July 17, 2009

July 17, 2009 Featured Trades: (SPX), (GOLD), (GLD)

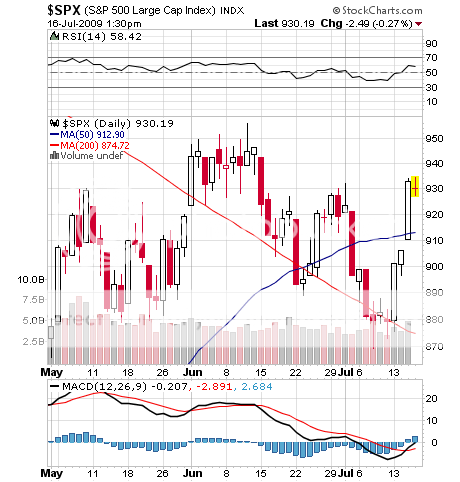

1) The ?head and shoulders? is off the table, and now the S&P 500 is looking at a double top at 950. This is why I hate listening to technical analysts, and why they shop at Men?s Warehouse and drive Hyundai?s instead of Bentley?s (see my earlier piece ). Generally, technical analysts tell you to buy every rally, sell every dip, and in a market that?s going nowhere this is a perfect formula for losing money. Watch them tell you to load up if we hit 950. It is clear from the ferociousness of the 70 point, three day rally, that too many hedge funds were drinking the Kool Aid and the blood is flowing as a result. One meekly explained to me that ?head and shoulders? formations fail only 6% of the time. Well, welcome to the 6%. They are going to have to invent a new name to describe this formation (?head and shoulders with a hump back?). This is why I issued my now famous ?Sell in May and Go Away? piece, because the quality of the trades you usually get in the three months that follow is uncommonly low. Look at the chart that has ensued so far. It looks like a lot of nothing.

2) I will be the first to bemoan the abundance of frivolous law suits in the investment community. But no litigation was more richly deserved than the $1 billion action brought by the California Public Employees System against the three rating agencies, Moody?s, Standard & Poor?s, and Fitch?s. CALPERS is claiming that the triple A rating they gave subprime backed SIV?s were wildly inaccurate, causing it to suffer huge investment losses as a result. An airing out of the dirty laundry in this industry, which sells fig leaves to debt issuers for high prices, is long overdue. When I go to my grave, the one revelation I will always remember about this crisis is that the models rating agencies used could not accept negative numbers for future real estate price assumptions!

3) As a follow up on yesterday?s gold piece I?d like to pass on to you an article by Global Resource Alert?s Peter Krauth outlining the entire long term bull case for the yellow metal. The future for the dollar is dark, indeed. Central banks, led by China, are backing off from US Treasuries and the dollar, and are returning to gold as a reserve currency. China has in fact increased its gold holding by 450 metric tonnes over the past six years. Individuals are doing the same, doubling their purchases to 862 million tonnes last year. US budget deficits are already running at the greatest levels since WWII, and a second stimulus package will pour more fuel on the fire. It?s just a matter of time before gold breaks to a new high. To read Peter?s well thought out article in its entirety, please click here .

4) To celebrate Bastille Day I walked over to my favorite French restaurant, Left Bank, to book what is normally the busiest day of the year. Sadly, on the front door was a sign saying ?au revoir, that the chain was closing half its San Francisco Bay Area restaurants because of the ?severe recession.? So instead, I walked to the Meridian Hotel, normally a safe bet for a steak au poivre on France?s national day. I found the main dining room was only open for breakfast, and was closed for the rest of the day to cut costs. However, I could get a nice cheap rib eye in the bar with great wines at ?happy hour? prices. The deals out there are awesome and legion. I reserved a room at a high end Lake Tahoe resort a few weeks ago that normally goes for $300 a night. I paid $40, and was the only one in the building. It appears that hotels are engaging panic dumping of rooms online, and will take whatever they can get. So 85% off is the new 50% off. How do you say ?green shoots? in French?

QUOTE OF THE DAY

?Democracy must be something more than two wolves and one sheep voting on what to do for dinner,? said commentator James Bovard.