July 9, 2009

July 9, 2009

Featured Trades: (SPX), (EURO/YEN), (GS)

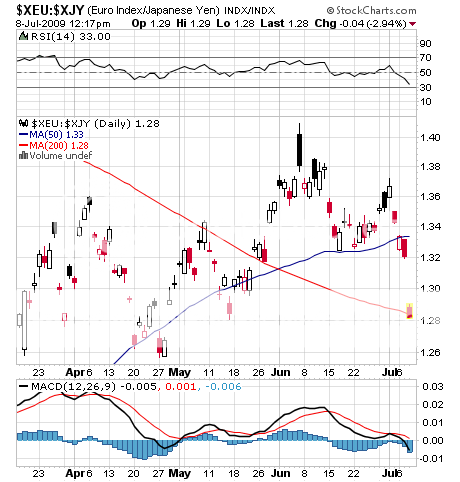

1) If anyone is wondering what that foul odor is, it's the sushi that hit the fan. Even the most obstinate,?? Kool Aid drinking perma bulls now concede the head and shoulders is in on the S&P 500. That great barometer of global risk taking, the Euro/yen cross, didn't just break key support at ??132.50, it completely melted down to ??128.00. Oil traders have had an epiphany, rediscovering fundamentals like wayward sinners finding a new religion, which, by the way, are terrible. So how did crude double in the face of a collapsing economy? Was it speculators? Was it Goldman Sachs? 'Green shoots' have returned to being those pesky things you get dirt under your fingernails ripping out of your back yard. If I get any more negative I am going to have to change the name of this letter to the 'Assisted Suicide Daily.' So I have to finish on an up note. I'm not in the Armageddon camp, which sees us going to new lows below Satan's 666. I think 750-800 is more realistic. But then I was always the one to take the easy money. If you get another Lehman bankruptcy type event, you could see a real crash. For the last two years, the market has had an unceasingly ability to come up with these shocks.

2) Totally overshadowed by Thursday's catastrophic June nonfarm payroll were the figures on total employment, which were much worse, falling by 0.8%. That means that one million fewer people worked in June. Furthermore, the average workweek fell to 33.0 hours, the lowest on record, while the weekly paycheck plummeted to $611.49. To illustrate how this is not your father's recession, or even your grandfather's, look at the chart below from www.chartoftheday.com, which shows that we were well on the road to recovery at this point in the cycle in past recessions. The jobs recovery should have started three months ago. Who is going to buy all of those houses?

3) If you want to read the greatest hatchet job of all time on a financial institution, pick up the July 9-13 issue of Rolling Stone and check out the piece on Goldman Sachs (GS) by Matt Taibbi, which the blogosphere is tittering about. Yes, the office was worried when they saw me walk in with the Jonas Brothers on the front cover tucked under my arm. According to the story, Goldman Sachs is responsible for every financial crisis during the last eighty years, including the 1929 crash, the dotcom bubble, the housing craze, the sub prime crisis, the oil spike, the bank bailout, and next, the trading of carbon credits created by cap & trade. Oh yes, and they control every aspect of the US government. Written in the edging, snarky, f*** you kind of style that appeals to a younger audience, any professional journalist will recognize this for what it really is. This is the most forceful buy recommendation of a stock I have ever seen. If GS really is that powerful, back up the truck. I want to own a stock with a 'damn the torpedoes, full speed ahead' management who will boost earnings at any cost. They're just the alpha males in a world of predators. Someone has to be number one. I think Taibbi is just angry that he could never get in the front door there, let alone get a job. Some people will say anything to sell their publication.

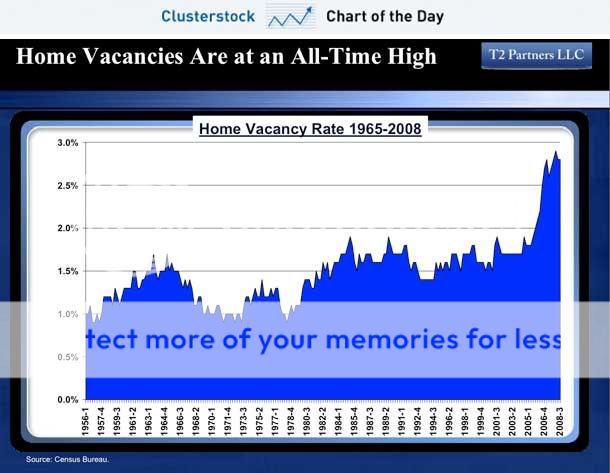

4) Those hoping for a quick rebound in residential real estate prices can now join the realm of Santa Claus, the Easter bunny, and the tooth fairy. The near complete shutdown of the high end housing market has prompted rating agency Moodys to downgrade 344 tranches of 61 securitizations of prime jumbo loans issued from 2002-2004. This is all full doc, high FICO stuff. They were prompted by a jumbo delinquency rate that has skyrocketed from 1% to 6% in four years. Worst hit will be the jumbo Meccas of California, New York, and Florida. Wells Fargo and Bank of America were the biggest originators of this defrocked paper. With the securitization markets closed, originators face the unappetizing alternative of keeping new loans on their own books, hence no deals. The only consolation in all of this is that Moody's is the same company that missed the whole crisis, sold the best ratings to the highest bidder, used a model that couldn't accept negative numbers for future home price assumptions, and rated junk as triple 'A'. If you are looking for another reason to jump off a cliff, check out Clusterstock's chart of the day showing that the home vacancy rate has shot up to 3%. That works out to 5 million homes, the equivalent of a New York City that is empty. Has anyone seen the Will Smith film I Am Legend?

QUOTE OF THE DAY

'Consumer sentiment has really risen on the pixie dust of this equity rally we have seen over the last four months'?a lot of those people are going to put some of that money in their pocket this week,' said Lincoln Ellis, managing director?? of the Linn Group.