July 20, 2010 - Ireland Points the Way for the Euro

Featured Trades: (FXE), (IRELAND)

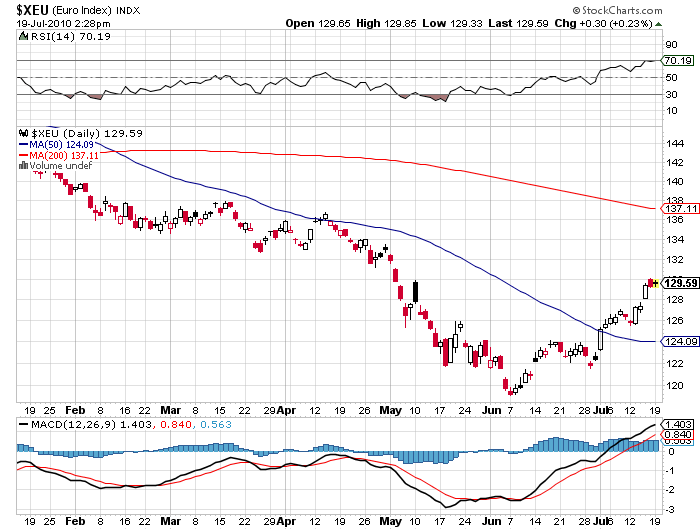

Currency Shares Euro Trust

1) Ireland Points the Way for the Euro. When you bend over backwards to kiss the magical stone at Ireland's Blarney castle, you can't help but notice a sign assuring you that your won't catch AIDS in your effort to obtain the gift of persuasion. However, the ancient stone is completely covered with lipstick. Investors in Ireland national debt certainly must feel like they contracted the dreaded disease this morning after rating agency Moody's announced a downgrade of the country's debt from Aa2 to Aa1. Ireland saw a real estate boom even more frenzied than our own, at the eventual price of $32 billion in bank bail outs. That has driven the country's debt/GDP ratio from 25% to 64%, and Moody's thinks it will eventually get to 100%. The bigger question is what all of this means for the Euro (FXE), which has spent that last two months getting talked down from a suicide leap (click here for my piece). Suddenly, the European currency has gone from being the leper with the least fingers to the most, thanks to the sudden economic slow down in the US. Credit default spreads for the PIIGS have been narrowing, traders are willing to give the European Central Bank's rescue package some grace, triggering a speedy unwind of one of the largest short positions in history. The European bank stress tests are expected to deliver the same arbitrary seal of approval that the American ones did. Hedge fund managers are choosing to take extended vacations at the Hamptons, Cannes, and Newport Beach than re-establish their Euro shorts. All of this means that the Euro could remain muscular through the summer. We'll get the first hint tomorrow when the troubled Irish tap the market for ?1-1.5 billion in new debt, and we find out how powerful that Blarney Stone really is.