July 7, 2011 - The Long View on Emerging Markets

Featured Trades: (THE LONG VIEW ON EMERGING MARKETS),

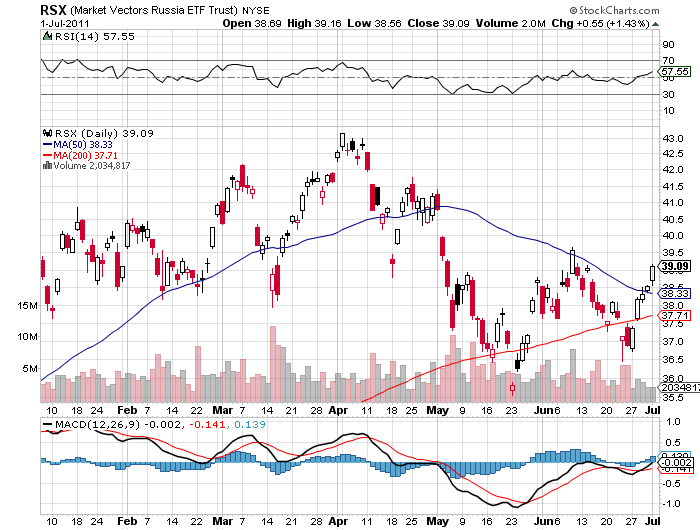

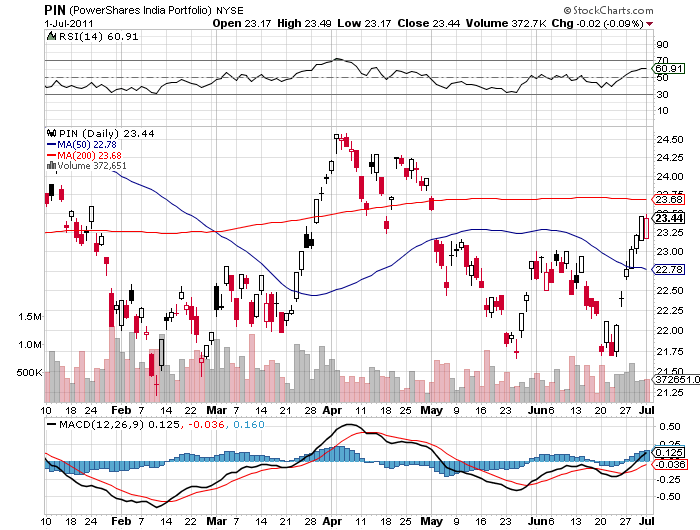

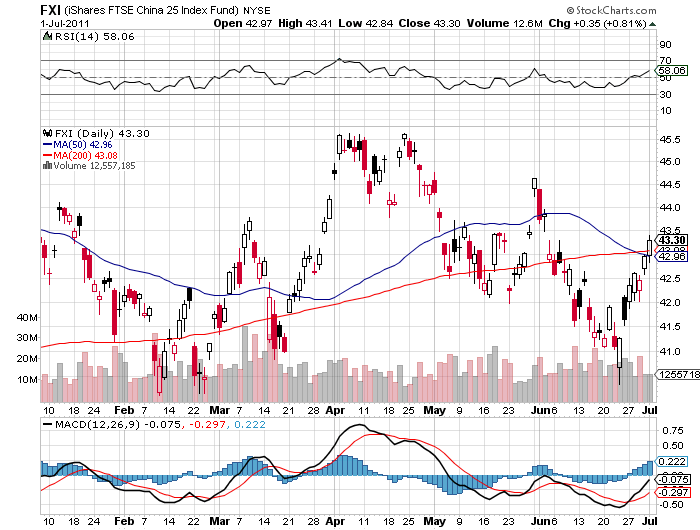

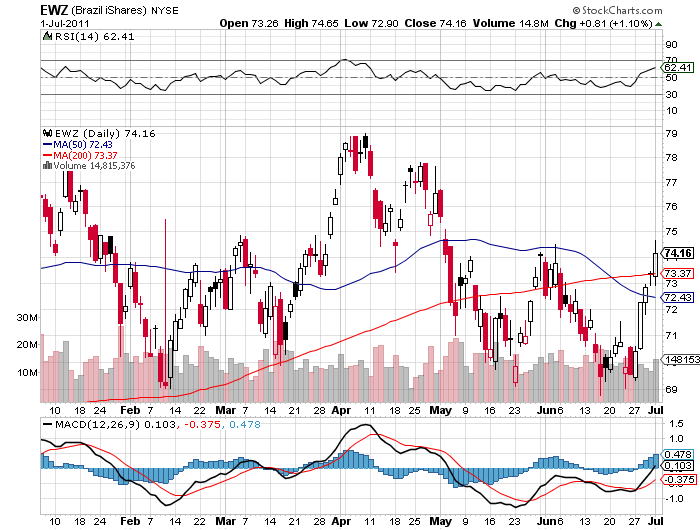

(EWZ), (RSX), (PIN), (FXI)

2) The Long View on Emerging Markets. I managed to catch Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London.

Jim thinks that it is still the early days for the space, and that these countries have another ten years of high growth ahead of them. As I have been pushing emerging markets since the inception of this letter, this is music to my ears.

By 2018 the combined GDP of the BRIC's, Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), will match that of the US. China alone will reach two thirds of the American figure for gross domestic product. All that requires is for China to maintain a virile 8% annual growth rate for eight more years, while the US plods along at an arthritic 2% rate.

'BRIC' almost became the 'RIC' when O'Neil was formulating his strategy a decade ago. Conservative Brazilian businessmen were convinced that the new elected Luiz In??cio Lula da Silva would wreck the country with his socialist ways. He ignored them and Brazil became the top performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

Although emerging markets have been somewhat moribund this year, I will jump back in once I see the appropriate triggers. This include, signs that inflation is under control in Brazil, falling interest rates in China, and a generalized return by money managers to a 'RISK ON' mode that lasts more than a week.

Then you probably should top up your positions in Brazil (EWZ) Russia (RSX), India (PIN), and China (FXI). Jim Chanos, you may be right about a China crash, but you're early by a decade!

-

-

-

-