July 18, 2011 - Is the Fat Lady About to Sing Again for the Treasury Bond Market?

Featured Trades: (IS THE FAT LADY SINGING AGAIN FOR THE TREASURY MARKET?)

1) Is the Fat Lady About to Sing Again for the Treasury Bond Market? One of my best calls of the year was to pick the bottom of the Treasury bond market in February and pile readers into synthetic long positions by shorting puts in March. That handy little trade brought in a nice 4.51% profit for my model portfolio.

All good things must come to an end. Since my watershed call, the

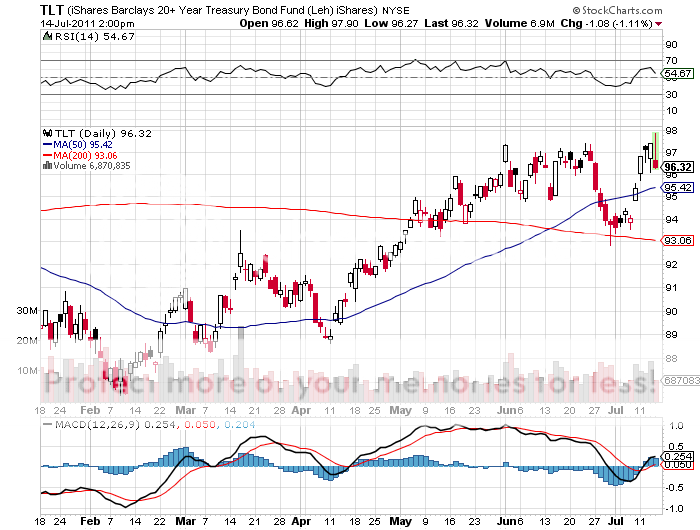

Treasury bond market has rallied an awesome ten points. The long bond ETF (TLT) has soared from $87 to $98. My logic was that a flight to safety would send Treasury bond prices to the moon, and that we have gotten in spades. While the 'RISK OFF' trade started for the main indexes, gold, silver, and oil on April 29, it really started in February for copper, banks, and technology two and a half months earlier.

With QE2 now over, I think the party is about to end for the bond market. For the last eight months, the Federal Reserve has taken down virtually all of the Treasury's new issues. That amounts to $75 billion a month. That massive quantitate of new bond buying is over.

Private US and foreign central banks are not going to be able to make up the difference, no matter how many of their cars, textiles, electronics, toys, and finger traps that we buy. This big problem is that the bond market these days is very much like a Ponzi scheme. Unless there is a steady inflow of new suckers, the entire plan collapses like a house of cards.

So I am going to use this strength in the bond market to sell short some out of the money calls with September strikes. I'll be picking strike prices that equate to a ten year yield of 2.40%, last year's low in yields and high in prices. That allows room for a huge, multi decade double top in bond prices to unfold over the next three months and still allow me make money on this trade.

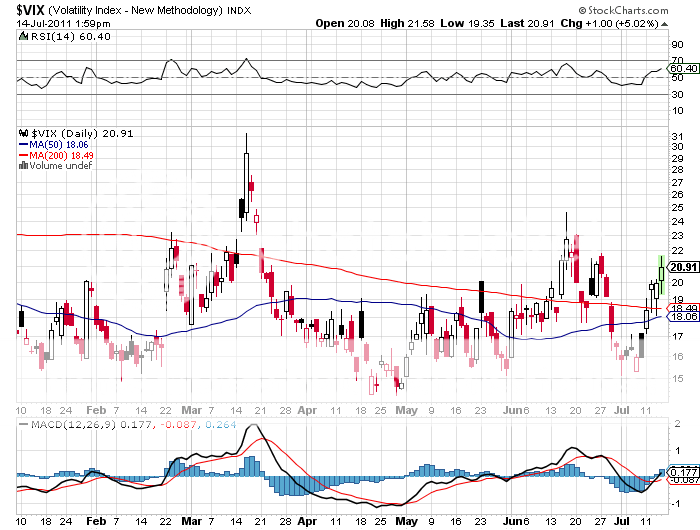

If I can see more confirmation of a double top in the bond markets, then I am going to have a reconciliation with an old flame, the (TBT), the 200% short play on the Treasury market. The only way I can lose money on this trade is for yields to blast through to new 30 year lows, driven by a true double dip recession and an utter collapse in the stock market. The volatility index for the stock market (VIX), stuck at a lowly 17% is telling us that is not going to happen, at least within the next two months, anyway.

-

-

Additional Pieces And Charts For Premium Subscribers