July 21, 2010 - Singapore Sizzles

Featured Trades: (SINGAPORE), (EWS)

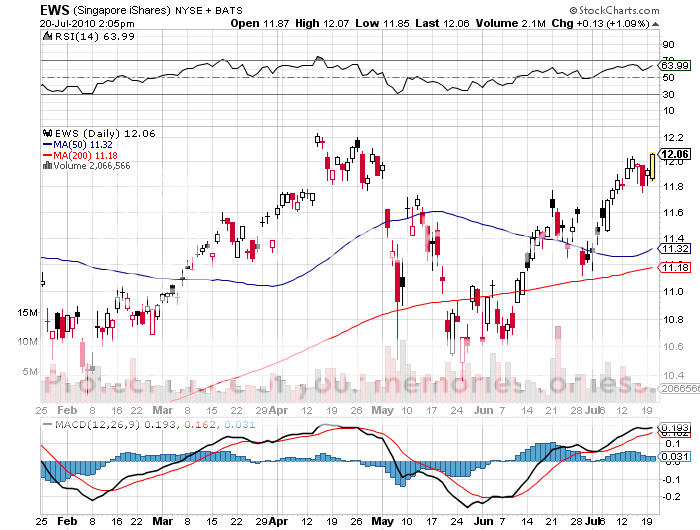

Singapore iShares ETF

2) Singapore Sizzles. I have always had a love/hate relationship with Singapore. During the seventies, the autocratic Prime Minister, Lee Kuan Yew, regularly locked up journalist friends of mine and banned magazines like The Economist that published my stories. The country is also notorious for public canings of offenders who had the audacity to discard chewing gum on public streets. On the other hand, my hedge fund was once one of the largest commission generators on the Singapore Monetary Exchange (SIMEX), and there is no better place to spend a weekend with ten grand burning a hole in your pocket. I spent more than a few nights closing down the bar at the Raffles Hotel, home of the Singapore Sling. Today, Singapore has won the sweepstakes to become the world's fastest growing economy, bringing in a white hot first half 18.1% GDP growth rate. Analysts believe that the full year number could come in as high as 15%. Global equity investors have taken notice, pushing the stock index up 5%, making it one of the best performers (EWS). The Singapore dollar has also been appreciating against its competitors. Even a slow ratcheting up of interest rates by the Monetary Authority of Singapore has done little to cool things off. The results were powered by a booming financial sector, which saw assets under management soar by 40% to $871 billion last year, thanks to an explosion of newly minted Chinese millionaires and billionaires. Foreign banks are jumping on the gravy train, with Goldman Sachs and Morgan Stanley scrambling to add local staff. Tourism has received a huge shot in the arm, thanks to the recent legalization of gambling. Drug giants like Pfizer, Sanofi Aventis, Roche, and Glaxo-Smith Kline have gravitated there to ramp up large scale manufacturing for export to the rest of Asia. The country's leaders have wisely parlayed decades of trade surpluses into Temasek Holdings, one of the largest sovereign wealth funds, and long a major player in the foreign exchange markets (click here for their link at http://www.temasekholdings.com.sg/). You heard international stock guru, Vivian Lewis of Global Investing, list this island nation as one of her favorite picks on Hedge Fund Radio (click here for the link). You also listened to Adrian Day of Adrian Day Asset Management extol the virtues of Singapore because of its believable accounting and super strong balance sheets (click here for the link). I'm not one to let an old grudge steer me away from a great investment opportunity, so better pick up a position in the best managed country in the world on any serious dips, even if the train has already left the station.

My Old Singapore Hang Out

Singapore is Caning the Competition