July 23, 2010 - Turkey Is On The Menu

Featured Trades: (TURKEY), (TUR), (TKC), (TURKISH LIRA)

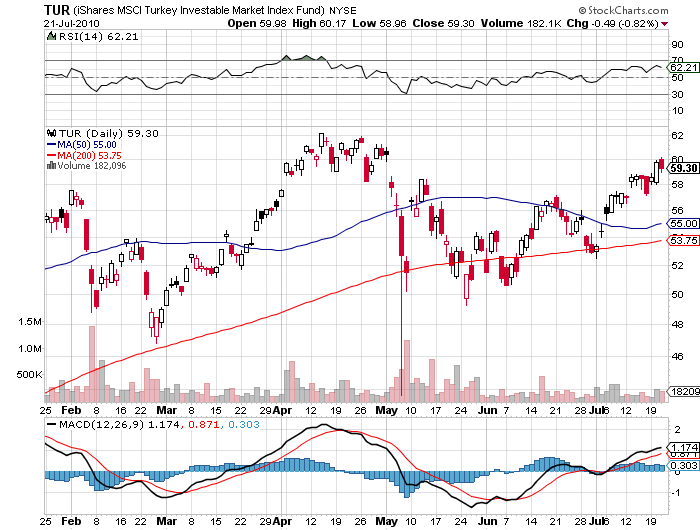

iShares MSCI Turkey Investable Market Index Fund ETF

1) Turkey Is On The Menu. The boarding of a Turkish ship by Israeli commandos and the international brouhaha that it sparked has thrown a searing spotlight on that emerging nation. Several hedge fund friends and now a few readers of this newsletter in Istanbul have urged me to explore this intriguing nation further. So I thought I would use this otherwise slow news day to do exactly that.

I first trod the magnificent hand woven carpets of the Aga Sophia in the late sixties while on my way to visit the rubble of Troy and what remained of the trenches at Gallipoli, a bloody WWI battlefield. Remember the cult film, Midnight Express? If it weren't for the nonstop traffic jam of vintage fifties Chevy's on the one main road along the Bosporus, I might as well have stepped into the Arabian Nights. They were still using the sewer system built by the Romans.

Four decades later, and I find Turkey among a handful of emerging nations on the cusp of joining the economic big league. Q1 GDP grew at a blazing 11.4% annualized rate, second only to China, exports are on a tear, and the cost of credit default swaps for its debt is plunging. Prime Minister Erdogan, whose AKP party took control in 2002, implemented a series of painful economic reform measures and banking controls which have proven hugely successful. Since the beginning of this year, Turkey's ETF (TUR) has outperformed BRIC poster boy China's ETF (FXI) by a whopping 11.8%.

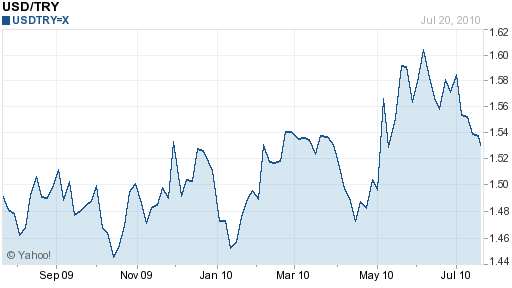

Foreign multinationals like general Electric, Ford, and Vodafone, have poured into the country, attracted by a decent low waged work force and a rapidly rising middle class. The Turkish Lira has long been a hedge fund favorite, attracted by high interest rates. With 72 million, the country ranks 18th in terms of population and 17th in terms of GDP, some $615 billion. It has a near perfect population pyramid; with young consumers greatly outnumbering expensive retirees (click here for more depth in my 'Special Demographic Issue').

Still, Turkey is not without its problems. It does battle with Kurdish separatists in the east, and has suffered its share of horrific terrorist attacks. Inflation at 8% is a worry. The play here long has been to buy ahead of membership in the European Community, which it has been denied for four decades. Suddenly, that outsider status has morphed from a problem to an advantage.

Growing economic power brings political influence with it. The last year has seen Turkey broker settlements in the Balkans and facilitate the Iranian uranium swap with Russia. Some analysts claim this new flexing of diplomatic muscle has a pronounced Islamic, anti American bent. Remember, Turkey refused transit rights to US forces during the invasion of Iraq.

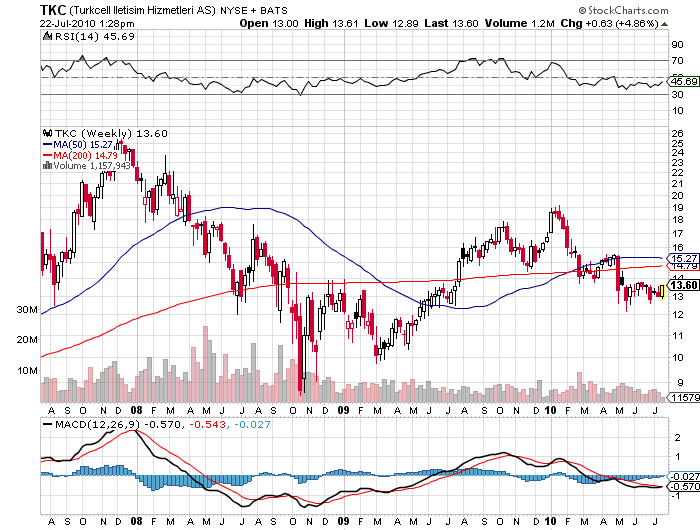

The way to play here is with an ETF heavily weighted in banks and telecommunications companies, classic emerging market growth industries (TUR). You also always want to own the local cell phone company in countries like this, which in Turkey is Turkcell (TKC). Turkey is not a riskless trade, but is well worth keeping on your radar.

US Dollar/Turkish Lira Inverse Chart

A Turkish Population Pyramid to Die For