 - China Puts the Squeeze on Rare Earths

Featured Trades: (RARE EARTHS), (AVARF.PK), (GWMGF.PK), (RAREF.PK), (LYSCF)

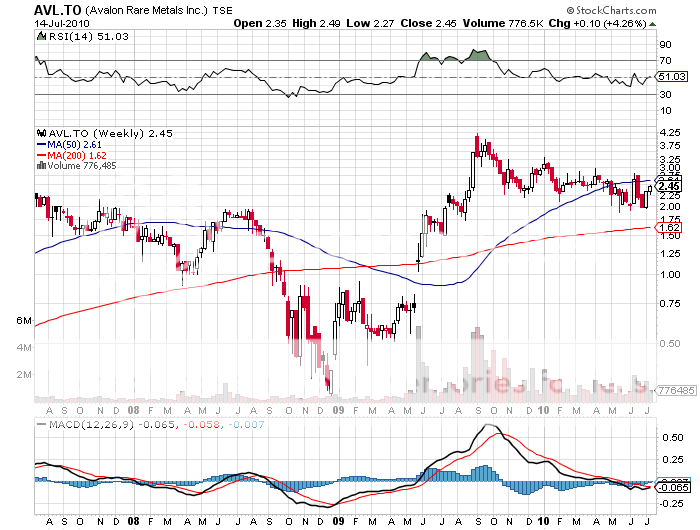

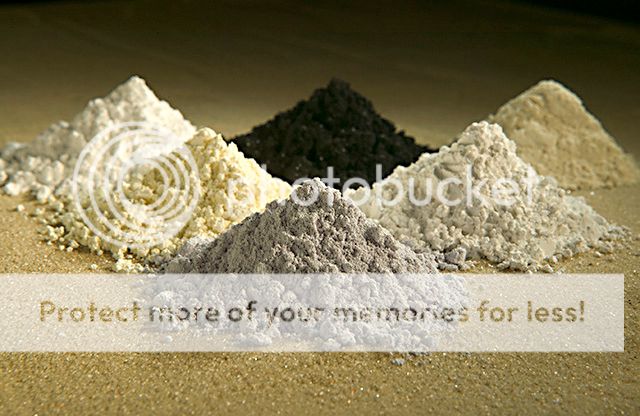

4) China Puts the Squeeze on Rare Earths. China has further tightened the screws on the world's rare earths market by announcing new export quotas that are only half of those seen last year. China's Ministry of Commerce has limited 2010 second half shipments by its 32 licensed producers to 7,976 tonnes, down from nearly 20,000 tones in the first half. Chinese authorities have also announced that they are cracking down on widespread illegal mining of rare earths, which is causing immense environmental damage. Why should you care? It turns out that you can't build a hybrid or electric car, a wind turbine, thin film solar, LED's, high performance batteries, or a cell phone without these elements. One Prius uses 25 kilograms of the stuff. You also can't fight a modern war without rare earths, being essential for radar, missile guidance systems, navigation, and night vision goggles. That's where things get interesting. The Middle Kingdom supplies 97% of the world's rare earths, and no new major western supplies are expected to come on stream for years. I think rare earths, which include esoteric elements like cerium, Ce, lanthanum, La, and neodymium, Nd, could be one of the next great hard asset plays. Please revisit Avalon Rare Metals (AVARF.PK), Great Western Minerals Group (GWMGF.PK), Rare Earth Metals (RAREF.PK), Lynas Corp (LYSCF), and Molycorp, after it goes public. You can learn more about this once obscure corner of the global commodity market by reading my earlier piece by clicking here.