July 24, 2009 Featured Trades: (SPX), ($INDU), (NASDAQ), (DO), (JAPAN), (CALIFORNIA)

Note to Subscribers: The Diary of a Mad hedge Fund Trader will not be published on July 27, 28, and 29. It?s time to clear out the cobwebs and restore my animal spirits. These days will be added on to the end of your subscription period. I knew it was time to take a break when I put the Preparation-H on my tooth brush this morning.?? I am going to be researching hiking trails in California?s Big Sur, looking for rare birds, and practicing my fly cast for the next few days. Those still in need of investment advice can look for me at the third campsite on the left past, the showers. I?ll even put some hot chocolate on the fire for you if you bring your own steel cup.

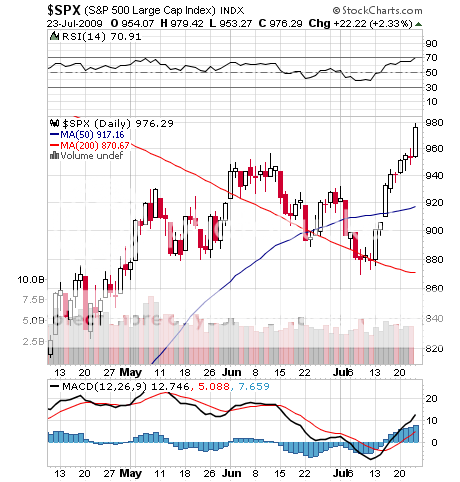

1)There is no doubt that the next trade from here in stocks is a sell. Buying NASDAQ on a 12th consecutive up day, the S&P 500 on the back of a 110 point move,?? and the Dow on top of a 1,000 point pop is not what great fortunes are made of. After stopping out of my own shorts in the 880?s, I have been holding back, holding back, holding back. See my warning not to sell too soon . I have never been one to fight the tape. The only trader who is always right is Mr. Market. The earnings to support a full fledged bull market are not just there. Deleveraging worlds don?t support expanding earnings multiples. It all works for me because the more it goes up now, the bigger the fall later. Even the raging bulls are warning about a ?W? shaped recession and another market dive in 2010. How finely do you want to trade this thing? It?s clear the big core shorts at the major hedge funds haven?t budged, and that most of the recent low volume action has come from day traders, momentum players and CTA?s. All we need now is for mom and pop to come in and ring the bell at the top. Is 2009 going to be replay of 2008? Is a ?Sell in May and go Away? to be followed by another October crash? If your friends? long positions make money from here, just revel in their good fortune,?? and let them pick up the dinner check.

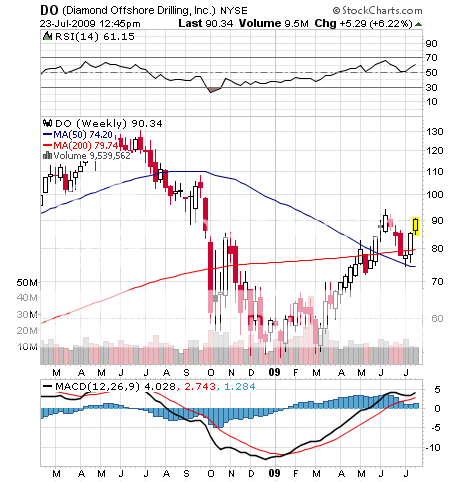

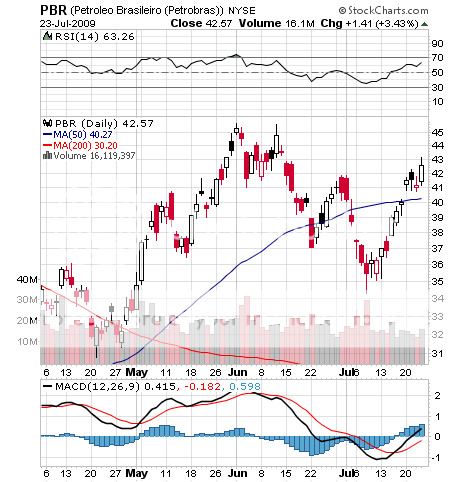

2) I am a huge long term bull on crude, and now that it is again threatening $70 it might be wise to look at more energy plays, especially since many analysts and companies still have their 2009 average prices pegged at $45. When a company like Diamond Offshore (DO) announced great Q2 earnings of $946 million, while Texas tea gyrates from $80 to $148 to $32, it piques my interest (check out the website at http://www.diamondoffshore.com/). Deep offshore is the marginal, high cost oil supply, and when crude runs, the operating leverage on companies in this area can be enormous. DO leases out 30 semisubmersables, 14 jack ups, and one drill ship, and has a $9 billion order backlog. Only the natural gas area continues depressed. It also has the additional benefit in that they are a major long term supplier to one of my favorite companies, the Brazilian oil exploration and production company, Petrobras (PBR). CEO Larry Dickerson says that even though US oil demand is weak, the long term needs of China and India will drive prices upward long term. It all sounds like music to my ears.

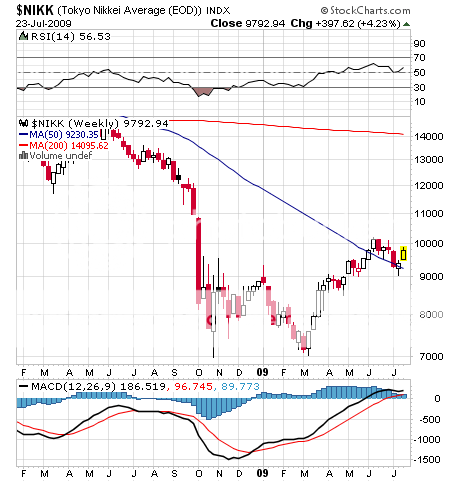

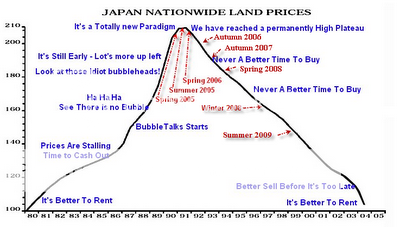

3) Japanese Prime Minister Taro Aso?s call for national elections on August 30 is setting up a potential ?black swan? type event. His Liberal Democratic Party (LDP) has ruled for all but 11 months of the past 55 years. But his party?s 18 year effort to spend itself out of an ?L? shaped recovery has failed miserably, succeeding only in converting Japan from the least, to the most indebted industrialized country.?? Think of a 1,000 ?bridges to nowhere.? Look at the 30 year round trip in Japanese real estate in the chart below. So the opposition Democratic Party of Japan (DPJ) has a real shot here, which has promised to fundamentally remake the economy by boosting social spending, canceling useless construction projects, and encouraging domestic consumption. Remember what a surprise Congress Party win did for India?s stock market? Look at the excellent piece from The Permanent Wealth Investor?s Martin Hutchinson?? for an analysis of how such an outcome could affect Japan on a stock by stock basis by clicking here.

4) The good news is that California has finally come to a budget compromise, covering a $26.3 billion shortfall with $8.8 billion in education cuts, $4.4 billion in forced borrowing from local governments, $2.2 billion in chopped social programs, $1.3 billion in unpaid furloughs of?? state employees, and $3.5 billion in accounting fudges. The bad news is that we are giving San Diego back to Mexico and San Francisco to China, who already own most of it anyway. As for me, I am going to spend the weekend putting iron bars up on my windows, installing a new burglar alarm system, and setting up booby traps. Part of the deal involves the release of 27,000 of the Golden State?s 155,000 prisoners. While 10,000 will be deported to Mexico, I?m sure the rest will be dumped in my front yard.

QUOTE OF THE DAY

?Daddy always wanted to be the bride at every wedding, and the corpse at every funeral,? said Alice Roosevelt Longworth about her father, Teddy Roosevelt, in an interview granted me during the seventies. The once beautiful and ever vivacious Alice mesmerized me with stories of her visit to China in the aftermath of the 1900 Boxer Rebellion and her audience with Japan?s Meiji emperor.