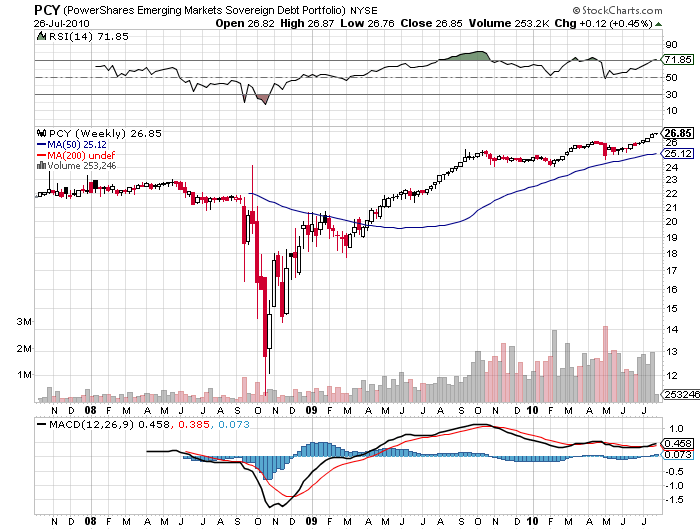

July 27, 2010 - Is Emerging Market Debt the New Prime Credit?

Featured Trades: (EMERGING MARKET DEBT), (PCY)

Invesco PowerShares Emerging Market Sovereign Debt ETF

4) Is Emerging Market Debt the New Prime Credit? Last year, I suggested emerging market sovereign debt ETF's as safe, high yielding investments in which to hide out in case the equity markets swoon again. The stock market has looked pretty grizzly for the last three months, so let's see how they performed. The Invesco PowerShares Emerging Market Sovereign Debt ETF (PCY), which has 40% of its assets in Latin American bonds and 31% in Asia, is up 156% from its low, and up 10% since the beginning of the year. The two year old fund now boasts $481 million in market cap and pays a handy 6.44% dividend. This beats the daylights out of the one basis point you currently earn for cash, the 3.02% yield on 10 year Treasuries, and still exceeds the 5.44% dividend on the iShares Investment Grade Bond ETN (LQD), which buys predominantly single 'A' US corporates. The big difference here is that the countries that make up the PCY can look forward to a much rosier future of credit upgrades.? PCY received a boost from a flight of capital, out of the euro zone, into other sovereign credits. It turns out that many emerging markets have little or no debt, because until recently, investors thought their credit quality was too poor. No doubt a history of defaults in Brazil and Argentina in the seventies and eighties is at the back of their minds. Not so for the US, which has bond issuance going through the roof, and downgrade noises growing ever louder. Still, all good things must come to an end. If you are holding a position in this ETF, I would think seriously about cashing out. With 10 year Treasury bonds tickling a 2.83% yield last week, I am getting leery about the entire fixed income universe. And no one even got fired for taking a profit.

Is it Time to Cash in Your Emerging Market Debt?