July 8, 2009

July 8, 2009

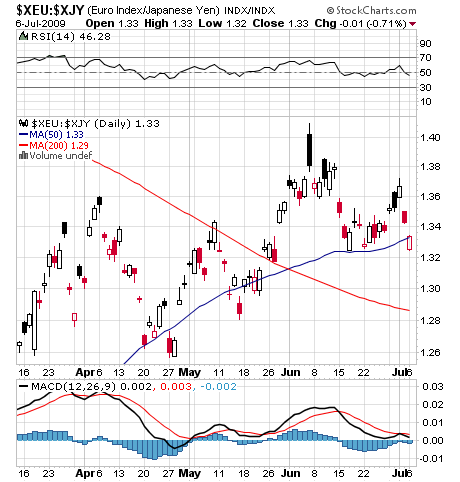

1) I am about to do you a huge favor. You can clear all of the stock tickers and widgets off of your computer desktop. The only thing you need to watch now are the wild, gut wrenching moves in oil. Everything else will follow suit. So when it drops $10 in four trading days, as it has done since Tuesday, it sends a sell signal so obvious that even Stevie Wonder can see it. For confirmation, take a look at Euro/yen, which I earlier identified a great ?tell? for global risk taking . It has sold off sharply since the ?green shoot? killing, Thursday unemployment figures, and if it breaks below ??132, the sushi will really hit the fan. Also look at the long term chart of the volatility index (VIX), which shows that we hit major long term trend support at 25%, and is overdue for a rebound to a least the mid thirties. That means lower stocks. If I had time, I could go into a dozen additional indicators flashing red lights. If you can?t get the tea leaves to work, then slaughter a goat and examine the entrails.

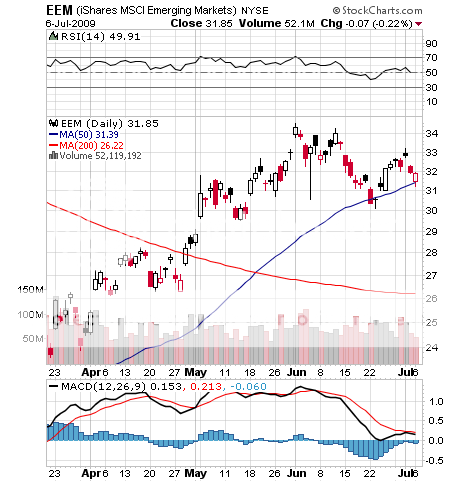

2)?? Given the profusion of negative indicators, and moving averages rolling over like the Bismarck, I would be remiss in my public duties if I did not tell you to sell everything. Dump the reflation trade. The ?green shoots? are dead. Liquidate emerging markets (EEM), commodities (DBA), the metals (GLD), foreign currencies (XEU), and cover your shorts on safe haven pays, like Treasuries (TBT) and the yen (XJY). Real estate in all forms will continue to die its own private death. Batten down the hatches. Reduce your risk. If you can?t sell, then hedge your positions. If you can?t hedge, then sell calls against your positions. If you can?t sell calls, then find another line of work, because there are so many inverse ETF?s around these days, you no longer have an excuse to take a big downside hit. This is where your stops earn their pay. I begged you, pleaded with you, and beseeched you to dump your position on May 1 (see ?Sell and May and Go Away? and June 16 see ?The Worm has Finally Turned? , and now I am trying again. Please also revisit the short plays I offered earlier on the S&P 500 (SDS) and the Euro (DRR) . And don?t ever call me indecisive, waffling, or equivocating.

3) You may recall my advice to abandon natural gas at $4.30 in the face of giant new discoveries in shale formations (see ?Cash out here at $4.30) and ?Huge Discoveries . Since then, the Midwest has suffered its wettest spring since 1871. It rained 25 inches in Chicago the first half of the year, drowning golf courses, and sending the mosquito population exploding to Biblical plague proportions. Let me assure you, I have absolutely no ability to predict the weather, except that my combat scars itch when a storm is coming. Cold weather means no air conditioning, which means cratering natural gas demand and a new two month low of $3.37. But when you see a parallel contract like crude soar to new heights, and NG fail a half dozen times to get off a five year low, you know rough weather is coming. The crude/gas ratio players really got carried out in body bags on this one, as one record after another was shattered, taking it to a stunning 19.4:1. Natural gas has been the worst performing investment this year, the ETF (UNG) falling a mind blowing 54% since January.?? Best to wait for natural gas to find its new, lower, range before entertaining a position.

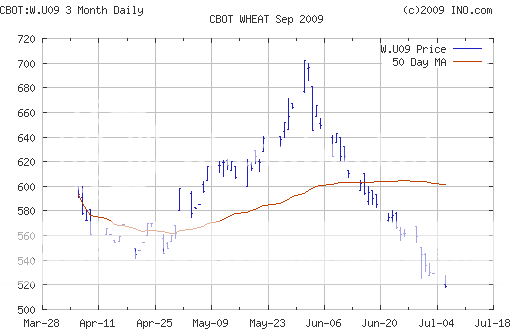

4) For indisputable proof that I am not infallible, please re-examine my call to watch wheat for a buy below $5.90 . It has since dropped 12%, falling almost every day.?? The weather that cut the legs from under natural gas has been great for grain supplies, but terrible for prices. The trigger was last week?s USDA report on corn acreage, which instead of delivering 1-2 million fewer acres because of late planting, announced a shocking increase of 1 million acres. The 3 million acre swing caused corn futures to go limit down, dragging the rest of the soft complex with them. On top of this, you can add the general flight from assets of all classes that has been unfolding over the last few weeks. This is yet again, another lesson about keeping stops on your ag positions at all times. You never know when a lightning bolt like this is literally going to come out of the blue. I still like the entire food play longer term, so for investors, as opposed to traders, this is a chance to build a core holding at lower prices. To quote Marine Corps. General Oliver Smith, at Korea?s Chosin Reservoir, ?Retreat, Hell,?? we?re attacking in a different direction.?

QUOTE OF THE DAY

?It has been a rude shock to see so many economists with good reputations recycling old fallacies,? says Paul Krugman, winner of the Nobel Prize for economics, and firebrand columnist for the New York Times. He is warning Obama of a replay of 1937, when an attempt to balance the budget triggered a second depression.