July 29, 2010 - It's Time to Revisit the TBT

Featured Trades: (TBT), (TMV)

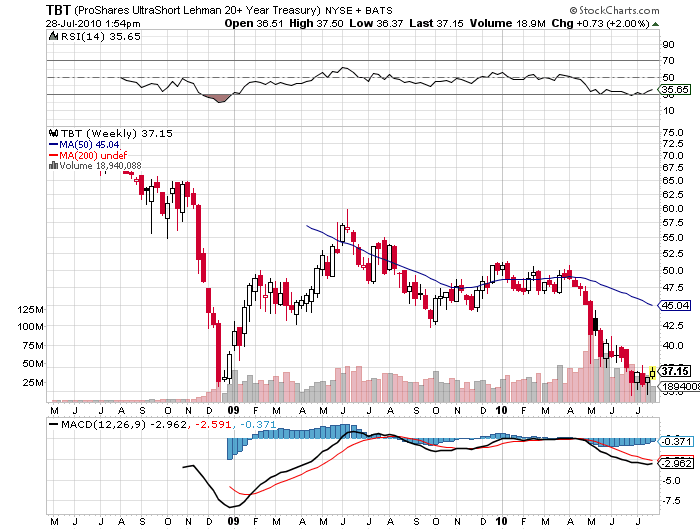

ProShares Ultra Short Lehman 20+ Year Treasury ETF

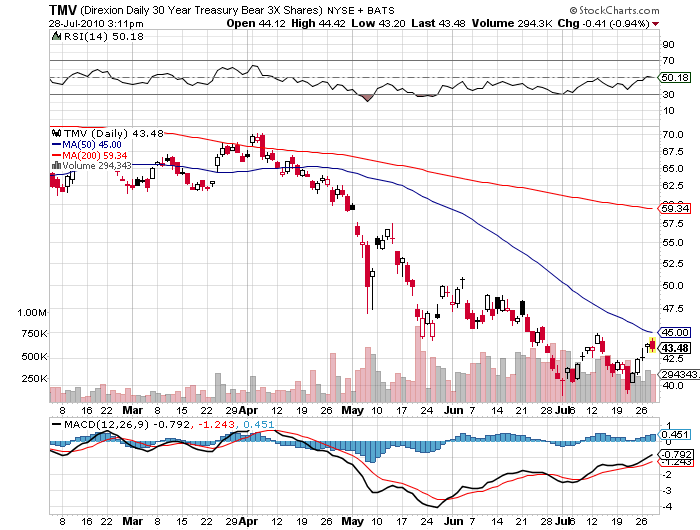

Direxion Daily 30 Year Treasury Bear 3X Shares ETF

1) It's Time to Revisit the TBT. Shorting the world's most overvalued asset, the 30 year US Treasury bond, has got to be the big trade from here. The relentless whirring of the printing presses is so loud that they keep me awake at night, even though, according to Mapquest, I live 2,804.08 miles away. What will be unique with this meltdown is that it will be the first collapse in history of a bond market in a non-inflationary environment.

It is not soaring consumer prices that will execute the coup de grace to the long bond. It will be the sheer volume of issuance. The Feds have to sell nearly $2.5 trillion of debt to cover a massive budget deficit and refund maturing paper, easily the largest cash call in history. Bring in a double dip recession and a second, larger stimulus package, and those numbers ratchet up considerably.

Pile on top of that trillions more in offerings from states and municipalities that are bleeding white. By the end of 2010, total government debt from all sources will rocket to a staggering 350% of GDP. Throw in private debt requirements, like the rolling over of a trillion dollars worth of commercial real estate financing and your garden variety corporate offerings. The rush to borrow has started overseas too, with hundreds of billions of dollars more in Eurobonds floated by cash strapped sovereigns like the PIIGS. It's clear that the bond markets of all descriptions are going to become very crowded places, driving rates irresistibly higher.

At some point, the world runs out of buyers, and the long bond yields will begin their inexorable climb from the current, ridiculously low 4.10% to 5.5%, 6%, and higher.? Even Moody's is talking about a ratings downgrade for the US debt, not that we should give that disgraced institution any credibility whatsoever. The unfortunate camel whose back is on the verge of breaking is about to have sticks come raining down upon him.

I am a worshipper of the TBT, a 200% bet that long bonds are taking the Lexington Avenue Express downtown. I managed three round trips in Q1 covering the $46-$51 range before a flight to safety bid stopped me out in April. It has clawed its way back up from $34.80 to $37.15, compared to the $70 it traded at in 2008.? Falling interest rates have a silver lining in that the annual cost of carry for this leveraged ETF has dropped appreciably, from 10.5% to only 8.2%.

If short interest rates double from the current levels, a virtual certainty, so does America's debt service, from the current 11% to 22% of the budget. This could happen as early as 2014. That's when the sushi really hits the fan.

If I'm wrong on this and the 30 year bond prices surge to a yield of 3% in some sort of second Great Depression scenario, as they did last year, the TBT will drop down to the high $20's. If I'm right, the final target could be as high as $200, when long rates top 13%. That's where they were when I bought my first coop on Manhattan's Upper East Side in 1981.? If you have a serious pair of cajones on you, take a look at the 3X short ETF (TMV) with its higher cost of carry.

A 20% downside risk and a 540% upside potential sounds like a good risk/reward ratio to me. If the TBT dips again in August, it might be time to take another bite from the apple.