June 10, 2009

June 10, 2009 Featured Trades: (FLS), (PTEN), (EPD), (KMP), (MS), ($TNX)

1) The market has gotten so dead here that I have started watching Suzie Ormand to get trading ideas. So I?m not supposed to run large balances on my credit card? Who knew? A hedge fund friend told me that the market is now like watching a ball tossed in the air that is at the apogee of its move, just before the free fall begins. No news, with shrinking volume and volatility. General Motors (GM) isn?t a stock anymore, so all of the news flow there might as well be a History Channel documentary. You can only sell so many out of the money short dated calls on other stocks before bumping up against risk control parameters. Even if you do make money in these conditions, it is at the expense of a Maalox addiction to fight the multiple holes in your stomach. It?s not worth it. This is why I prefer to spend my summers mountain climbing or practicing my ballroom dancing. Please see my ?Sell in May and Go Away? opus.

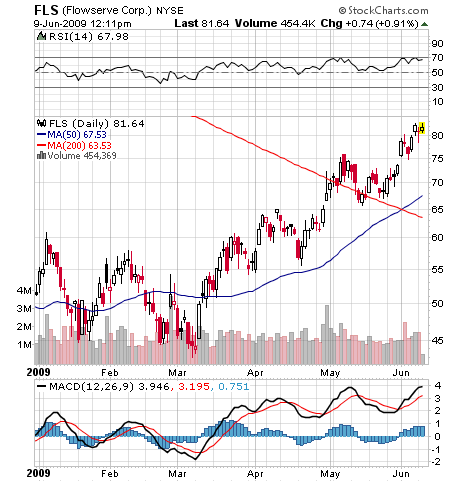

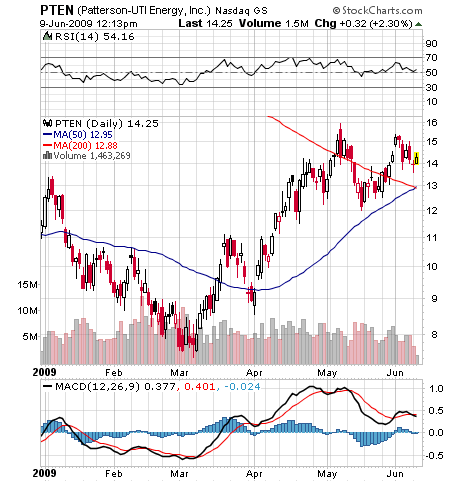

2) Last January I said that I felt like a kid in a candy store when I looked at the oil service stocks here and here. Let?s see how those worked out. Flowserve (FLS) is a global supplier of pumps, valves, seals, automation, and services to the power, oil, gas, and chemical industries, and seemed like the deal of the century at a PE multiple of 7X. It has since soared by 88% from $45 to $85. Buying Patterson-UTI Energy (PTEN) at a 5X multiple seemed like a better idea because it operates 403 rigs for oil and gas drilling in the Midwest. It has exploded 125% from $7 to $16. Subsequent recommendations to buy Kinder Morgan Energy Partners (KMP) and Enterprise Products Partners (EPD) did just as well. As much as I love these companies, you have to take some money off of the table after such humongous moves. The entire sector tracked the up move in crude very nicely, dollar for dollar. If I am the least bit right to take profits in long positions in crude, as I mentioned in yesterday?s comment, you have got to cash in some chips in the oil service sector as well. I have always been a big fan of taking the easy money, and the easy money has been made. Long term, these are great holds, but short term, they?ve run ahead of themselves. Make the volatility work for you. Remember, you are dating these companies, not marrying them.

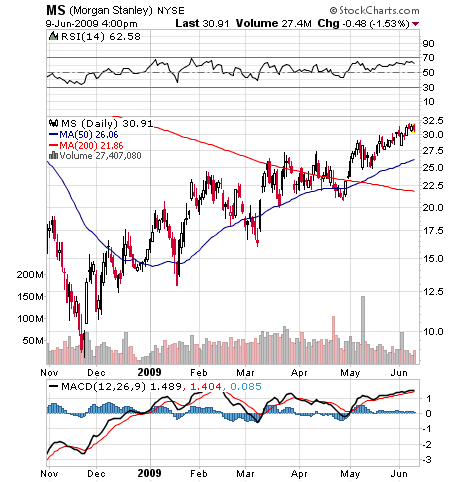

3) The world?s largest hedge fund is taking profits on one of its biggest positions. I?m talking about the US Treasury allowing ten banks to repay $83 billion in TARP money. I guess the banks really want to get the government green eye shades out of their board rooms, who have been surreptitiously swiping the soap out of the executive washroom. This means paying back 5% money when it costs 6% to fund in the markets, and 10% of you want to raise equity. I guess it?s worth it if this enables you to revive your celebrity golf tournaments in California for ?clients,? throw Caribbean parties for your top producers, and get the Gulfstream out of storage after it couldn?t be sold. Could bonus compensation also be an issue? Gee, do you think? I have to begrudgingly give the government credit for making a ton of money on this trade. Not only did they borrow from us at zero and lend at 5% in huge size. They also got, at the point of a shotgun, fistfuls of? equity warrants that have tripled. And they did stop the bank runs that took Morgan Stanley (MS) down to a near death experience of $6, boosting it back up to a positively virile $32. Alas, if only I could play by their rules. I have a question, Mr. Geithner. Does the government have to pay taxes on those profits? Will it report them?

4) First of all, let me warn you that reading this paragraph is a complete waste of time. Still interested? There is chatter about that the Fed is considering raising interest rates at its next meeting. After all, where can they go from zero, but up? The bond market is certainly telling us that rates should go higher, with yields on ten year Treasuries jumping from 2.45% to 3.95% since March. This is the usual kind of gibberish you get from financial journalists, who deep into a summer with no real news, resort to making stuff up out of thin air. US industrial capacity utilization is terrible and still falling, while unemployment is still rising at a record pace. Sure, commodity prices have doubled this year. But this is happening because investors are looking for an alternative to the sick dollar, not because there is huge underlying demand by end users. This is one of the reasons why I have recently become cautious about all of my long positions. So I can say with complete confidence that the chances of an interest rate hike are less than zero for the foreseeable future. This discussion did have the one benefit that it did enable me to fill this space in my newsletter.

?If you think health care is expensive now, wait until you see what it costs when it is free,? said P.J. O?Rourke, an American satirist and former National Lampoon editor.