July 26, 2010 - Give All the European Banks "A's"

Featured Trades: (EUROPEAN BANK STRESS TESTS),

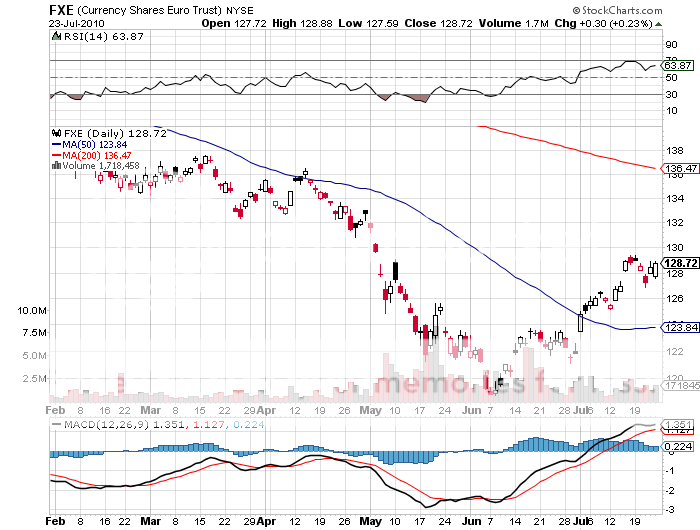

(EURO), (FXE)

Currency Shares Euro Trust ETF

1) Give All the European Banks 'A's'. A favorite ploy of poorly managed school districts in California is for the teachers to simply give all their students 'A's'. That way the state and federal money keeps rolling in, and demanding parents can be assured that their over protected children are performing. That seems to be what is happening with the stress test given to European banks, the results announced on Friday, which most passed with flying colors. French banks were found to be the healthiest. Only 7 out of 91 banks in 20 countries were sent to the markets to raise more capital. One German bank flunked the test, one from Greece, and five from Spain. Having been a banker in Europe myself for a decade, I can tell you first hand that they have never been big on transparency. The test assumes that banks will be able to maintain a minimal 6% tier one capital ratio, even after another economic or sovereign debt crisis wipes out $700 billion in new losses. Healthy banks generally have 10% capital ratios. Many analysts suspect that the European Union reverse engineered the test, setting the standard by calculating the lowest capital ratio that would pass the most banks. Eyebrows were further raised when the German banks refused to disclose their sovereign debt holdings, which are believed to already carry huge losses. Still, there has been a sigh of relief in the global capital markets, as credit spreads tightened all week. Add one known, scratch one unknown. The news is considered good enough to allow the rallies in US stocks and the Euro a few more days of life. We'll find out for sure when the next round of disclosure comes our way in two weeks.

Europeans Have Never Been Big on Transparency