July 21, 2011 - Time to Get on the (SPX) Roller Coaster

Featured Trades: (TIME TO GET ON THE (SPX) ROLLER COASTER), (SPY), (SPX)

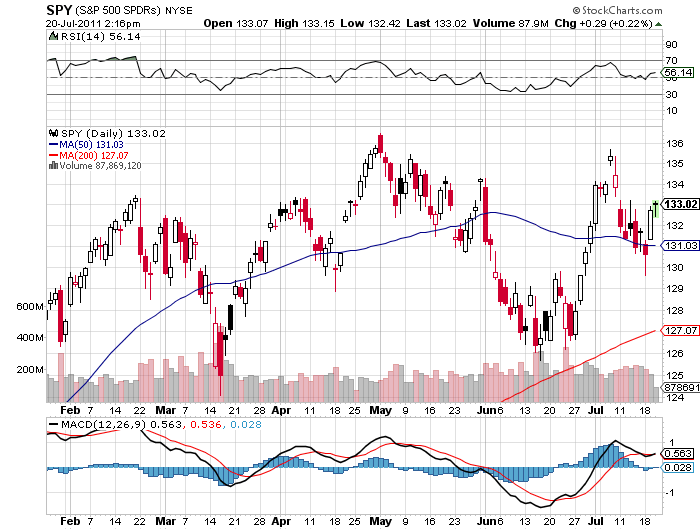

3) Time to Get on the (SPX) Roller Coaster. I think yesterday's reaction to a rumored settlement on the debt ceiling was a great 'tell' on the short term direction of the financial markets. The S&P 500 popped 20 points, bonds roared by two points, and it was off to the races for commodities. However, gold took a $30 hickey.

To some extent, I am making a political call here. I think that there is a 100% chance that we get an agreement on the debt ceiling by the August 2 deadline because the republicans have unwisely, and some would say recklessly, painted themselves into a corner.

The debt ceiling is the responsibility of the House of Representatives, and using it as a weapon to achieve political gains has never been done before. Reagan did it, Clinton did it, and Bush did it big time. If they fail to take action and the US defaults, all President Obama has to do is suspend payment of Social Security checks and correctly blame it on them.

That would assure a big win for the democrats next year and return to them control of both houses of congress. There is no way the republicans are willing to risk even a remote chance of this. So deal they must, and very soon.

A final agreement could create a short term love fest for equities and take the (SPX) up to the old high of 1,370, and possibly to a new yearly high of 1,400.

This is not exactly a low risk trade. I am not predicating the onset of a whole new bull market here, just a swing up to the upper end of a narrow, tedious, and boring range.

You can expect some volatility as the rumors continue that a deal is on, then off, then on again. But we know that the final answer is 'on', so if you get any big dips, you might want to double down.

-